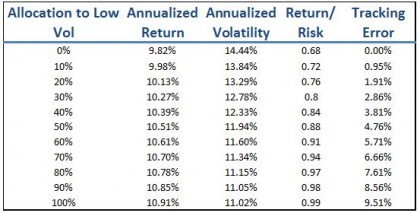

We’ve written at length of the many historical benefits of the low volatility anomaly. The S&P 500 Low Volatility Index selects the 100 least- volatile members of the S&P 500 index; lacking any sector constraints, the index seeks to provide pure exposure to the low volatility factor. In doing this, it has experienced a large tracking error (9.5%) relative to the S&P 500.

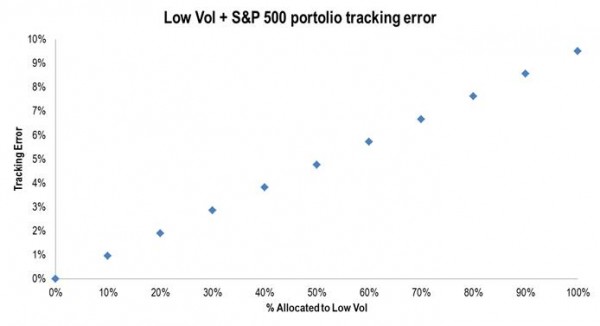

Some asset owners are not comfortable with such a large tracking error. While it would be easy to dismiss low vol on the grounds of tracking error, the decision need not be binary. The chart below plots the tracking errors at various levels of exposure to the S&P 500 Low Volatility index. The remainder of the equity exposure in these points is to the S&P 500. For example, if 50% is allocated to Low Vol, the other 50% is allocated to the 500.

The key takeaway is that tracking error increases proportionally as low vol allocation is increased. Unsurprisingly, the benefit of exposure to low vol increases as allocation to low vol increases.

A fund comfortable with 4% tracking error may resist a 100% allocation to low vol but could still benefit from a 40% allocation. Historically, that would have provided enhanced return with a reduction in volatility versus the S&P 500. When it comes to low vol, a little exposure goes a long way.

The posts on this blog are opinions, not advice. Please read our Disclaimers.