Two distractions creating uncertainty for the treasury market right now are the debt ceiling and who said what at the Fed. Both annoyances should fade away, one in a few weeks, the other possibly not until sometime in the first half of 2016.

The debt ceiling law dates back to shortly before the Second World War. It covers the total federal debt; the current limit is $18.1 trillion. The Treasury Secretary says that the debt will be hit the first week in November as all the extraordinary measures to conserve cash are exhausted. Most of the time there is enough room between the current total debt and the ceiling that ceiling doesn’t matter much. However, every so often the amount of debt approaches the ceiling and Congress must pass a bill to increase the ceiling. Practically speaking lowering the debt isn’t an option. However, surpluses during the Clinton administration did somewhat reduce the debt and leave more room below the ceiling.

Since Congress must approve all tax and spending bills, it is not clear why the debt ceiling is necessary. However, the periodic debt ceiling battles give Members of Congress an excellent opportunity to complain to the government about the government – so permanently eliminating the debt ceiling isn’t too likely.

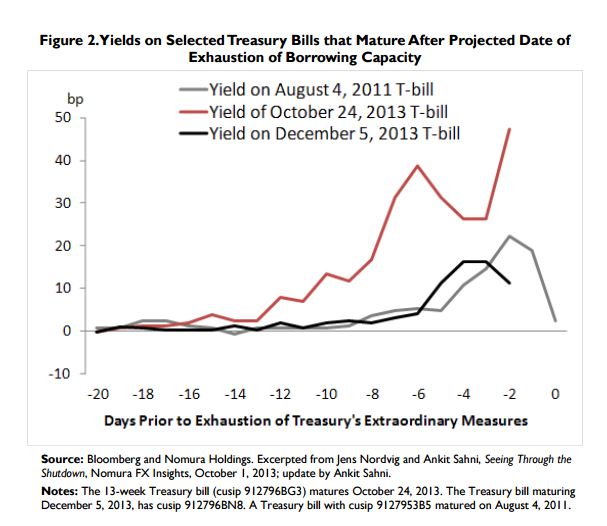

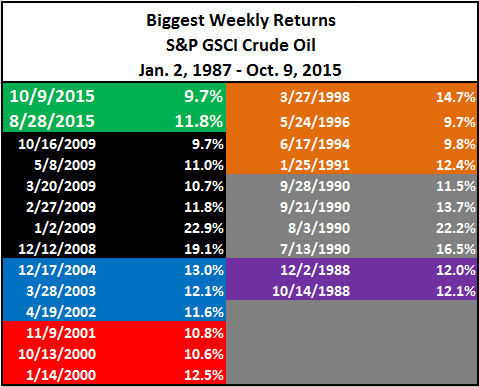

What to spend or tax is economics, the debt ceiling is politics. There will be a lot of political grandstanding and noise. But everyone knows that defaulting rather than raising the debt ceiling would be disastrous. The debt ceiling will be raised in the end and then everyone will claim to have saved the day at the last moment. However, in the run-up to “victory” we could see yields on treasury securities scheduled to mature between now and November 15th jump higher or crash. The chart below, from a recent report by the Congressional Research Services (see www.crs.gov #R43389) shows T-bill yields during some previous debt ceiling debates.

The FOMC, the Fed’s policy unit, meets next week on Tuesday and Wednesday. There is little chance that they will raise interest rates at the meeting. First, raising interest rates just as the debt ceiling is roiling the market isn’t a good idea. Second, there isn’t much new economic data since the last meeting on September 16th-17th and there is no post-meeting press conference scheduled. Despite these reasons, right now there is an unusual amount of debate and discussion about Fed policy.

The FOMC is data-driven, its decision on raising interest rates, whenever it happens, will depend on how the economy looks at that time. The question of what they might do in at the December 15th-16th meeting depends on the economic reports appearing between now and then. Moreover, as the economic numbers change, so do people’s opinions of the future. There is a lot of uncertainty and noise in forecasts of the Fed’s next move. Currently the noise level is increased because of apparent disagreements among members of the Fed Board of Governors. In the last few weeks, Stanley Fischer argued for raising rates sooner while Lael Brainard and Daniel Tarullo spoke in favor of waiting longer and everyone is trying to guess Janet Yellin position.

Will the Fed act in December? If we knew what the future data will reveal and how people would react, we might have an answer. What is likely is that until then the markets will see extra uncertainty even though the debt ceiling will have been raised.

The posts on this blog are opinions, not advice. Please read our Disclaimers.