Published every six months, the SPIVA Europe Scorecard aims to measure the performance of active funds against their corresponding benchmarks. The results for the Year-End 2014 Scorecard are now in, and they reveal few surprises.

Euro-Denominated Funds

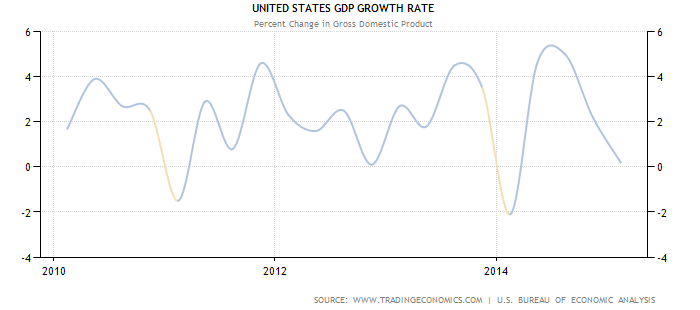

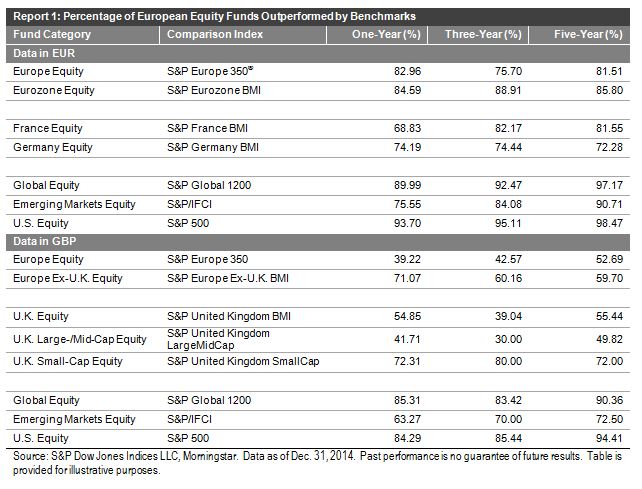

In spite of a slight improvement in the last quarter of the year, growth in Europe for the other quarters of 2014 was generally anemic. At the start of the year, the markets had generally been optimistic that the European Central Bank (ECB) would start quantitative easing in the event of continued slow growth, but they were disappointed that the ECB did not announce any concrete measures. This led to bouts of high volatility throughout the year and a generally lackluster performance in the equity markets. Normally, these conditions would be ideal for active managers, but our report indicates that the majority of euro-denominated funds invested in European equities trailed their respective benchmarks over the one-, three-, and five-year periods.

This pattern of underperformance[1] was not only limited to European equities. We saw a similar pattern of underperformance in euro-denominated funds invested in other regions, such as emerging markets, the U.S., and international markets (see Report 1).

Sterling-Denominated Funds

In regards to sterling-denominated fund categories, some categories of active funds invested in U.K. equities performed well. Across all time periods, the majority of U.K. large- and mid-cap funds posted higher returns than their benchmark, suggesting that active management opportunities may be present in the U.K. large- and mid-cap spaces.

However, sterling-denominated funds invested in emerging markets, the U.S., and international equities underperformed their corresponding benchmarks. This is in line with the finding for euro-denominated funds invested in these markets.

![Source:http://www.worldeconomics.com/papers/Global%20Growth%20Monitor_7c66ffca-ff86-4e4c-979d-7c5d7a22ef21.paper Real GDP data was taken from the World Economics Global GDP database Population data was obtained from the Maddison and the United Nations tables 2012/14 data was calculated from the year on year estimated % increase in real GDP from the IMF tables[1] (Gross domestic product, constant prices, % change)](https://www.indexologyblog.com/wp-content/uploads/2015/05/GDPyoyAmericas.png)