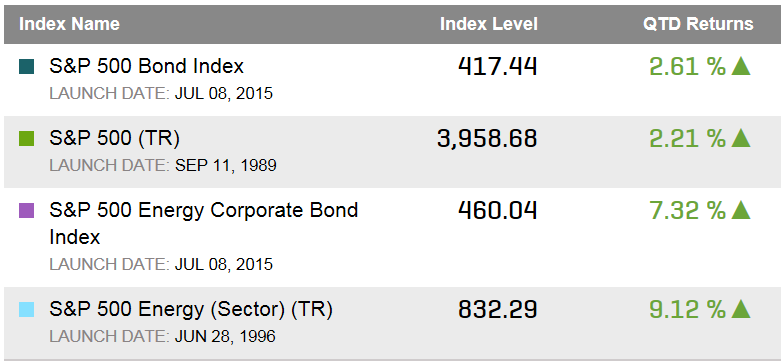

The recent oil price rally has pushed the energy sector upward in both the equity and bond markets. In the second quarter so far, the S&P 500 Energy Index (equity) has returned over 9.1% in total return and the S&P 500 Energy Corporate Bond Index has returned over 7.3%. Meanwhile, the broader indices have seen more modest returns: the S&P 500 Bond Index (the debt of the S&P 500 companies) has returned 2.61% and the S&P 500 (TR) has returned 2.21%.

Table 1: Select indices and their quarter-to-date returns:

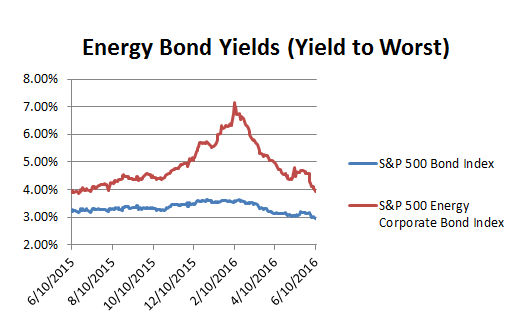

Yields of bonds in the S&P 500 Energy Corporate Bond Index have tumbled as bond prices have rallied. At the end of March the average yield of bonds in the index was a 5.17% and ended June 10th at a 3.95% – a 122 basis point drop. The average yields of bonds in the S&P 500 Bond Index have also fallen but only by 25 basis points during this time frame, helped in part by the inclusion of the energy bond sector.

Chart 1: Select indices and their yields (Yield to Worst):