In the iconic film The Hunt for Red October, released in 1990, the cold war standoff between the U.S. and the Soviet Union is taken new to heights. Based on a novel of the same title written by the recently deceased author Tom Clancy, a CIA analyst finds himself in over his head in the middle of an international crisis. Packed with too many stars to mention, Jack Ryan, played by Alec Baldwin, finds himself on the nuclear submarine U.S.S. Dallas trying to convince its Captain, Bart Mancuso, that a Soviet submarine they are chasing is actually looking to defect, not to attack the U.S. with nuclear weapons as the Soviets claim. As the two submarines sail towards each other, Captain Mancuso says to Ryan, “The hard part about playing chicken is knowin’ when to flinch.”

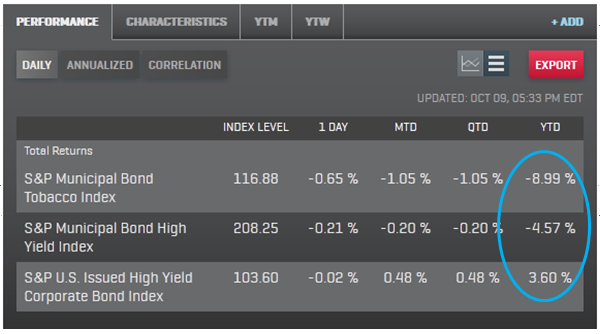

Although not quite as theatrical or as thrilling as in the movie, the U.S. economy is facing a similarly tense situation today. Though the political haranguing over the debt limit has been quite public, its effect on investments has, so far, remained relatively unseen. Equity markets, as measured by the S&P 500 Index, have been steady, with average price actions that would not garner significant attention. The largest decline this month was a 20.6 point drop on Oct. 8, which was followed by four days of gains totaling 55 points. As for bonds, the S&P/BGCantor Current 10-Year U.S. Treasury Index, which measures the performance of the on-the-run 10-year Treasury, is down -0.53% month-to-date while its yield-to-worst has widened by 0.07 basis points (bps). Investment-grade corporate bonds, as measured by the S&P U.S. Issued Investment Grade Corporate Bond Index, are up 0.09% for the month, while lower quality high-yield bonds represented by the S&P U.S. Issued High Yield Corporate Bond Index are up 0.7% on the month.

So far everything seems like business as usual, with all eyes watching Washington to see if something more significant develops. If there have been any worrisome waves from this round of partisan bickering, they would be in the U.S. Treasury bill market. The yield-to-worst on the S&P/BGCantor U.S. Treasury Bill Index has widened by 13 bps. This is a yield that, up until the end of September, has averaged 6 bps for the year. The maximum change in daily yield for the same time period had been just 3 bps. Funding for the U.S. government is getting more expensive and the clock is ticking. The Treasury’s October 17th, deadline is quickly approaching and, like the plot of Tom Clancy’s novel, the ramifications of failure will have a great impact both politically and economically.

The posts on this blog are opinions, not advice. Please read our Disclaimers.