Lipper reports high yield bond funds have seen the first cash outflow in 7 weeks which might be a sign that junk bonds could run out of gas.

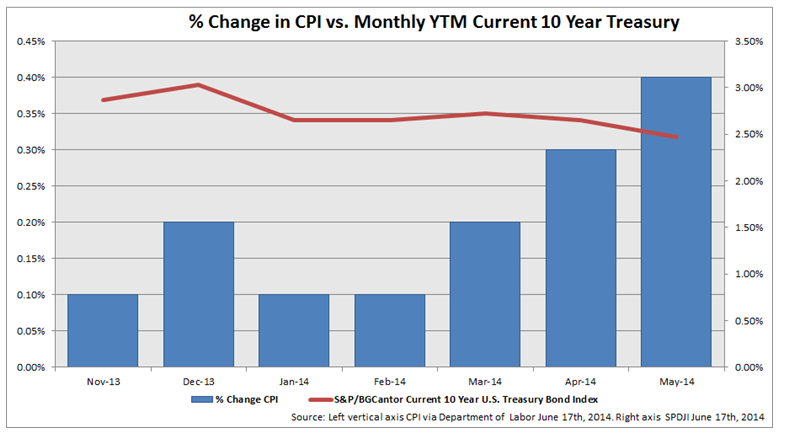

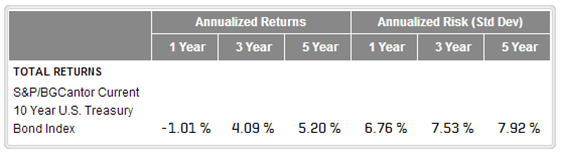

Over the last five years the S&P U.S. Issued High Yield Corporate Bond Index has seen annualized returns of over 13.6%. Year to date the index has returned 5.43% as yields have ended at 4.84% impacted by a 55bp drop since year end. By comparison, safer 10 year US Treasury bonds have seen yields drop by 40bps and have returned 5.17% year to date.

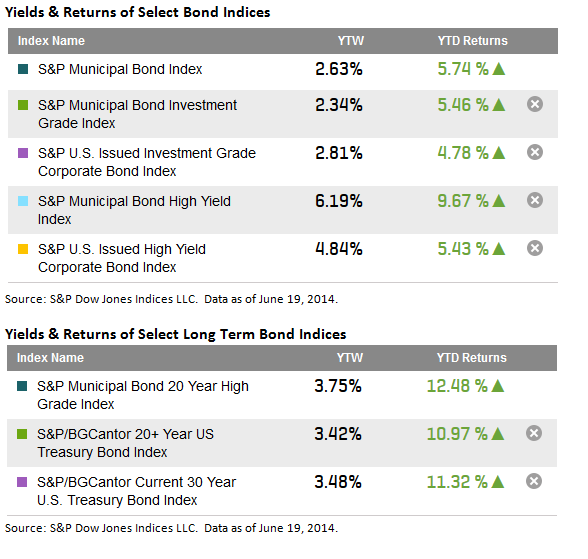

Can more juice get squeezed out of the junk bond sector? Looking at incremental yields of different asset classes can be revealing:

- The yield of the S&P U.S. Issued High Yield Corporate Bond Index is 4.84% or 203bps higher yield than investment grade corporate bonds.

- This is the lowest spread differential seen during the last two and half years of quantitative easing. During that time this spread has gotten as high as 317bps in June 2013.

- High yield bonds are now only 221bps higher in yield than yield of the 10 year U.S. Treasury bonds.

- High yield bonds are only 61bps higher in yield than the yield on senior loans tracked in the S&P/LSTA U.S. Leveraged Loan 100 Index.

- High yield bonds are 135bps lower in yield than the yield of high yield municipal bonds tracked in the S&P Municipal Bond High Yield Index.