This is the third blog in a series on the evolution of Australia’s tax-aware investment management (TAIM) landscape.

Large asset owners, including statutory authorities, university endowments, and charitable bodies dominate the Australian investment landscape. However, the largest asset owners by asset size are the 260-odd superannuation funds who collectively manage some 60% of Australia’s ~AUD 2 trillion pool of retirement savings known as superannuation. Each fund pays tax on taxable contributions made by employers and members, together with income and capital gains earned on investment assets. Super funds do not, however, pay tax on earnings of assets backing pensions. In Australia, super funds either pay tax at a notional rate of 15% for working members, or 0% for members in pension mode who are 60 years or older.

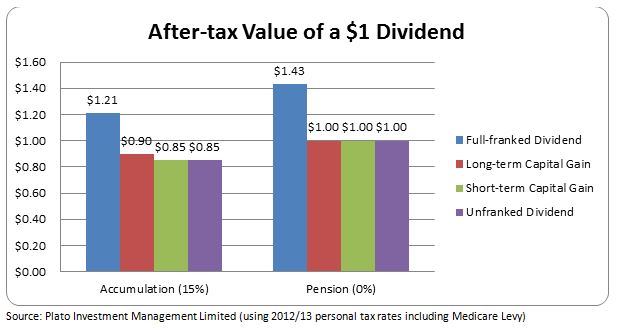

What difference do these tax rates have on returns experienced by members? In the case of Australian shares that pay dividends, quite a great deal as the below chart illustrates:

Members in accumulation (working) mode might incur a tax of between 10% and 15%, or receive an uplift of up to 21% on their Australian shares. Members over age 60 and in pension mode either have no tax effect or receive an uplift of up to 43% on each dollar of fully-franked dividend attributed them.

Given the low rate of tax paid by superannuation funds, their ability since 2000 to recoup excess franking credits, and the large difference in tax effect between working and pension members, one would assume that super trustees would be among the most tax aware of investment fiduciaries. However, recent history has painted quite a different picture, which will be discussed in the fourth, blog in this series.