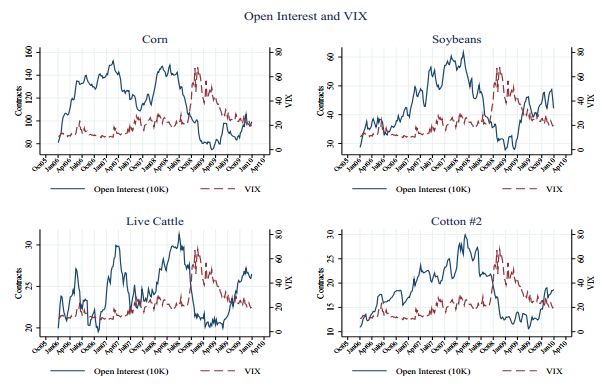

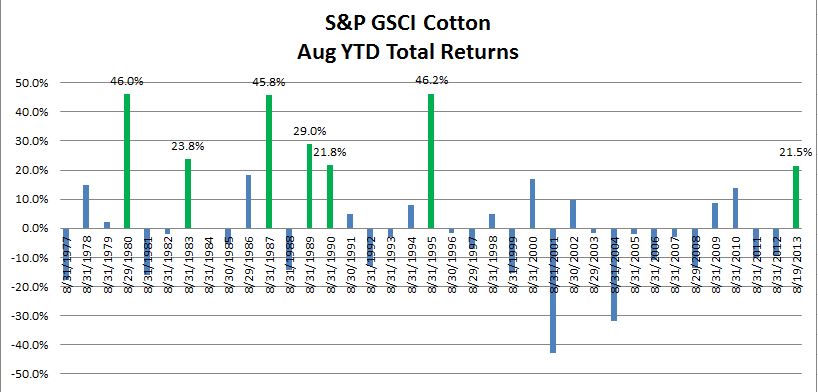

If you are back to school shopping and notice clothing prices are higher this year, don’t just blame it on designer brands. Cotton has been on a roll as measured by the S&P GSCI Cotton, which is up 21.5% YTD through Aug. 19, 2013. The last time the S&P GSCI Cotton was up over 20% YTD through Aug was 18 years ago in 1995 when it was up 46.2%, and historically this is only the 7th time since 1977 where cotton has been in a bull market by this time of year. Prior to 1995, the other years were 1980 (46.0%), 1983 (23.8%), 1987 (45.8%), 1989 (29.0%) and 1990 (21.8%), noted in green in the chart below.

Cotton prices have been supported by fundamental factors in 2013 as I mentioned in an earlier post. The supply of cotton is being threatened in both quantity and yield from recent rainfall in the U.S., the world’s biggest exporter, a poor harvest in Uzbekistan, and a destructive flood in Pakistan.

Even though the price of cotton has surged compared to corn and soybeans as measured by the S&P GSCI Corn (-17.7%) and S&P GSCI Soybean (10.0%), in March the prospective plantings report from the USDA (United States department of Agriculture) predicted a 28% increase in corn acreage, unchanged soybean acreage, and a 43% decrease in cotton acreage. The relative performance of cotton has not been attractive enough to get the farmers to make a significant switch. Also in a recent June report from the USDA (United States Department of Agriculture), the NASS (National Agricultural Statistics Service) forecasted all cotton production at 13.1 million 480-pound bales, down 25% from last year, and the service stated the yield is expected to average 813 pound per harvested acre, down 74 pounds from last year.

The global price increase for cotton has been further pushed this year by an effort in India to control higher price increases and boost domestic supplies. While this might be helpful for India, its biggest consumers Pakistan, Bangladesh, and China may suffer from the higher prices. China, the largest consumer of cotton, has been stockpiling cotton as the textile industry is seeing higher demand. The China Cotton Association said it will increase its import quota by almost 1 million metric tons and sell more from its stockpiles to fill a supply shortfall. In response to the higher prices, the textile firms are also stockpiling, which may lock in the current cotton price but may also push the future price up further by taking more off the market.

Going forward, according to new figures released by the International Cotton Advisory Committee (ICAC), they expect a rise in the season average 88 cents per pound in 2012-13 to more than one dollar in 2013-14.

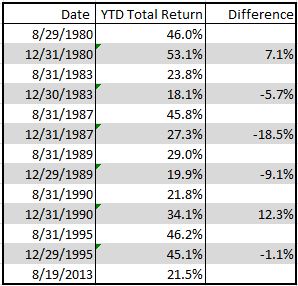

The table below shows in the 6 years prior to 2013 that cotton has had a bull market increase of more than 20% through Aug, the index has dropped on average by 2.5% through Dec with 4 of the 6 times losing between Aug and Dec.

Let’s see if ICAC gets an “A+” in forecasting.

The posts on this blog are opinions, not advice. Please read our Disclaimers.