Check out this infographic in our quarterly magazine, INSIGHTS

The posts on this blog are opinions, not advice. Please read our Disclaimers.S&P 500®: A Look Back At A Very Good Year

Indian Fixed Income or Equities: Know your onions!

Investing in Solutions: Leaders in Finance and Climate

National Credit Default Rates Decreased in December 2013 According to the S&P/Experian Consumer Credit Default Indices

The Yellen Fed

S&P 500®: A Look Back At A Very Good Year

- Categories Equities, S&P 500 & DJIA

- Tags earnings, S&P 500

Indian Fixed Income or Equities: Know your onions!

The fixed income market is quintessential for the growth of the economy. They serve as one of the mediums for the government to raise money. In India the fixed income market has been attaining the depth as well as maturity over the years and the government securities play a dominating role.

The on-the-run 10 year fixed interest rate bond issued by the Reserve Bank of India is treated as the benchmark and serves as a reference point for pricing of the other bonds along a yield curve. The S&P BSE India 10 Year Sovereign Bond Index seeks to measure the performance of the benchmark security and can be considered as the bellwether index.

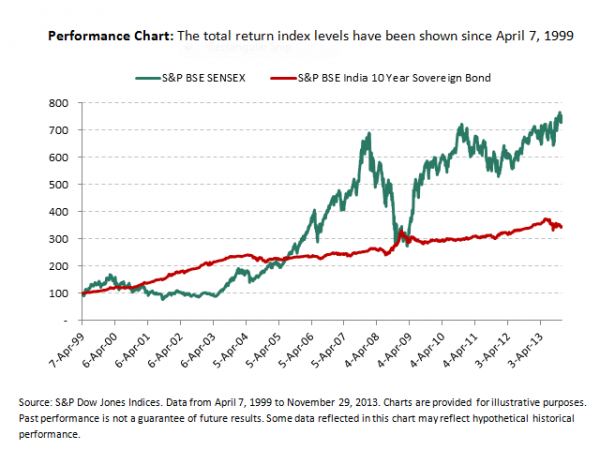

Fixed income market returns in general tend to be less volatile as compared to the equity market returns. This is very well depicted in the performance chart below. We can observe that S&P BSE India 10 Year Sovereign Bond index is less volatile as compared to S&P BSE SENSEX index.

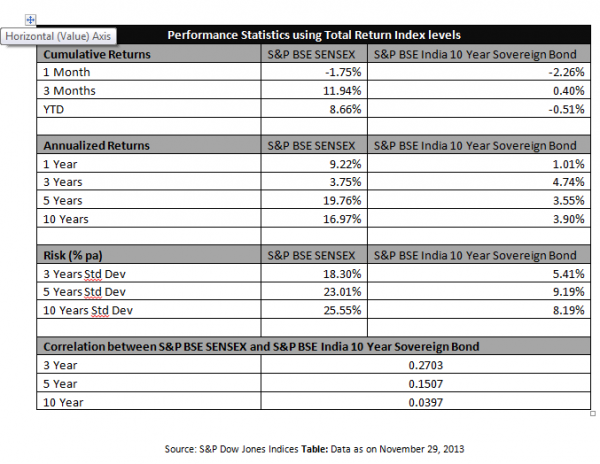

Average inflation in India was low during 2003 to 2007 and S&P BSE SENSEX index did well in these years. The S&P BSE India 10 Year Sovereign Bond Index remained mostly stable. In the year 2008, which was marked by recession, the S&P BSE SENSEX index nosedived, whilst the S&P BSE India 10 Year Sovereign Bond Index rose. Since 2009, the S&P BSE SENSEX index has improved significantly and the S&P BSE India 10 Year Sovereign Bond Index has also shown stable growth. The risk percentage and the annualized returns of the S&P BSE India 10 Year Sovereign Bond Index are low vis-à-vis S&P BSE SENSEX Index. The correlation of monthly returns in both the asset classes is very less and it decreases further as the time span increases. Table below summarizes the statistics.

Investing in Solutions: Leaders in Finance and Climate

This week, I participated in an event at the White House on Women Leaders in Climate Finance and Investment that highlighted the pioneering role women leaders in the finance sector are playing to mainstream climate change into finance and investment decisions. Women around the world are often the first to feel the effects of climate and at the same time can offer unique perspectives and solutions.

I was privileged to be part of a conversation on “making climate finance work for growth,” where we discussed that a consistent global policy framework on climate change could make implementation of scalable solutions practical and possible. At S&P Dow Jones Indices, we are working to advance these solutions by creating equity indices — tools for investment products like exchange traded funds — which respond to consumer demand for products that help address climate change. We have created specialized indices, such as the global clean energy index, and variations of mainstream indices, such as the S&P U.S. Carbon Efficient index and the S&P/IFCI Emerging Markets Carbon Efficient index that weight companies by their carbon emissions, with higher weights going to lower emitting companies. These indices help investors choose whether to invest in companies with high carbon pollution. Over time, we have seen investor perceptions change from excluding large polluting companies from their portfolios for environmental reasons, to doing so to manage risk, to understanding that companies with progressive environmental standards are poised for more sustainable, long-term growth. We are also seeing some investors seek to completely avoid fossil fuel investment in their portfolios.

