Summary

Many studies have documented the fact that market participants in many regions, including Canada, invest more in the companies from their home country than would be warranted by their country’s share of global markets. Three of Canada’s largest and most sophisticated pension funds have cut Canadian exposure in their equity allocations. Yet private Canadian market participants have so far failed to follow suit. Private market participants’ Canadian equity holdings represent almost 18 times Canada’s share of world markets.

Large, Sophisticated Managers Are Reducing Canadian Equity Exposure.

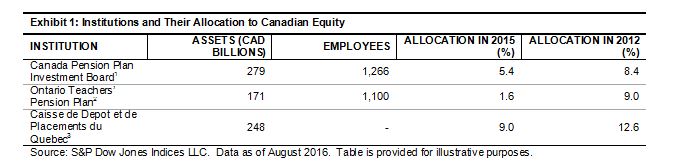

Canada has several world-class pension plan managers. The Canada Pension Plan Investment Board, the Ontario Teachers’ Pension Plan, and the Caisse de depot et de placements du Quebec collectively manage CAD 700 billion. Each has over 1,000 employees with offices in financial centers around the globe.

It’s worth exploring the holdings of these large, sophisticated fund managers to compare and contrast with your other portfolios. Of particular note, all three pension managers have materially cut their portfolio allocations to publicly traded Canadian equities in the past three years. The Ontario Teachers’ Pension Plan has lead the way, reducing its Canadian equity exposure to 1.6% in fiscal 2015 from 9.0% in 2012. The Canada Pension Plan cut its Canadian equity holdings to 5.4% from 8.4%, and the Caisse de Depot’s allocation fell from 12.6% to 9.0%.

Private Canadian Investors Heavily Overweight Canada

In contrast to Canadian institutions, Canadian private market participants tend to heavily overweight the local market. A 2016 Vanguard study calculated that Canadians held 59% of their equity investments in Canada.

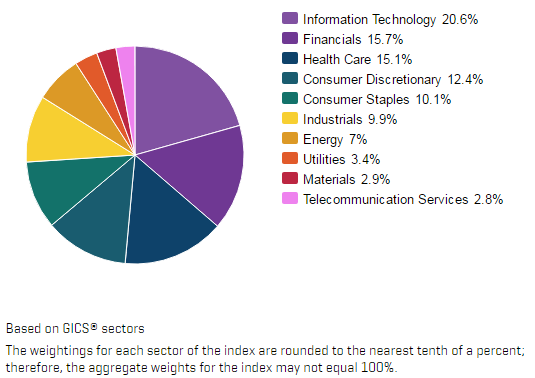

These figures are about 18 times more than Canada’s share of the world equity markets. For example, according to the S&P Global 1200, as of June 30, 2016, Canadian stocks accounted for 3.3% of global equity market capitalization.

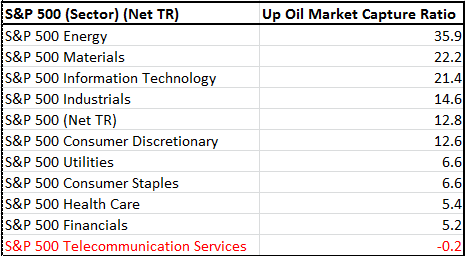

“Home country” bias is a common theme in behavioral economics literature about investing, but a multiple of 18 seems excessive. It means that most market participants are making an active “bet” that the commodity-driven Canadian market will outperform all other global markets and asset classes by a substantial margin. This view appears to stand in contrast to the views expressed by some of Canada’s most respected institutions.

Conclusion: Time to Think Globally

Canada’s most sophisticated institutions have moved to take advantage of global opportunities in their equity allocations. Individual Canadian market participants might benefit from a similar line of thinking.