Dividend focused strategies as well as strategies offering exposure to alternative income sources have become popular and proliferated over the past few years given the low interest rate environment. Throughout history, dividends constitute an important part of total equity return. In decades such as the 40s and the 70s, dividends constitute 50% or more of the equity markets returns whereas during the 90s, dividends made up only 14% of the total return with capital appreciation making up the rest. In addition, academic research has shown that dividends offer protection during bear markets. It must be noted that, while dividends offer benefits, not all dividend strategies or dividend indices are constructed the same. Some indices are designed with the specific purpose of absolute high yield, some focus on stable, consistent dividend growth and others encompass a bit of both. Nearly all dividend indices employ quality measures to ensure their objectives are achieved. During our webinar this Thursday on dividends, we will breakdown the methodology construction behind several leading dividend indices as well as highlight how different index mechanics can lead to different risk/return profiles and sector compositions.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Are Dividends the Answer to Growth for Income Hunters?

What’s in a Name

Video: U.S. Market Wrap-up: Week of 7/8

25 and Counting for the Dow

Ready to Roll or Need to Weight?

Are Dividends the Answer to Growth for Income Hunters?

Former Managing Director, Global Head of Core and Multi-Asset Product Management

S&P Dow Jones Indices

- Categories Strategy

- Tags dividend indices, dividends

What’s in a Name

Picking the right ETF among the hundreds that are currently available is certainly a formidable task for many investors – one that has been made more difficult by iShares recent announcement that it is removing index names from a number of its ETFs. Why should this raise concerns for investors and for the financial industry overall? Well, simply stated, it’s a transparency issue. As investors will no longer be able to determine the index that underlies an ETF just by looking at the ETF name, investor transparency has taken a few steps in the wrong direction.

As we have seen with the issues facing LIBOR and Reuters/WM, transparency of indices has become a paramount theme for investors. Knowing your exposures and where your potential returns are coming from are vital pieces of information that every investor should be aware of. As a recent Index Universe article pointed out, “the underlying index choice is the single biggest determinant of your returns”, and I couldn’t agree more. Given the growing number of indices available in the marketplace (S&P Dow Jones Indices, itself, calculates and publishes over 830,000 indices) – each with different weighting schemes, components, rebalancing schedules, and stated objectives – it’s absolutely critical that investors know what they are buying when they decide to invest in an ETF.

But what about the index provider? Finding the right index that underlies your ETF is one important step in the process, but knowing the index provider responsible for calculating and publishing the index underlying your fund is another. Does the index provider have a considerable track record in producing stock market indices, is it independent from the product, does it have a team that monitors the index 24/7, does it have a dedicated customer service department, are its benchmarks free of conflicts of interest, is it known for consistently and reliably producing indices, has it secured the necessary data licenses to ensure the ongoing calculation of the index, and does it utilize a transparent system comprised primarily of independently sourced pricing? With over 125 years of experience producing uncompromised indices and benchmarks, S&P Dow Jones Indices has worked tirelessly to ensure that our brand meets all of the above criteria while consistently and reliably serving as the seal of approval for markets both domestic and abroad.

Knowing the characteristics of the index underlying a fund, as well as the history, expertise and the integrity of the index provider are critical pieces of information that all investors should have upfront. In a time when financial market transparency is being called into question, it’s important that investors have at their fingertips the relevant information necessary to make an educated and informed investment decision.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Video: U.S. Market Wrap-up: Week of 7/8

- Categories Equities

- Tags

Click here and watch Craig Lazzara, global head of index investment strategy at S&P Dow Jones Indices discuss last week’s market performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.25 and Counting for the Dow

