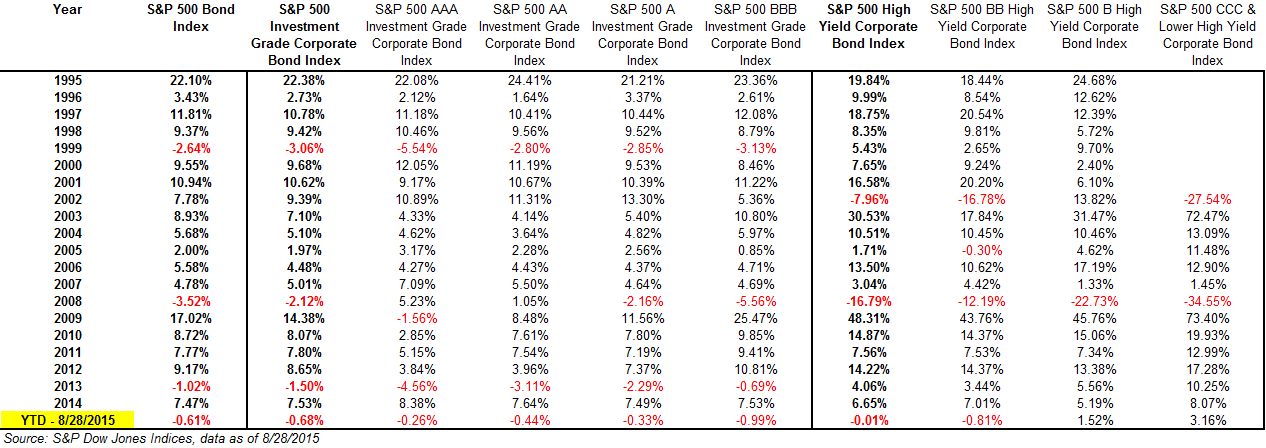

August is shaping up to be a negative month for the S&P 500 Bond Index (-0.52% month-to-date and -0.61% YTD), as of Aug. 28, 2015. Though, for all the drama of this month, attributable to the drop in oil prices (-24% YTD), weakness in the Chinese economy, and a major sell-off in equities, bond returns look relatively stable. U.S. equities, as measured by the S&P 500, have a total return of -2.07% YTD, (-3.4% price return) as of the same date.

Investors who have been chasing higher yields by moving down in credit will most likely experience a loss this month, as the S&P 500 High Yield Corporate Bond Index has returned -1.26% month-to-date. The S&P 500 BB High Yield Corporate Bond Index has returned -1.5% month-to-date, while the single B index is down -0.70% month-to-date and the CCC and lower index is down -0.99% month-to-date. When looking at the year-to-date returns, the riskiest of assets (S&P 500 CCC & Lower High Yield Corporate Bond Index) is still holding up, returning 3.16% after being as high as 4.33% on July 16, 2015.

Higher up the rating scale, the loss has been to a lesser degree. The S&P 500 Investment Grade Corporate Bond Index has returned -0.46% month-to-date and -0.68% YTD. The monthly returns by rating bucket are as would be expected, with AAA returning -0.18%, AA -0.26%, A -0.25%, and BBB -0.65% month-to-date.

At the height of this month’s selling, many questions arose about how bonds have performed historically. Exhibit 1 shows that even in most stressed of times (2008), investment-grade bonds weathered the storm, while high-yield bonds experienced significant losses. Those losses did not last too long, however, as the lower credits and investment-grade bonds bounced back in performance in December 2008 and did not look back during 2009.

Exhibit 1: Historical Returns