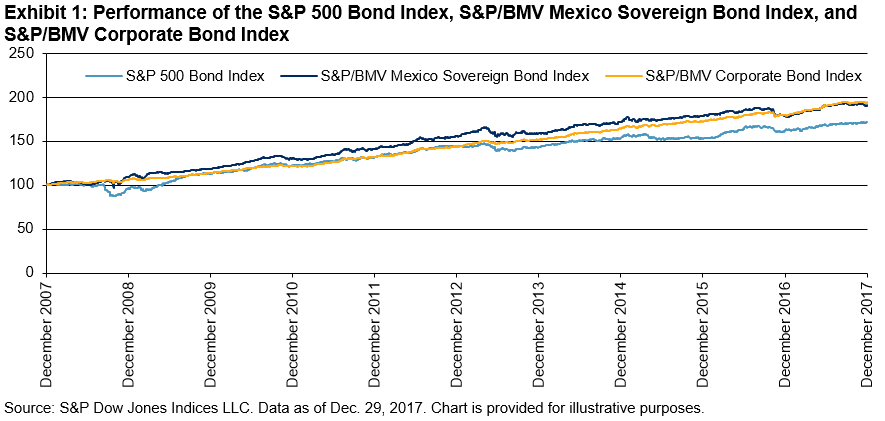

Over the past five years, the more worrisome government-issued debt in Europe has made significant progress in managing the normal mechanism of higher-perceived risk equaling higher yields. The Wall Street Journal focused on Portugal’s debt in their article, “Decade of Easy Cash Turns Bond Market Upside Down”. Quantitative easing (QE) by the European Central Bank (ECB) not only lowered rates to spur economic development in the region, but it also seems to have eased concerns about the risks of buying from some of the heaviest debt-ridden European countries. The negative yield environment created by the ECB’s QE program pushed investors to find higher yields in countries with higher risk profiles. Portugal, Italy, and Spain have all seen yields tighten significantly over the past five years, as measured by the S&P Portugal Sovereign Bond Index, the S&P Italy Sovereign Bond Index, and the S&P Spain Sovereign Bond Index, respectively. As of Jan. 31, 2018, yields for the overall indices saw both Portugal and Spain below 1%, with Italy hovering above 1% at 1.12%. Yields for all three indices have tightened from a range of 3.28%-5% back in the beginning of 2013 to a range of 0.79%-1.12%. When compared to the yield of U.S. Treasuries (2.36%), as measured by the S&P U.S. Treasury Bond Index, one may wonder what the reaction will be when the ECB reverses QE. While all four countries have different durations between 5.24 and 6.47, the U.S. has the shortest duration of them all, with the lowest risk profile and the highest yield.