Are U.S. municipal bonds rich or cheap relative to other fixed income asset classes? It is all relative. As of January 15th 2016, the yield to worst of investment grade bonds tracked in the S&P National AMT-Free Municipal Bond Index was a 1.8% (tax-free yield). The Taxable Equivalent Yield (TEY) of those bonds using a 35% tax-rate assumption would be 2.77% (the required yield of a taxable bond to keep the same interest income after taxes).

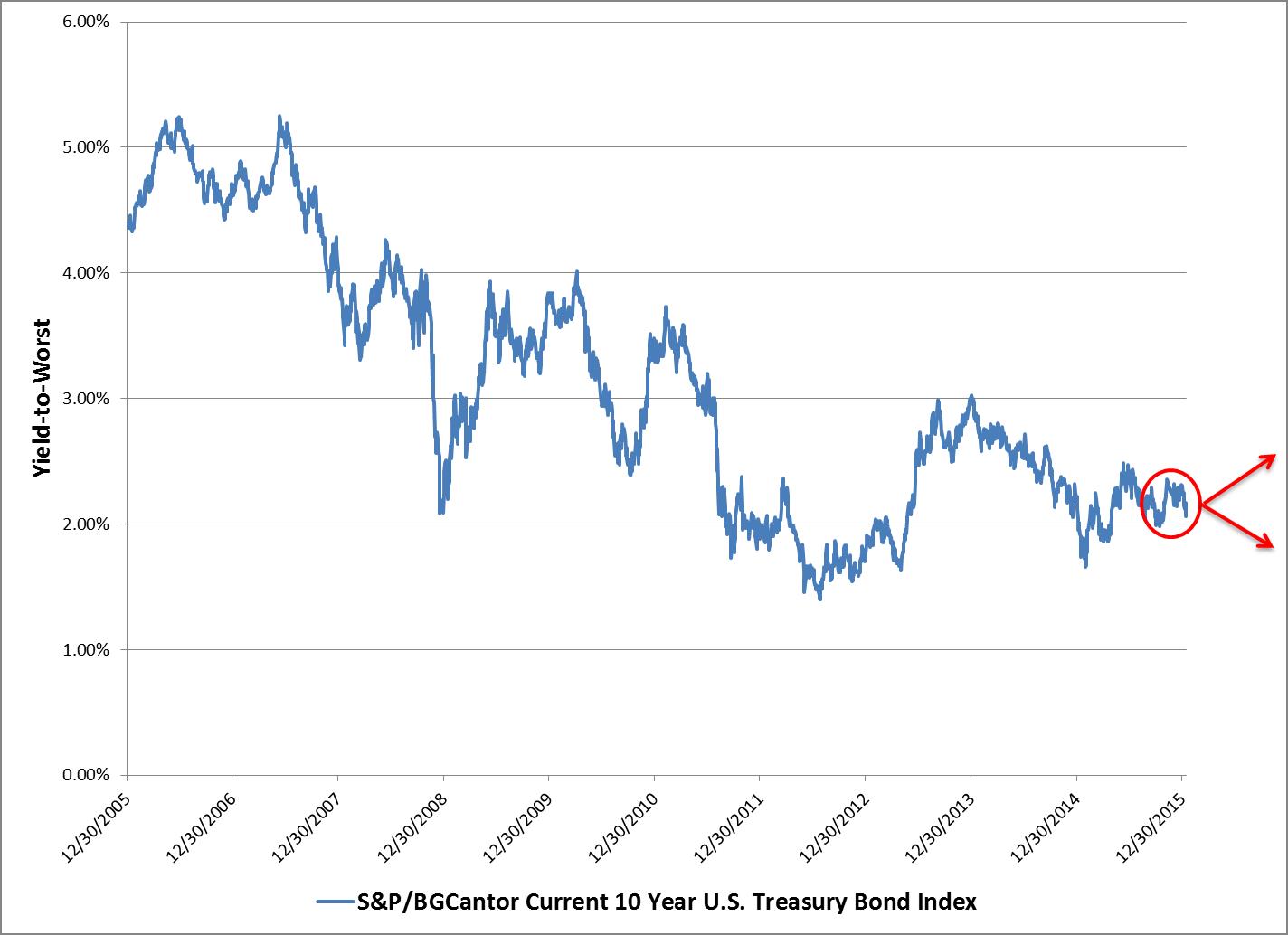

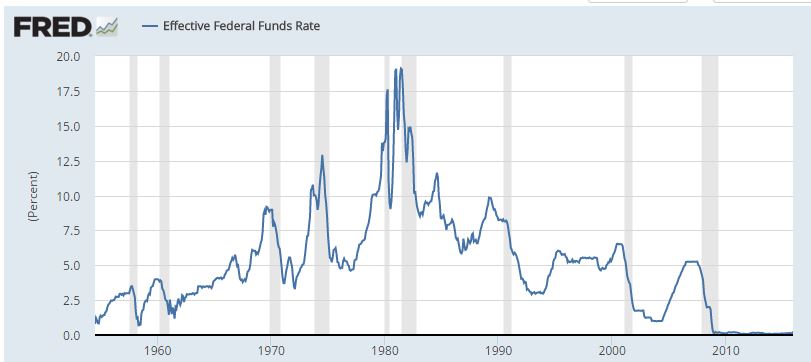

Historically, the traditional measure of rich or cheap for municipal bonds has been the tax-free yield to U.S. Treasury yield ratio. Prior to quantitative easing that rations had been about 75 – 80%. By most measures, the yields of municipal bonds remain higher than the historical trend. For example, the investment grade non-callable municipal bonds maturing in 2024 tracked in the S&P AMT-Free Municipal Series 2024 Index ended at a yield of 1.87% verses the yield of the S&P/BGCantor Current 10 Year U.S. Treasury Bond Index yield of 2.03%…or 92% of the U.S. Treasury yield.

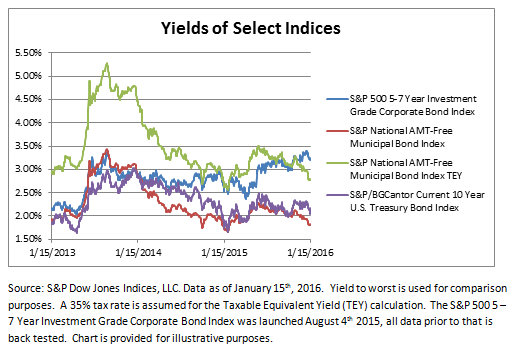

When comparing municipals to corporates we get a different picture:

Municipal bonds are currently rich when comparing tax-free municipal bonds to investment grade corporate bonds. To make a fair comparison between the two asset classes indices were selected that have comparable weighted average modified durations: S&P National AMT-Free Municipal Bond Index and the S&P 500 5-7 Year Investment Grade Corporate Bond Index. The green line in the chart below is the Taxable Equivalent Yield of bonds in the S&P National AMT-Free Municipal Bond Index again using a 35% tax-rate assumption. Yields of investment grade municipal bonds have now fallen to levels that in relative terms make them ‘rich’ to corporate bonds. Higher or lower tax assumptions would change the outcome of the graph.

Chart 1: Yields of select indices

Weighted modified durations as of January 15, 2016:

S&P National AMT-Free Municipal Bond Index: 4.72

S&P 500 5 -7 Year Investment Grade Corporate Bond Index: 5.25

No tax advice is provided or intended in this blog. Taxable Equivalent Yields are used as a comparative measure only .

The posts on this blog are opinions, not advice. Please read our Disclaimers.