Similar to fixed income securities, the U.S. Preferred Stock market has started 2014 with positive performance. The S&P U.S. Preferred Stock Index (Total Return) ended January 2014 up 2.68% . A good start given the S&P 500 Index (Total Return) was down 3.46%. As a fixed income comparison the S&P/BGCantor U.S. Treasury Bond 7-10 Year Index was up 2.98% for the month.

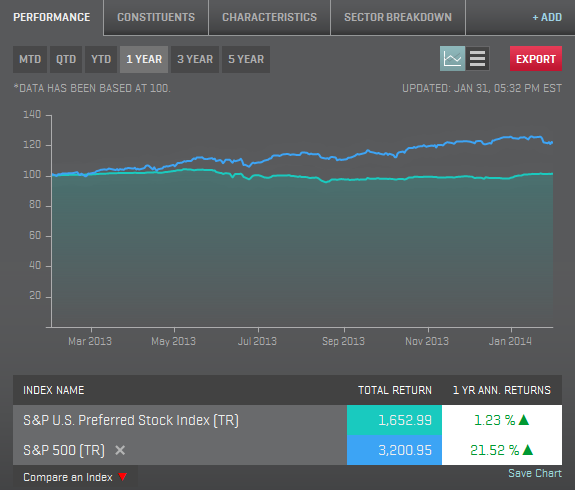

Looking back over a longer period the price return (excluding dividends) of the index declined 5.42% for the twelve months ending January 31st. The dividend yield of the S&P U.S. Preferred Stock Index ended January at slightly over 6.9%. The net result was a positive return of 1.23% during that twelve month period. Simply put, the dividend income helped keep the returns in positive territory.

The 12 month total returns of both indices are charted below.

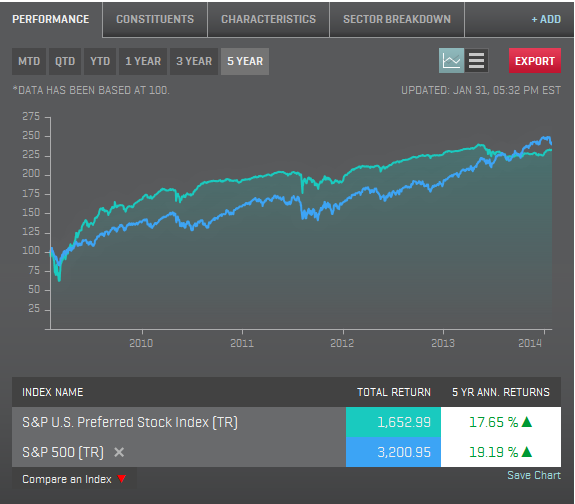

Over the five year period ending January 31, 2014, the S&P U.S. Preferred Stock Index had a five year annualized return of over 17.6% while the S&P 500 returned over 19.1%. The five year total return values for both indices are charted below.