The year 2022 was riddled with investment challenges worldwide, as fears of recession, rising inflation and geopolitical uncertainty ranked among a whirlwind of other market pressures. In South Africa, these risks manifested in two notably different halves of the year, with major equity and bond indices ending H1 in negative territory, but then rallying to recover in H2 (see Exhibit 1). The SPIVA® South Africa Year-End 2022 Scorecard assesses the aftermath and reveals how many active managers successfully navigated the 12-month rollercoaster of risk.

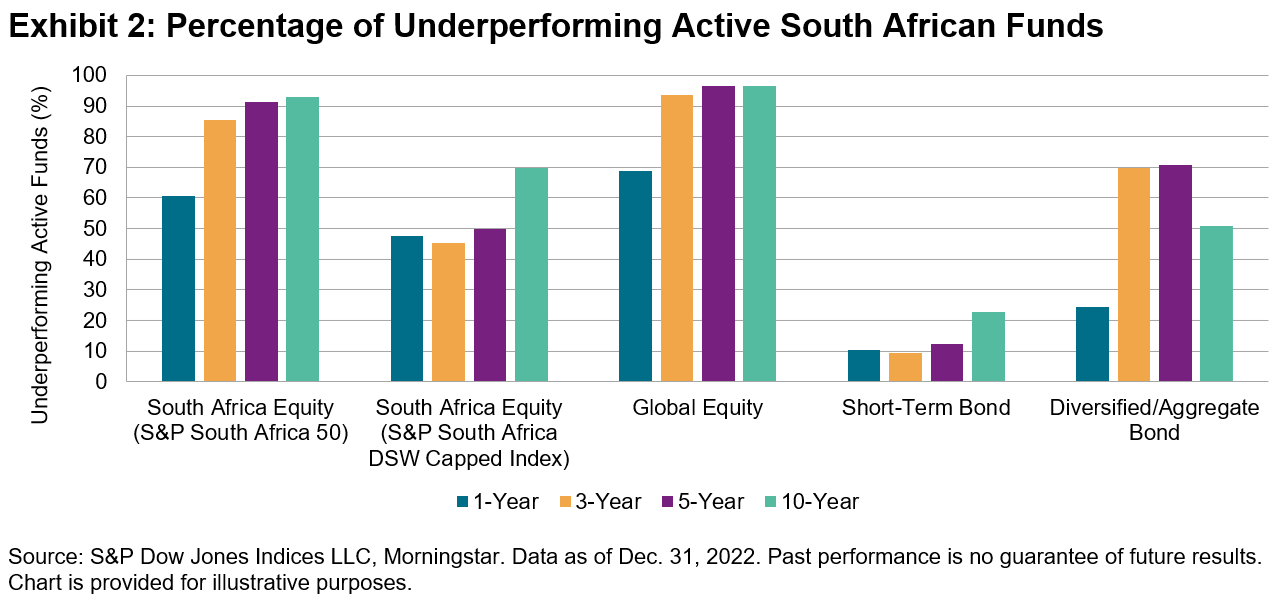

Although many actively managed South Africa Equity funds started the year strong—with only 36% underperforming the S&P South Africa 50 Index at the end of H1—most lost their advantage by the end of 2022, as 61% of South Africa Equity funds finished 2022 as underperformers relative to the benchmark (see Exhibit 2).

Our South Africa Scorecard (unusually) offers two comparison benchmarks for the domestic equity category, reflecting the differing opportunity set for foreign-investment-constrained fund managers versus those managers with fewer constraints. Consistent readers of SPIVA South Africa might observe that 2022 was the fifth year in a row that less than half of South Africa Equity managers underperformed the S&P South Africa Domestic Shareholder Weighted (DSW) Capped Index, but the eighth consecutive year in which more than half underperformed the S&P South Africa 50 Index. These differences emphasize the importance of benchmark selection in evaluating active performance. It is perhaps worth highlighting that, nonetheless, most active funds underperformed either benchmark over a 10-year horizon (see Exhibit 2).

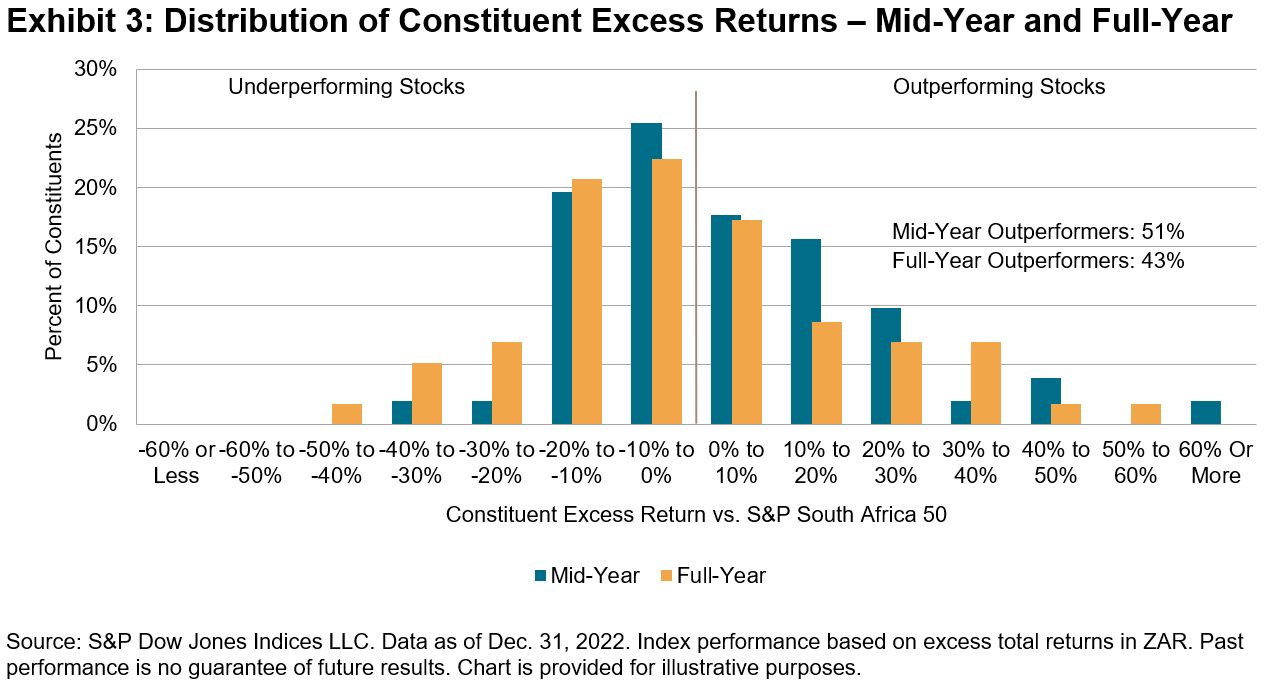

The changing rate of underperformance from H1 to H2 seems to have mirrored similar changes in the challenge of stock selection: although 51% of stocks in the S&P South Africa 50 Index outperformed the index itself through the end of H1, by the end of the year, only 43% of stocks had a higher return than the index (see Exhibit 3).

Among other notable highlights from this year’s reports, Short-Term Bond funds caught the eye with a commendably low 12.5% underperformance rate. This was the fifth year in a row that 20% or fewer of Short-Term Bond fund managers underperformed the STeFI Composite on an absolute return basis. However, the dramatic increase in the underperformance rate to 83% using risk-adjusted returns suggests managers may be generating their outperformance from higher-risk securities.

Adding risk brought added return for some managers in 2022. Only time will tell whether such approaches result in persistent success in 2023 and beyond.