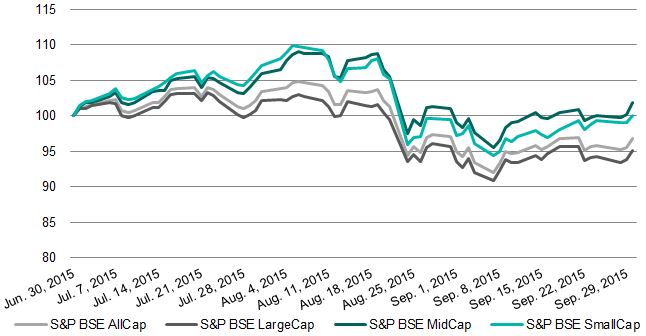

Key highlights of the past quarter that ended Sept. 30, 2015 were the continued fall in wholesale and retail inflation, the devaluation of the yuan and the subsequent reduction in interest rates by the Chinese government, the Fed keeping interest rates the same, and the reduction in the repo rate by the Reserve Bank of India (RBI). Amid all these events, the third quarter of 2015 was weak for Indian markets, with India’s broad market index, the S&P BSE AllCap, posting a loss of 3.1% and the S&P BSE SENSEX declining further, at -5.4% (please see Appendix for a market heat map and monthly total returns).

During July 2015, most of the benchmark indices posted gains, and the S&P BSE MidCap and the S&P BSE SmallCap outperformed the S&P BSE LargeCap. In August 2015, the Chinese government devalued the yuan to remain competitive in exports; the surprise move created apprehension in the global markets, resulting in a depreciation of various emerging market currencies. August 2015 was the worst month of the third quarter, as all size and sector benchmark indices (except for the S&P BSE Information Technology and S&P BSE Healthcare) posted negative returns. However, in September 2015, the Fed’s decision not to change its interest rates and the RBI’s decision to reduce its interest rate (the repo rate) by 50 bps helped the S&P BSE SENSEX to recover from its quarterly low of 24,833.54, as it closed marginally lower than the previous month, posting a return of -0.4%.

Within benchmark size indices, the S&P BSE MidCap was the best-performing index, with a total return of 1.9% during the quarter. Large-cap stocks were the worst performing, with the S&P BSE LargeCap posting a return of -4.9% during the same period. The S&P BSE SmallCap posted a marginal gain of 0.1% during the third quarter of 2015.

Source: Asia Index Private Limited. Index performance based on total return in INR. Data from June 30, 2015, to Sept. 30, 2015. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

To read the full Report, please click here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.