Dividends are getting more and more into the spotlight as overall corporate earnings growth continues to face many challenges in a low inflation and relatively slowly growing world. And, a U.S. Treasury 10-year note yield of sub-2% certainly adds interest to the dividends that can be earned from S&P 500® companies. And, dividends may also provide a modest potential hedge against changes in nominal GDP growth, should the economy decelerate unexpectedly.

The principal drivers of dividends are corporate profit growth and payout ratios. From an economic perspective, the amount of dividends market participants should expect for the whole economy may be defined by the following formula:

Aggregate Dividends = (Nominal GDP) x (Corporate Earnings as % of GDP) x (Average Dividend Payout Ratio)

That is, aggregate dividends can be determined arithmetically by nominal GDP, corporate earnings as a percent of nominal GDP, and the average dividend payout ratio.

Moreover, dividends are a key component of one of the most venerable means of valuing equity markets — the dividend discount model, which holds that equity valuations are (or should be) equal to the discounted value of future dividends.

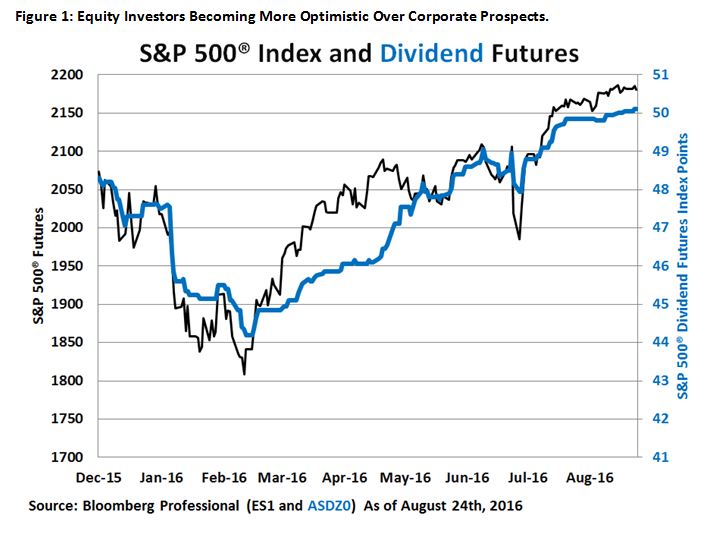

Currently markets are pricing slow growth for dividends. The December 2020 futures price for S&P 500® dividends points to 50.1 index points versus 45.6 for December 2016. This implies a modest 2.2% annualized growth rate over the last four years of this decade. Nominal GDP might expand a little faster than that, perhaps at around 3.5% or 4% per year, assuming 1.5% to 2.0% real growth and a similar level of inflation. In turn, this implies that corporate earnings, from which dividends are paid out, will likely grow more slowly than nominal GDP.

Market participants have been revising their views on dividends and are becoming much more optimistic. Since February, pricing for 2020 dividends has risen from 44.35 index points to 50.1 — a 12% increase. This increase comes on the back of a 20% rise in the S&P 500® index as equity investors become more optimistic about prospects for firms in general (Figure 1).

We are living in a slow growth world, however, and the rather modest expectations for dividend growth reflect that.