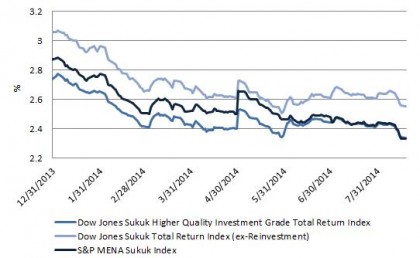

The growing popularity of sukuk is reflected in the recent strong index performance.The Dow Jones Sukuk Index delivered a total return of 7.08% year-on-year (Y-o-Y) and 5.26% year-to-date (YTD), as of August 18, 2014. The index’s yield-to-maturity also tightened by 51bps YTD to 2.55%. Noticeably, the yield of the S&P MENA Sukuk Index dropped 55bps YTD to 2.33%, which is almost on par with the yield of Dow Jones Sukuk Higher Quality Investment Grade Index. Please see Exhibit 1 for the yield comparison.

Exhibit 1: The Yield-to-Maturity Comparison of the Dow Jones Sukuk Index

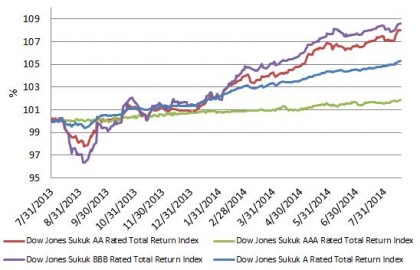

According to the rating based and maturity based sub-indices of the Dow Jones Sukuk Index family, the sukuk with longer maturities and lower ratings outperformed the market. The Dow Jones Sukuk 7-10 Year Index rose 11.1% Y-o-Y and 9.60% YTD, while the Dow Jones Sukuk BBB Rated Index gained 9.44% Y-o-Y and 7.03% YTD. In search of higher yields, investors tend to go further out on the risk spectrum, see Exhibit 2.

Exhibit 2: The Rating Based Sub-Indices of the Dow Jones Sukuk Index

The market size tracked by the Dow Jones Sukuk Index expanded 23% YTD to USD43 billion. The new names tapping into the market are Export-Import Bank of Malaysia and Emaar Malls from UAE, together with returning issuers such as Islamic Development Bank and Saudi Electricity. The continued growth is fueled by ongoing financing needs, solid investor demand and more importantly, the regulatory support.

The issuance pipeline remains robust; for example, Indonesia sovereign just released a preliminary OC on a USD Sukuk, which is rated “BB+” by S&P Ratings. The Malaysia Airports also announced a perpetual subordinated sukuk that is denominated in Malaysian Ringgit.

The posts on this blog are opinions, not advice. Please read our Disclaimers.