The companies in the S&P 500 are often described as leading companies in leading industries. The S&P 500 is the go-to index for analyzing, tracking and understanding large cap stocks in the US market. Its history goes back over 50 years to 1957 and its predecessor indices extend back to 1923 and 1926. Only the Dow claims a longer heritage. With about 50% of the revenues of the S&P 500 companies coming from overseas, the index is also a leading benchmark for developed markets worldwide. Until now one thing has been missing – many of these 500 companies raise capital in the fixed income markets as well as in the equity markets.

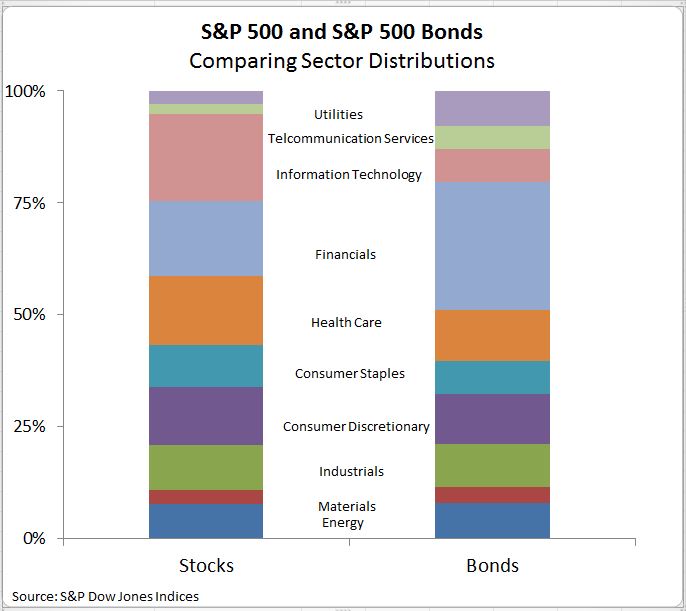

S&P Dow Jones Indices is introducing a bond index covering the 500 companies in the S&P 500 (equity) index. The index will include all publicly traded bonds issued in the US by companies in the S&P 500. This is about 4,760 issues covering some $3.7 trillion of debt. The combination of the stock and bond indices makes possible consistent analyses of the two most important asset classes for investors. By anchoring both indices in the same list of leading companies the two indices will provide a more complete picture of the financial condition of large cap corporations in the US. The distribution of debt and equity among companies and sectors differs and a comparison of the indices highlights these differences. On the bond side the largest sector measured by the market value of bonds is financials, followed by consumer discretionary. Financials are also high on the equity list at number two by market value. However, the largest in equities, information technology, is the seventh by size in bonds. Health care is the third largest sector in both the S&P 500 and the S&P 500 Bond index. Telecommunication services is the smallest equity sector and the second smallest bond sector. The chart compares the sector shares in the two indices.

In fixed income analyses of bonds, a primary division is between financial and nonfinancial corporations. Using this division and data from the Federal Reserve, bonds issued by nonfinancial companies in the S&P 500 represent about 59% of nonfinancial corporate bonds while bonds issued by financial companies represent about 23% of the financial bond market. On the equity side, the S&P 500 represents about 80% of the total market value of equity of US corporations.

There are many ways to divide or classify the issues in the S&P 500 Bond index that can’t be done with equities. These can add to our understanding of both bonds and stocks. The bond ratings and the distribution of the ratings gives a picture of the overall credit quality of the S&P 500. About 94% of the market value of the debt is rated investment grade, a good report card for this group of companies. Possibly less inspiring is the percentage of market value that receives the highest rating of AAA: 1.4%. The maturities range from one month to almost 96 years. By market value 41% is less than five years, 31% is between five and ten years and the balance are over ten years. There are nine issues with maturities longer than 80 years including one at almost 96 years. These long lived issues include a bank, a railroad, a health care company and some industrials.

The posts on this blog are opinions, not advice. Please read our Disclaimers.