There are too many funny coffee jokes to single one out but this one I found seriously relevant:

Though I take my coffee black, I also take it seriously since it is one of the commodities in the S&P GSCI and DJ-UBS. Coffee has been the best performing commodity this year, up 23.9%. As I mentioned in a prior post, Coffee is up since the consumption of coffee in China is expected to grow by an annual rate of 9% for the next five years. This is not only from China’s large population but it’s rising middle class, which is expected to grow to 630 million people from 230 million. Further, the International Coffee Organization reported “annual consumption should continue to grow at around 2.4% per year, and demand for coffee remains buoyant and should provide potential for further growth in the long term”.

Additionally, dry weather in Brazil has supported coffee returns this year. According to the International Coffee Organization, “The recent publication of official Brazilian production estimates for crop year 2014/15, which is due to start in April, suggests that output could fall for the second consecutive crop year, giving an initial forecast of between 46.53 and 50.15 million bags. This uncertainty over the 2014/15 crop, exacerbated by notably dry weather in some coffee-producing regions, has given support to coffee prices over the last month.”

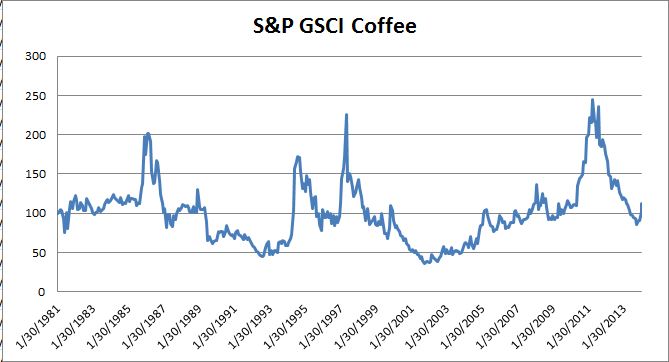

However don’t be fooled by the seemingly supportive economics. Let’s take a look at history because it looks like the 30.1% increase since October 2013 could be a head fake. Below is a cumulative return chart of monthly index levels since the index inception in 1981:

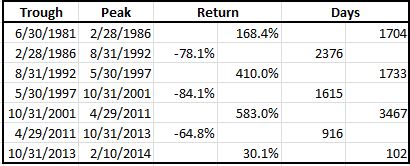

Historically, the major drawdowns have lasted on average about 5.5 years with a loss of 81.1%. The gains from trough to peak on average with the exception of the 2008 financial crisis period lasted 4.8 years with average gains of 387.1% that includes the gain between 2001-2011. The last drawdown ending 10/31/2013 only lasted 2.5 years and was only down 64.8% before gaining 30.1% until now. If the next drawdown looks like the past, it is possible to see a downward spiral for another 2.5-3 years with a loss of 58.6%. Please see the table below: