Volatility and correlation are history.

In fact this is a consequence of their definitions. The calculation of volatility and correlation – the preeminent measures of risk – requires multiple observations. Quite a few periods are needed if the resulting estimates are to be relied upon as robust. Because of this, volatility and correlation are not particularly quick to capture new and changing market dynamics[1].

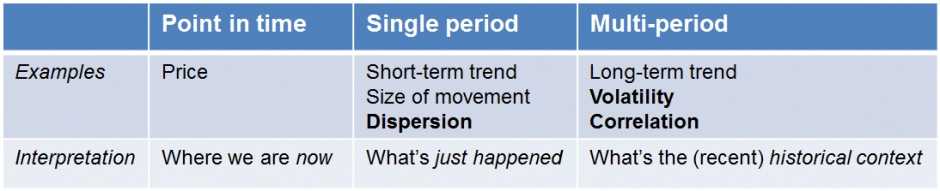

Shorter term measures can help. For any market – the S&P 500® for example – at any given moment in time the price of each stock (or the level of the index) provides an immediate indication of market outlook. Looking over a single period tells us, at the most basic level, if and by how much the market was up or down. But within a single period there is more information — such as the percentage of winners and losers, or how different the performances were among individual stocks. This last measure we call dispersion, and because dispersion is a single period measure, we can use it to capture changes in market dynamics more immediately.

Dispersion is a useful concept considered in isolation, but the question of how it is connected to the multi-period measures arises naturally. Our most recent research describes the conceptual link between dispersion, market volatility and correlation.

Just as “How much did the market move today?” provides an indication for future measures of volatility that include today’s returns, one can use dispersion to provide intelligence about how volatility and correlation will evolve, as “history” catches up with new dynamics. The relationship is more subtle and occasionally technical. But three practical conclusions emerge:

- Dispersion is driven by the difference between the volatility of an index and the average volatility of the index’s components. Otherwise said, it measures the “diversification benefit”.

- It’s not too much to say that volatility, dispersion, and correlation are like three legs of a right triangle – if you know two, you can figure out the other. This relationship can be particularly useful in using volatility and dispersion to estimate the average correlation among an index’s components.

- We’re recently been in a period of relatively low dispersion and relatively low volatility. If market volatility is to increase, either correlations or individual stock risk (i.e. dispersion) must rise.

[1] A 60-day rolling calculation of market volatility is only 1/60th influenced by the most recent day. Part of the widespread popularity of the VIX as a measure of market sentiment is due in no small part to its more forward-looking nature.