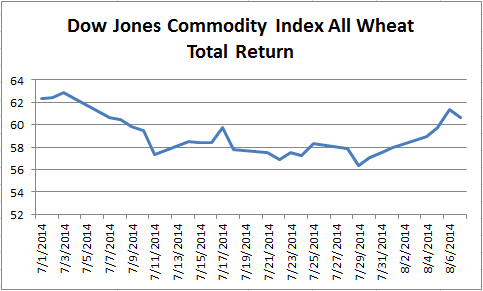

Wheat lost more than 8% in July from the near perfect weather that brought the agriculture sector down to its lowest in four years. Now, in the first week of August the DJCI All Wheat Total Return is already up 5.4% MTD through Aug 7, despite a 1.2% loss for the day.

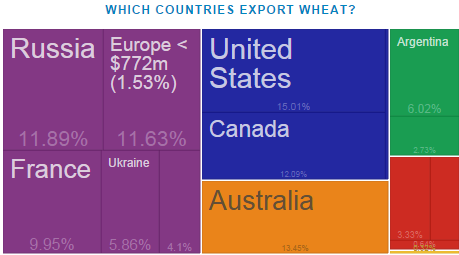

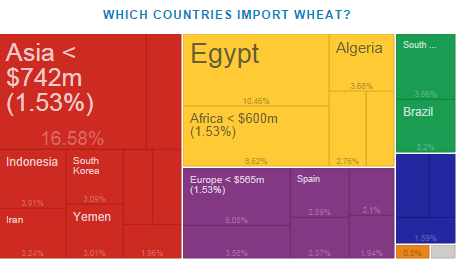

However, Russia’s food trade ban has implications that may push wheat prices up or down, depending on location. The simple economics dictate the Russian ban on food imports could raise inventories in exporting countries, which may depress local prices. On the other hand, if there is a ban on its food exports, there may be price increases in importing countries.

What is an important detail is that Russia, the 4th largest wheat exporter, is a big producer of competitively priced wheat that is not experiencing the same quality problems emerging in the US, Ukraine, and in the European Union from the harvest -time rains, boosting kernel sprouting that has reduced milling appeal. This means that the ban on exports may generally elevate wheat prices since the high quality, abundant, cheap wheat is being hoarded. Although the rationale is different, the impacts are similar as for cotton from China’s stockpile, and for nickel from the Indonesian ban on exports.

According to the UN FAO, cereal prices dropped 5.5% to a four-year low, “a reaction to excellent production prospects in many major producing countries and to the anticipation of abundant exportable supplies in the 2014-15 marketing season”, the agency said.

If this is the case, in order to keep prices down – all else equal – the U.S., Australia, Canada and France will need to see a strong crop to compensate for the loss of Russia’s export market.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

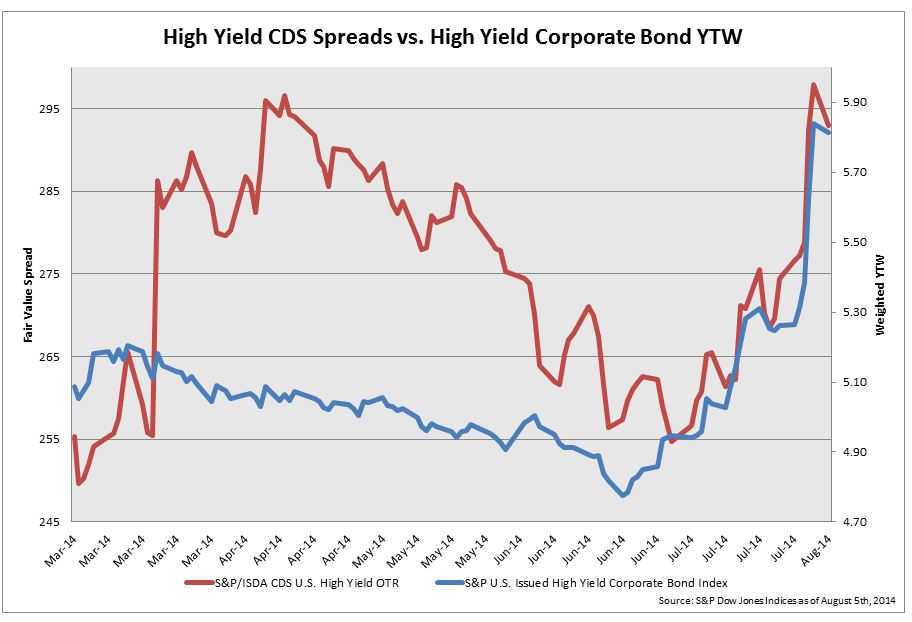

The divergence between CDS spreads and actual high yield bond yields show that the bond market has not followed CDS spreads movements due to the appetite for yield supporting the high yield market and pushing bond yields down. Argentina’s default caused bond yields to move more in line with the direction of CDS.

The divergence between CDS spreads and actual high yield bond yields show that the bond market has not followed CDS spreads movements due to the appetite for yield supporting the high yield market and pushing bond yields down. Argentina’s default caused bond yields to move more in line with the direction of CDS.