The Asia-Pacific region is the third-largest ETF market in the world, after the U.S. and Europe. Despite the fact that the ETFs listed in the Asia-Pacific region represent less than 10% of global ETF assets, the region’s asset growth rate has outpaced the two former leaders and is now ranked at the top.

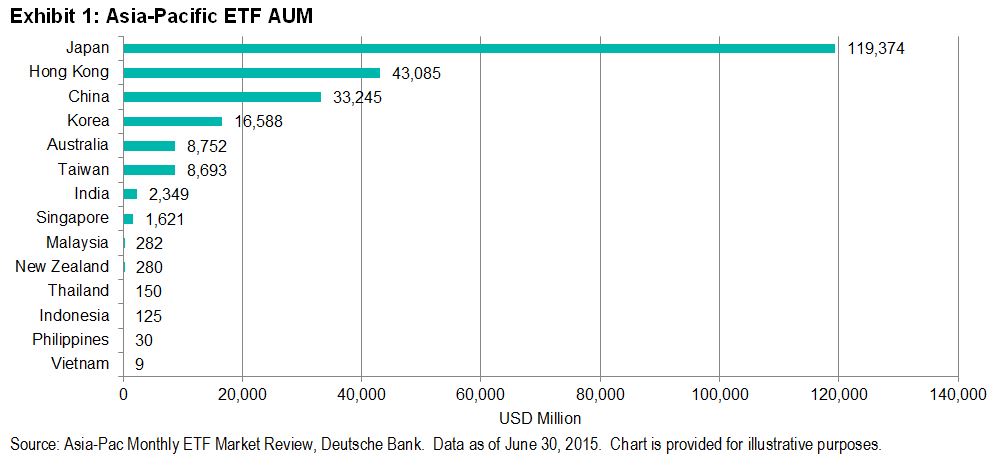

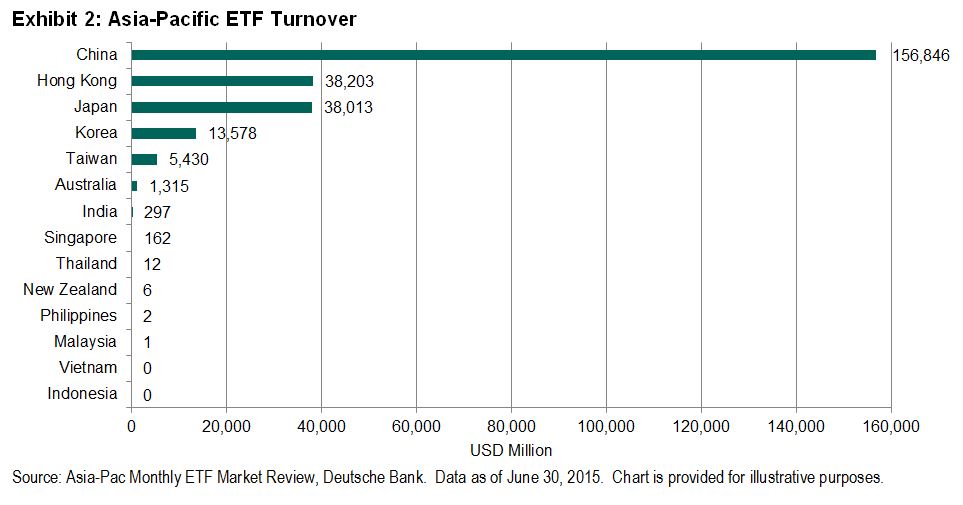

The Asia-Pacific ETF market is quite scattered, with ETFs listed across different countries. By AUM, Japan has a dominant position in the Asia-Pacific ETF market (see Exhibit 1). However, the significant growth potential of Hong Kong and China cannot be underestimated. The exchanges in Hong Kong and China have recorded the highest ETF turnovers among their peers, at USD 38 billion and USD 157 billion, respectively (see Exhibit 2). The emergence of cross-border initiatives, including Mainland-Hong Kong Mutual Recognition of Funds (Mutual Recognition) and Shenzhen-Hong Kong Stock Connect (SZ-HK Connect), could also serve as a catalyst for the growth of Hong Kong’s and China’s ETF markets.

Expanding Footprints to Other Markets

The Mutual Recognition and SZ-HK Connect programs are setting the stage for Hong Kong- and China-listed ETFs to penetrate the other markets. The Mutual Recognition program allows eligible and approved mainland China and Hong Kong funds and ETFs to be offered to each other’s markets. Similarly, the SZ-HK Connect program would allow eligible shares listed on the Shenzhen Stock Exchange and the Hong Kong Stock Exchange to be offered to the other markets (and could potentially include ETFs). These two arrangements could open more opportunities for cross-border ETF distribution to retail investors and potentially help boost their sales momentum.

Stimulating ETF Market Growth

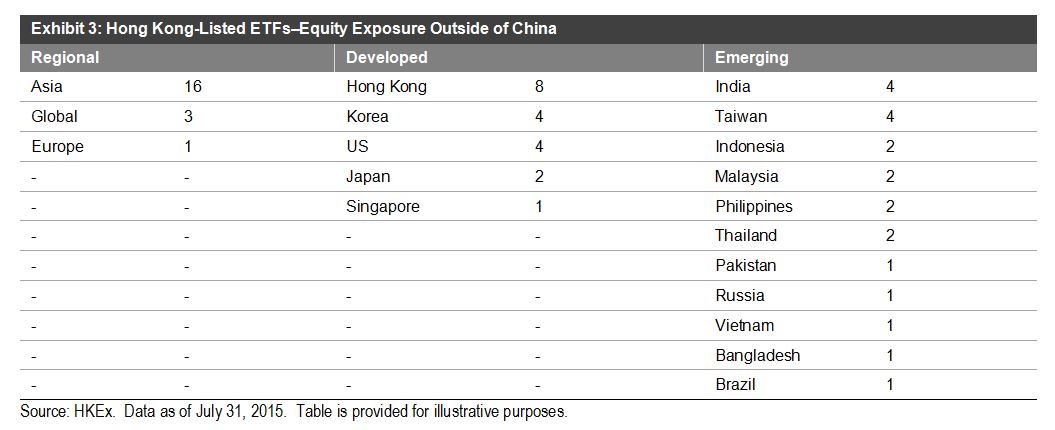

The Hong Kong ETF market is more diverse than the Chinese ETF market in terms of product offerings, and hence the southbound flow could benefit more from the cross-border initiatives. On top of the strong product lineup of local Hong Kong and A-shares ETFs, Hong Kong has also showcased a variety of ETFs covering different geographies, sectors, and asset classes.

The China A-shares market has become volatile this year, which is a concern for many investors in mainland China. To diversify their risk out of the A-share market, investors may look for investment products that provide overseas exposure. Hong Kong-listed ETFs could be a good tool for them to access markets outside of China.

Furthermore, the cross-border initiatives could accelerate the development of China’s ETF market. China-listed ETFs will be facing direct competition from their Hong Kong counterparts that are well-regulated and more advanced in terms of market making, product diversification, investor education, etc. In order to become more competitive and keep abreast of the global standard, China’s ETF market could be enhanced in order to attract more inflow over the long term.

The posts on this blog are opinions, not advice. Please read our Disclaimers.