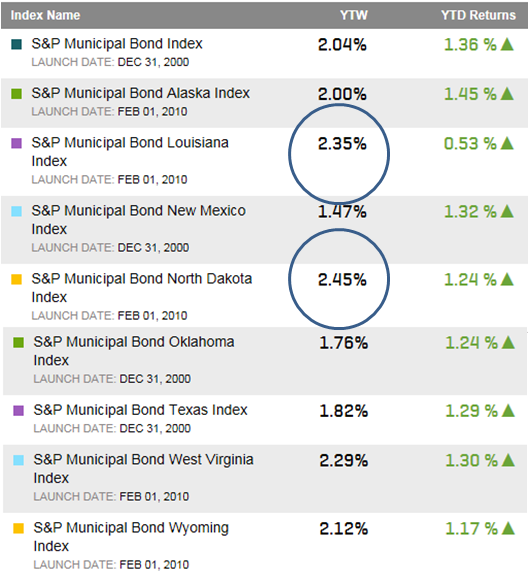

Local and state municipal bonds issued within states dependent on oil production are potentially in a cycle where they could underperform the overall bond market. So far, modestly higher yields can be seen in Louisiana and North Dakota and only Louisiana has underperformed to any significant degree year-to-date. Supply and demand of the bonds themselves plays an important role here as some states do not issue bonds in large volumes or have state supported debt.

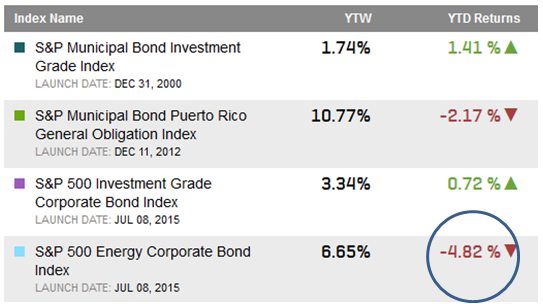

Table 1: Select municipal bond indices, their yields and year-to-date returns

The posts on this blog are opinions, not advice. Please read our Disclaimers.