- Categories S&P 500 & DJIA

- Tags DJIA, Dow

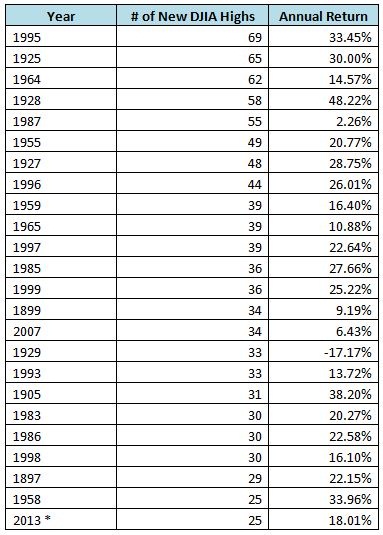

The number 25. Christmas Day. The atomic number of manganese. The jersey number typically reserved for a baseball team’s best slugger. And to date in 2013, the number of new highs hit by the Dow Jones Industrial Average. Year to date through Friday (July 12) the Dow, ending the session at 15,464.30, has closed at a new high 25 times. How does this compare to years past? Well, it’s a pretty active pace – the DJIA is up over 18% on the year – but still a ways off the record. In the 118 years since the DJIA’s inception, the most active year for new highs was 1995 when the DJIA hit a record close 69 times. 2007, in the lead up to the great recession, is on the list with 34 new highs. With about 5 ½ months left to go – and with no apparent end to the Fed’s QE actions – 2013 currently ranks 24th on the list. Keen observers of the list below will also note some other significant numbers: 1929 and 1987, years associated with historic equity market declines.

Source: S&P Dow Jones Indices. Data is through July 12, 2013.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Ready to Roll or Need to Weight?

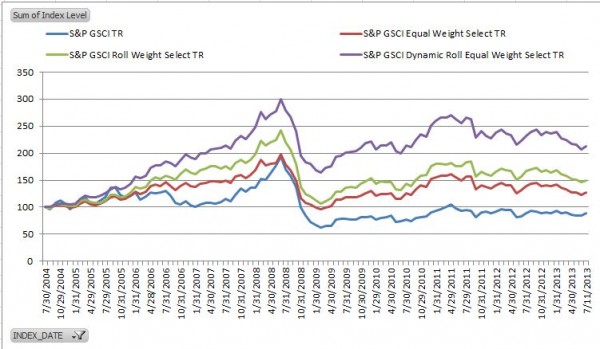

In the past few years a number of indices have been launched with a goal of minimizing the impact of contango. The first indices launched with this goal were the simple (1-5 month) forward indices and the relatively static S&P GSCI Enhanced. In the time period from Aug 2004-May 2011, mentioned in my prior post, these indices did the job of outperforming the front month contracts in the S&P GSCI by reducing the negative impact from contango as shown in the chart below.

However, 2012 told a different story, where the S&P GSCI 3-Month Forward and S&P GSCI Enhanced underperformed the S&P GSCI by 1.6% and 0.3%, respectively, but the S&P GSCI still was not the star performer. The S&P GSCI Dynamic Roll outperformed the S&P GSCI by 2.3% for the year.

So, the front month paid off but the flexibility to switch to contracts with different expiration dates on the curve was more lucrative. Now the question is whether as good a result may have been achieved by changing weights rather than rolls (contracts) based on the term structure. In order to help answer this question please see the following chart:

Immediately noticeable over the entire time frame from Aug 2004 -Jul 2013, is the gain earned by moving from the S&P GSCI, which has a world production weighting of 24 commodities, to the S&P GSCI Equal Weight Select, which includes a sampling of the most liquid commodities from each sector of the S&P GSCI to reduce the number of constituent to 14 commodities that are equally weighted. In 2012, the S&P GSCI Equal Weight Select gained 3.1% versus the S&P GSCI which was up 0.1%. The next improvement is earned by changing the weights from the S&P GSCI Equal Weight Select based on the change in realized roll yield as illustrated in the newly launched S&P GSCI Roll Weight Select, which gained 4.0% in 2012. Finally in the chosen period, the S&P GSCI Dynamic Roll Equal Weight Select, which only changes the contract based on implied roll yield when compared to the S&P GSCI Equal Weight Select, added the most value overall. However, the S&P GSCI Dynamic Roll Equal Weight Select only gained 3.6% in 2012.

It is possible there is more of a premium to be gained by giving up some liquidity as the contracts are longer-dated but it may depend on the time-frame. Overall, whether the better choice is to roll or to weight may just depend on how long the wait is to roll or to weight.

The posts on this blog are opinions, not advice. Please read our Disclaimers.