August Highlights:

- Most Major Islamic Indices Closely Track Conventional Benchmarks in 2015

- Emerging Markets Plunge Over China Growth Concerns, Weak Commodity Prices and Prospects for Fed Tightening

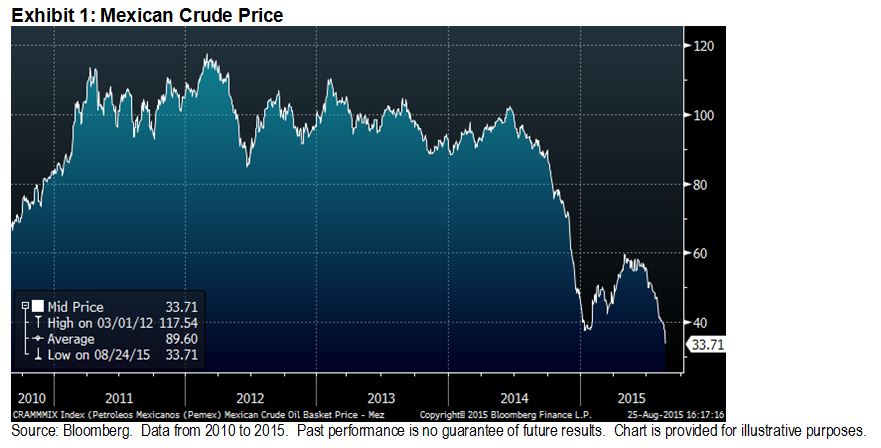

- MENA Equities Drop Sharply as Oil Falls

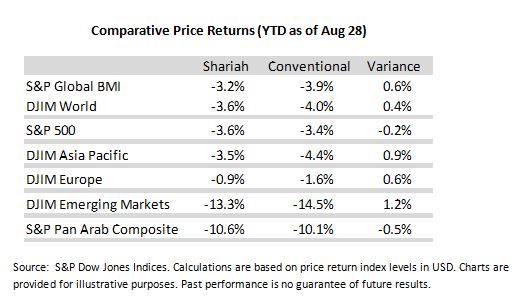

Most Shariah-compliant benchmark have performed similarly to their conventional counterparts in 2015 as Financials have generated returns roughly in-line with the broader equity market.

Through August 28, the S&P Global BMI Shariah and Dow Jones Islamic Market World Indices declined 3.2% and 3.6%, respectively, modestly outperforming their conventional counterparts. Over the same period, the S&P 500 Shariah lost 3.6%, slightly underperforming the 3.4% decline of the conventional S&P 500. Islamic indices covering Asia Pacific, Europe and Emerging Market equities each modestly outperformed their conventional counterparts, while the S&P Pan Arab Composite Shariah slightly underperformed.

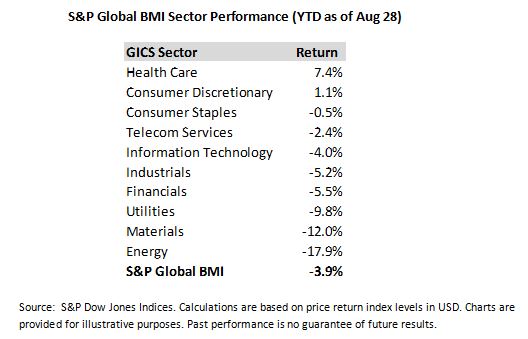

After a strong start to the year, emerging markets have led global equity markets into negative territory in 2015. Concerns about the sustainability of China’s economic growth, plunging commodity prices and expectations for higher U.S. interest rates have combined to trigger major equity market and currency declines, particularly among emerging market commodity exporters and countries with larger fiscal and current account deficits.

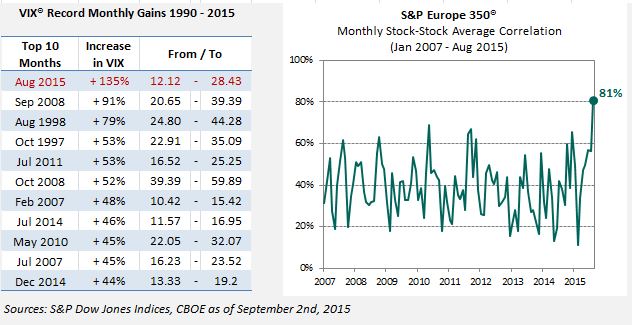

Volatility returned to U.S. markets as concerns over high valuations, the Fed possibly raising interest rates and the slowdown in China drove markets into the red for the year. The steep decline in commodity prices has also led to equity market weakness in resource driven developed market countries such as Australia and Canada. Despite relative strength in Japan, the DJIM Asia Pacific Index declined 3.5% year-to-date, driven by double-digit declines in Australian equities. Europe has been the best performing region, as DJIM Europe declined by just 0.9%.

Largely driven by falling oil prices, MENA equities, likewise, experienced a sharp reversal after a strong start to 2015, After peaking up 11.5% on May 19, the S&P Pan Arab Composite Shariah lost nearly 20% through August 28, leaving the index down 10.6% year-to-date.

The posts on this blog are opinions, not advice. Please read our Disclaimers.