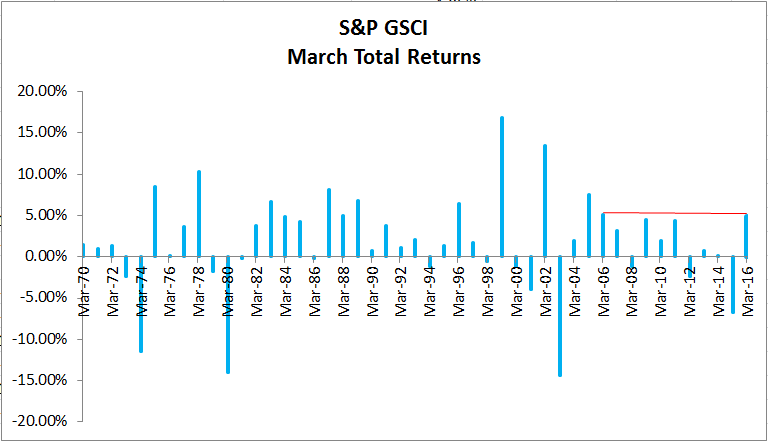

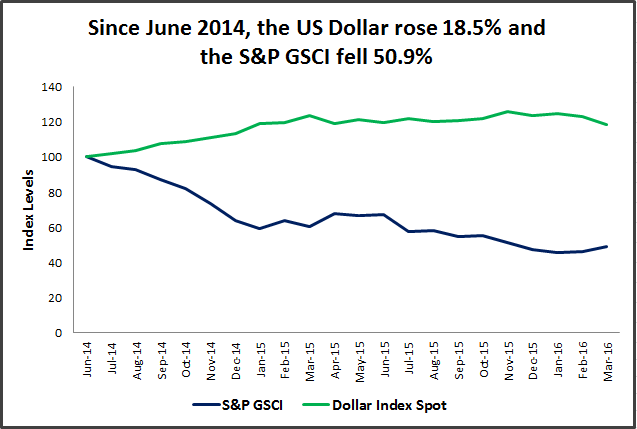

For the first time since June 2014, the Dollar Spot Index yoy% was negative in March. That was one of the main reasons commodities had such a strong month with the S&P GSCI gaining 4.9% and Dow Jones Commodity Index (DJCI) up 4.0%. Since commodities are priced in US dollars, when the dollar rises, it hurts commodities.

However, not all of the commodity market demise can be blamed on the the strength of the US dollar. Historically in the past 10 years, there is a -0.60 correlation between the rising dollar and commodities, meaning the relationship is negative but not very strongly. More importantly, when the dollar rose year-over year, it increased on average 8.1% driving commodities down 7.0% on average. While some economically sensitive commodities are moved more by the rising dollar, especially in energy, many are less sensitive and some even rise with a rising dollar.

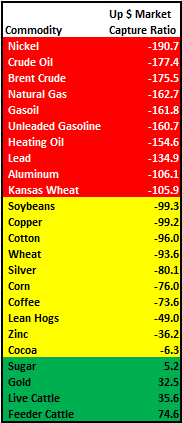

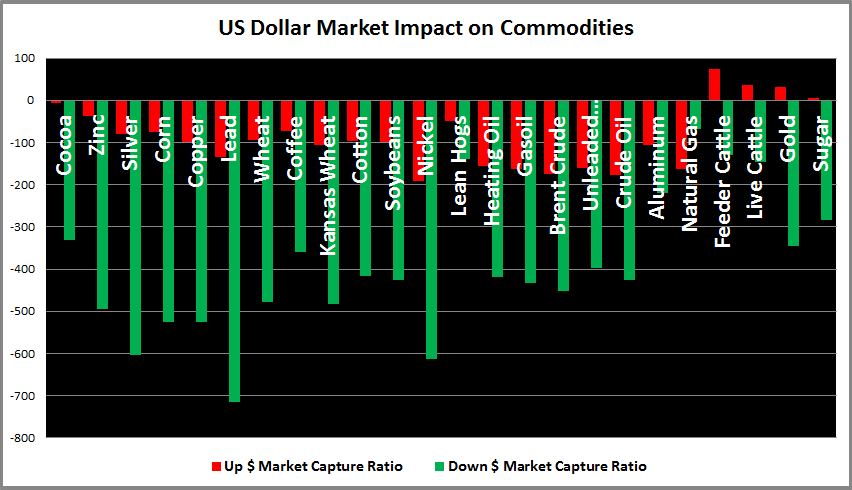

When the dollar rises, it is possible some opportunistic buying happens to take advantage of cheaper commodities, helping the prices from falling even further. On average the up $ market capture ratio for the commodities is -87.2, meaning for every 1% the dollar rose, commodities on average fell 0.872%.

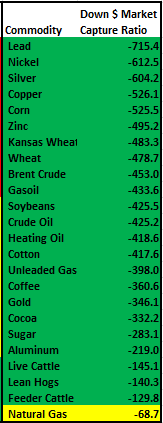

Now that the dollar has started to fall, it is interesting to note how much more power a falling dollar has in boosting commodities than a rising one hurts. On average when the dollar fell it fell 6.5% year-over-year, pushing commodities up on average 25.5%. The average down $ market capture ratio for commodities is -393.2, meaning for every 1% the dollar fell, commodities on average rose 3.932%. The falling dollar is 4.5 times more powerful than the rising one on commodities. Plus every single commodity benefits from the falling dollar, with the metals gaining most.

Not only does every single commodity benefit from a falling dollar, but only natural gas gets hurt more by a rising dollar than it gets helped by a falling one. It may be since it is so difficult to store.

If the Fed continues its more dovish sentiment, the dollar may fall more, which could be highly beneficial for commodities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.