The event also included Administration officials such as Presidential advisor John Podesta, Chair of the Council on Environmental Quality Nancy Sutley, Domestic Policy Council Director for Energy and Climate Change Dan Utech, Ambassador-at-Large for Global Women’s Issues Cathy Russell, and President and CEO of the Overseas Private Investment Corporation Elizabeth Littlefield, who described efforts under the President’s Climate Action Plan to make U.S. cities and states more resilient, support good clean energy and clean technology jobs, and help developing countries adapt to climate change and access renewable energy. U.S. Senator Jeanne Shaheen (NH) discussed her energy efficiency legislation, which supports investment in clean energy technologies that help to reduce carbon pollution.

The discussions revealed some key challenges and unique initiatives associated with mainstreaming climate change into finance. For example, Lindene Patton, Chief Climate Product Officer of Zurich Insurance Group, discussed the insurance industry’s role in managing climate risks and a commitment by Zurich to provide climate-smart insurance products and invest up to $1 billion in “green bonds,” which would help address climate change. Nancy Pfund, Founder and Managing Partner of DBL Investors, stated that while many private investments in green energy make good business sense and several have delivered good returns to their investors, the challenge is to attract positive attention from all sectors to the benefits of these options.

The event brought to focus the real desire to make a positive social and environmental impact through investment decisions and showed that women are playing an increasingly crucial role to make this happen.

The posts on this blog are opinions, not advice. Please read our Disclaimers.National Credit Default Rates Decreased in December 2013 According to the S&P/Experian Consumer Credit Default Indices

S&P Dow Jones Indices released the latest results for the S&P/Experian Consumer Credit Default Indices. Data is through December 2013

The Yellen Fed

- Categories Blitzer's Insights, Fixed Income

- Tags

The FOMC, the Fed’s monetary policy unit, meets next week on January 28th and 29th. It will be Ben Bernanke’s last meeting and the beginning of Janet Yellen’s leadership of the central bank. No immediate change in Fed policy is likely – winding down QE3 over the next few months as announced in December will continue, the Fed funds rate target won’t shift from its current zero to 25 basis points and the yield on the ten year Treasury note won’t rise by much.

While there won’t be an immediate shift, the membership of the FOMC will change and a review of the economic outlook and monetary policy is likely at this meeting. The changes to the FOMC include the usual rotation of the four representatives from among 11 of the 12 regional banks as well as two recently nominated members of the Fed Board of Governors.

What will the new year and new members bring?

Tapering and the end of QE3 are expected in 2014. The quantitative easing programs were successful in lowering intermediate and long term interest rates and boosting the stock and housing markets. However, with the economy better off than it was a few years ago and questions heard about the additional benefits of further bond buying, this effort is likely to fade away. Despite fears voiced by some, the program did not create inflation. In fact, inflation at about 1.5% is below the Fed’s target and deflation is seen by some analysts as a larger worry for 2014.

With the end of QE1-2-3, the Fed’s policy making tools will focus on interest rates, forward guidance or announcements of future policy and possibly some of the Fed’s banking regulations. The target for the Fed funds rate is likely to stay at zero to 25 basis points well into 2015 if not longer. This will keep a lid on the yield on the ten year Treasury note, even if economic growth exceeds expectations. The ten year yield can be thought as the average of the ten successive one year returns. With assurances that the one year returns won’t rise much in the next two or three years, the longer 10 year number is likely to be somewhat contained.

Jawboning – as forward guidance used to be called – is both powerful and hazardous. For investors and traders, ignoring the Fed is always a risky policy. So, forward guidance of lower interest rates will encourage a rapid market response to bring rates down towards the Fed’s desired levels. But the Fed is not clairvoyant when it comes to predicting the economy or future policy needs. Sooner or later there will be a moment when the central bank will need to change its forward guidance, change from lower interest rates to higher interest rates. In the days when watching the Fed was “watch what they do, not what they say,” a policy reversal was accepted, maybe even expected. But if forward guidance is cancelled and reversed, investors are likely to doubt or even ignore future forward guidance. For now announcing intentions works, but for how long no one knows.

Currently the Fed pays interest on the reserves banks hold at the Fed. Excess reserves – funds greater than the required level of banks’ reserves – rose sharply during the financial crisis when the Fed began to pay interest on reserves. Whether or to what extent the Fed can influence banks’ reserve positions through the interest rate it pays remains to be seen. However, this is one area that the Fed may look to if the needs of monetary policy shift.

What Next?

Expect a new economic forecast from the upcoming FOMC meeting. If it is as optimistic as the last one or more so, say goodbye to QE123, expect more focus on the Fed funds rate and a little less interest in forward guidance. The transparency that Ben Bernanke brought won’t change.

The posts on this blog are opinions, not advice. Please read our Disclaimers.