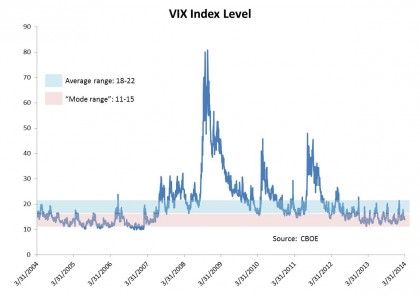

In the article at this link, Bill Luby – VIX analyst extraordinaire – dispels a misconception I have heard repeated at conferences and in presentations. Very often, people refer to VIX as “mean reverting.” This is not correct in the strictest sense of that phrase. VIX is not inclined to return to its long-term average. Rather, VIX is more likely to return to its “typical” levels. It’s more correct to say that VIX is mode reverting. I’ll explain more, since understanding this distinction is essential to understanding VIX.

In Luby’s words, VIX has an asymmetric return profile. He notes that “VIX spikes are generally short-lived” and that “a low VIX often persists for extended periods.”

Put another way, VIX is defined by its extremes. It’s like your hothead friend in high school who day to day is a reasonable guy, but occasionally, when something agitates him, he flares up and punches someone. Your friend’s average mood – halfway between calm and ready to commit criminal assault – doesn’t matter that much because he is rarely there.

Let’s look at the past ten years, ending March 2014, to get a sense as to why an average is a less useful measure in the case of VIX. In that time, we have had 2,517 trading days. The average closing VIX value has been around 20. How many times has VIX closed at or around this average, say between 18 and 22 (those values inclusive)? The answer is 511 times, or 20% of all observations.

Now let’s look at the most frequently observed level, the mode. After rounding, the VIX level that shows up most is 13. But how often does VIX land at or near this particular level? Again, let’s count. VIX has closed in a range between 11-15 exactly 955 times the past ten years, representing 38% of all trading days.

The best way to see this, however, is with a graph. You see huge upticks, particularly during the financial crisis. But VIX seems to drift back, sooner or later, to a certain base level.

So, the next time you are at a conference and you hear someone say VIX is mean reverting, boldly step up to the mic and correct them. You now know the real story.

The posts on this blog are opinions, not advice. Please read our Disclaimers.