Overall in October, the gassy hogs (natural gas -15.3%, lean hogs -11.3%) cast a spell over the sweet meat (sugar +12.7%, all cattle +8.5%) for a flat brew of commodities that were neither a trick nor treat. Although the S&P GSCI was up just 23 basis points and the Dow Jones Commodity Index was down only 87 basis points, commodities in October may be waking from the dead.

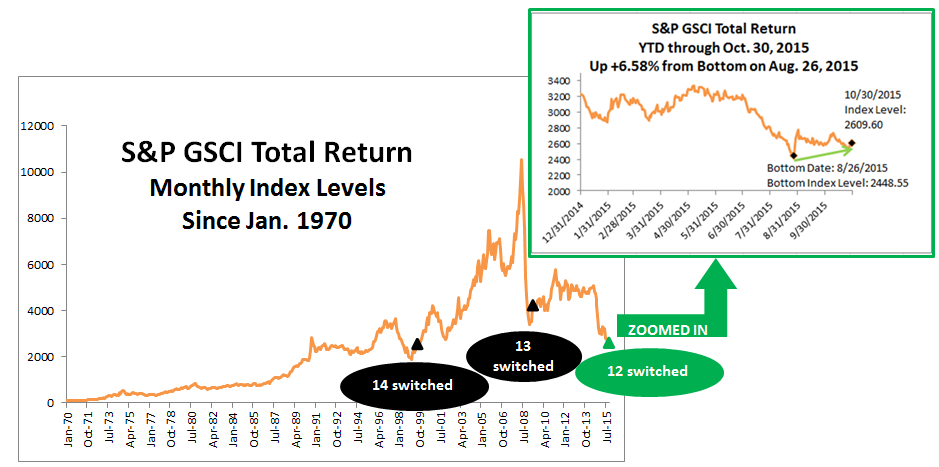

This past July, just three months ago, every single commodity was negative except for one. Commodities have made a remarkable comeback with more than half (13 of 24) posting positive returns in October. There has never been a time in history where 12 single commodities went from posting a negative month to a positive month this quickly after 23 were negative together. However, in January 2009, 11 single commodities came back, just before the S&P GSCI hit its bottom, the next month in February 2009. That month, 8 commodities were positive but by May 2009, 13 additional commodities posted gains so that almost all were positive (21 of 24.) Also, in August 1999, 18 single commodities were positive after just 4 were positive in May that year, following its bottom, just a couple months earlier in February.

A few other scary statistics in October are the following:

- S&P GSCI Total Return is -19.3% YTD through October 30, 2015, the 4th worst on record since 1970. Worse YTD returns through Oct happened in 2008, 2001 and 1998, down 27.5%, 27.1% and 25.6%, respectively.

- S&P GSCI Total Return is on pace for the 6th worst year on record since 1970. 2008,1998, 2014, 2001 and 1981 were worse, losing 46.5%, 35.8%, 33.1%, 31.9% and 23.0%, respectively.

- S&P GSCI is on pace to set the 1st 3-year consecutive negative annual return. 2013 and 2014 lost 1.2% and 33.1%, respectively.

- S&P GSCI is set to have the worst back-to-back 2-year loss in history since 1970, but 2008’s loss alone, is still worse by 51 basis points – even with 2013 included.

- This is the 3rd worst October on record for number of commodities in contango. 17 of 24 commodities in the S&P GSCI were in contango in October, compared to just 12 in October 2014. Only October 2001 and October 2009 had more commodities in contango with 18 and 20 in contango, respectively.

- S&P GSCI Natural Gas Total Return lost 15.3% in October 2015, recording its 3rd worst October in history (since Feb 1994) and worst October in 10 years. October 1998 lost 15.9% and October 2005 lost 15.3%.

The posts on this blog are opinions, not advice. Please read our Disclaimers.