Australian equities and bonds both had double-digit returns last year. Looking at the one-year returns as of Jan 30, 2015, the S&P/ASX Australian Fixed Interest 0+ Index gained 10.22% and the S&P/ASX 200 (TR) rose 12.48%.

While the levels of volatility came down in both markets, the annualized volatility of the S&P/ASX 200 (TR) maintained an elevated level of 11.04%, whereas the annualized volatility of the S&P/ASX Australian Fixed Interest 0+ Index stayed low at 2.19%.

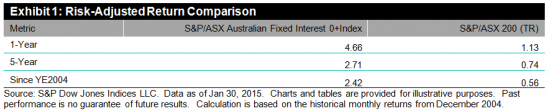

Exhibit 1 shows the risk-adjusted returns of the two indices for the one- and five-year periods, and since year-end 2004. The one-year, risk-adjusted returns of both indices outperformed the longer periods. Noticeably, the one-year, risk-adjusted return of the S&P/ASX Australian Fixed Interest 0+ Index came at 4.67, which is four times the equities index’s return for the same period. The risk-adjusted return seen by the S&P/ASX Fixed Interest 0+ Index is also one of the highest among the major fixed income markets.

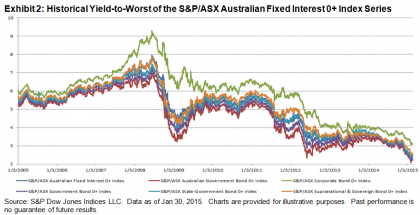

The solid performance in the Australian fixed income market was supported by the strong gains in government bonds. Contrary to historical performance, the S&P/ASX Corporate Bond 0+ Index underperformed other sector-level indices, despite the hunt for yields continued in other markets. Yield contraction continued; the yield-to-worst of the S&P/ASX Australian Fixed Interest 0+ Index tightened by 103 bps to 2.42% in the same period, which is the lowest level since the index inception on Dec. 31, 2004 (see Exhibit 2 for historical yield-to-worst performance). Interesting to note is that the current cash rate is 2.25% and the inflation rate was recorded at 1.70% in the fourth quarter of 2014, according to the Reserve Bank of Australia.

The posts on this blog are opinions, not advice. Please read our Disclaimers.