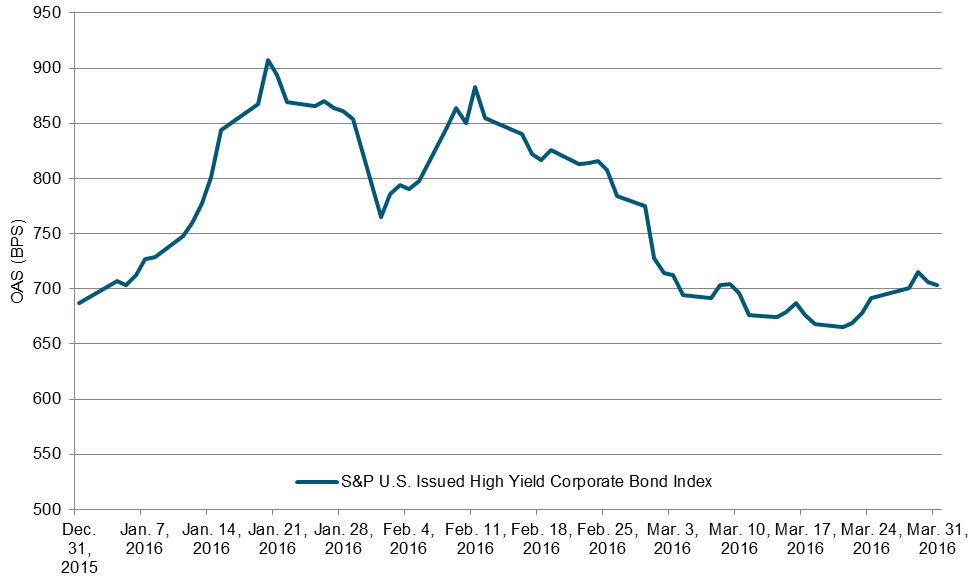

Given the FOMC minutes released yesterday we expect to see two rate increases in 2016. The next move is likely to be in June, not at the April 27th meeting. Some analysts blame disagreements within the Fed for what they see as inconsistent and changing policy. While it is difficult to anticipate short term market volatility, not paying attention to those market gyrations would be a mistake. This year began with sharp drops in the S&P 500 and Treasury notes and a spike in VIX (see chart). Had the Fed stuck to the plan it hinted at in December and pushed rates up in late January, it would have put stocks into a correction and spooked the economy. Instead it changed its mind when the data changed.

Unexpected bouts of market turmoil aren’t likely to end anytime soon. Moreover, few investors would want the Fed to ignore market events and steam-roller through rates hikes on a pre-set schedule. Whether the FOMC raises interest rates at its meeting in June, or later in the year, depends on the Fed’s view of the economy and how volatile the markets are at that moment.

We can look past the uncertainty of short term volatility and examine the Fed’s longer term outlook to discern the likely path of interest rates. The Fed expects the US economy to continue growing with real GDP growth of 2.25% in 2016 and 2017, slowing slightly to about 2% in 2018. The unemployment rate is anticipated to drop from the current 5.0% rate to about 4.65% in 2016 and 2017. Inflation projections show some changes. The core PCE inflation rate is expected to rise from 1.5% this year to about 1.8% in 2017 and 1.95% in 2018. The increase in the overall PCE rate – including volatile food and energy components — is from about 1.4% in 2016 to 1.9% or 2.0% in 2017 and 2018. The inflation numbers tell the story – the Fed is expecting inflation to rise to its 2% target over the next year or two. Given the associated drop in the unemployment rate, there will be a gradual increase in the Fed funds rate. The FOMC’s own projection for the Fed funds rate is to pass 2% in 2017, pass 3% in 2018 and settle at 3.5% in the long run. Given 2% inflation in the long run, the real rate of interest would be about 1.5%.

Looking forward, interest rates will rise over the next year and a half. Progress could be slowed if the market gyrations that opened the year repeat; or the rise could come sooner if growth picks up and stock prices climb without interruption. Of course, smooth sailing is not guaranteed. What could go wrong? For the rest of 2016 the risks are focused on the down-side: weakness in China, volatility in financial markets, fallout from Europe or Brexit or something unexpected that would slow US growth and push up unemployment. There is always some risk of recession. If the economy turns seriously down, the Fed is likely to respond by cutting interest rates back to zero, considering a return to QE or possibly joining the negative interest rate club. The recession risk is also a motivating factor behind the Fed’s efforts to raise interest rates: today rates are one step from the bottom so any rate cut to support the economy would be small. Were the interest rates at 2%, the Fed could cut rates farther is necessary.

If the economy develops as the Fed expects the risk of higher inflation will increase over time. Given the difference between core PCE and total PCE, the Fed is expecting oil prices to rise in the next 12 months. Add the momentum from rising oil prices to the decline in the unemployment rate and there is some probability that inflation could move over the 2% target to 3% or 4%. Were that to happen, the Fed would likely move aggressively to raise interest rates and dampen inflation

The posts on this blog are opinions, not advice. Please read our Disclaimers.