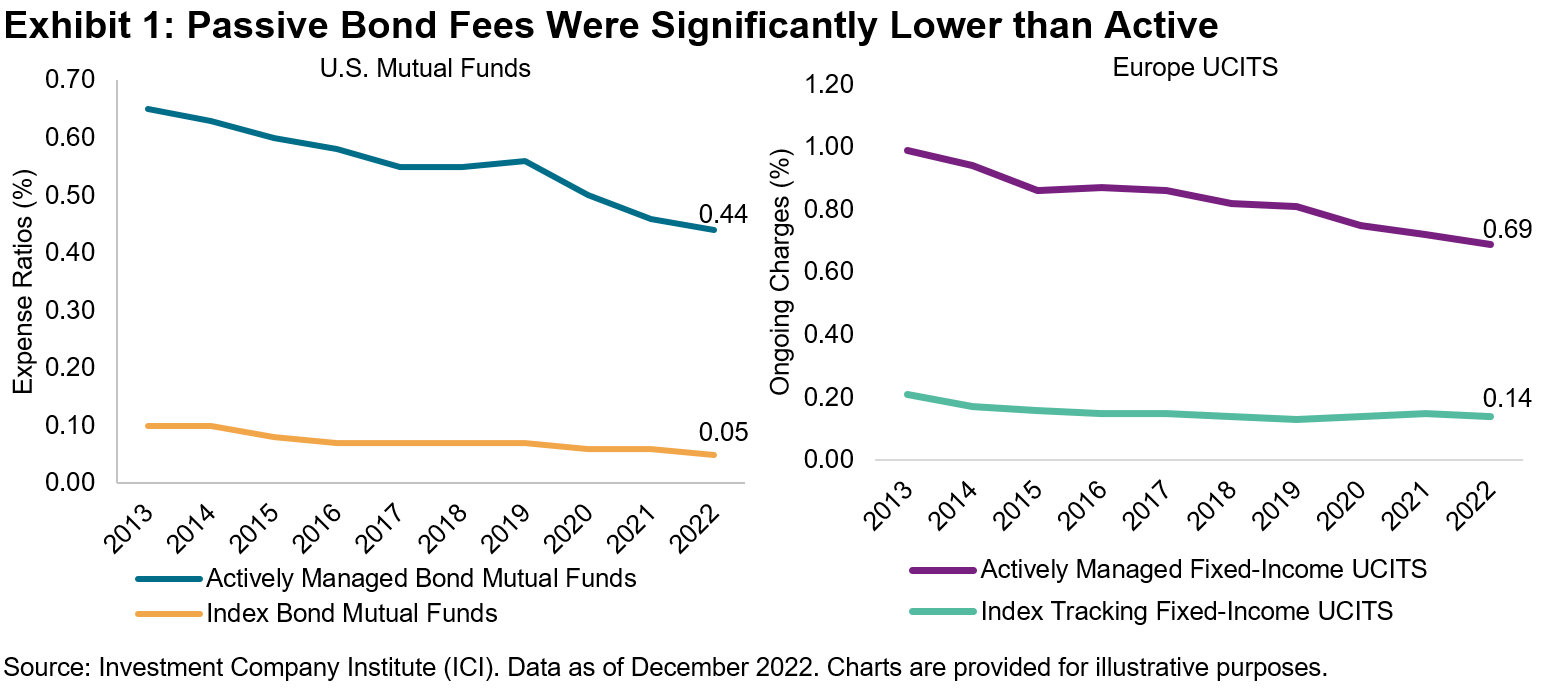

One of the benefits of indexing is its low cost relative to active management. As indexing has grown, investors have benefited substantially by saving on fees and avoiding active underperformance. These benefits are not limited just to equities but have also extended to other asset classes including the fixed income space, where fees can play a particularly pivotal role.

In Exhibit 1, we see that index bond fund expenses in the U.S. and Europe have been consistently lower than their active counterparts for the past decade. While that spread has narrowed in recent years, we still observe a fee differential of 39 bps in the U.S. and 55 bps in Europe as of 2022.

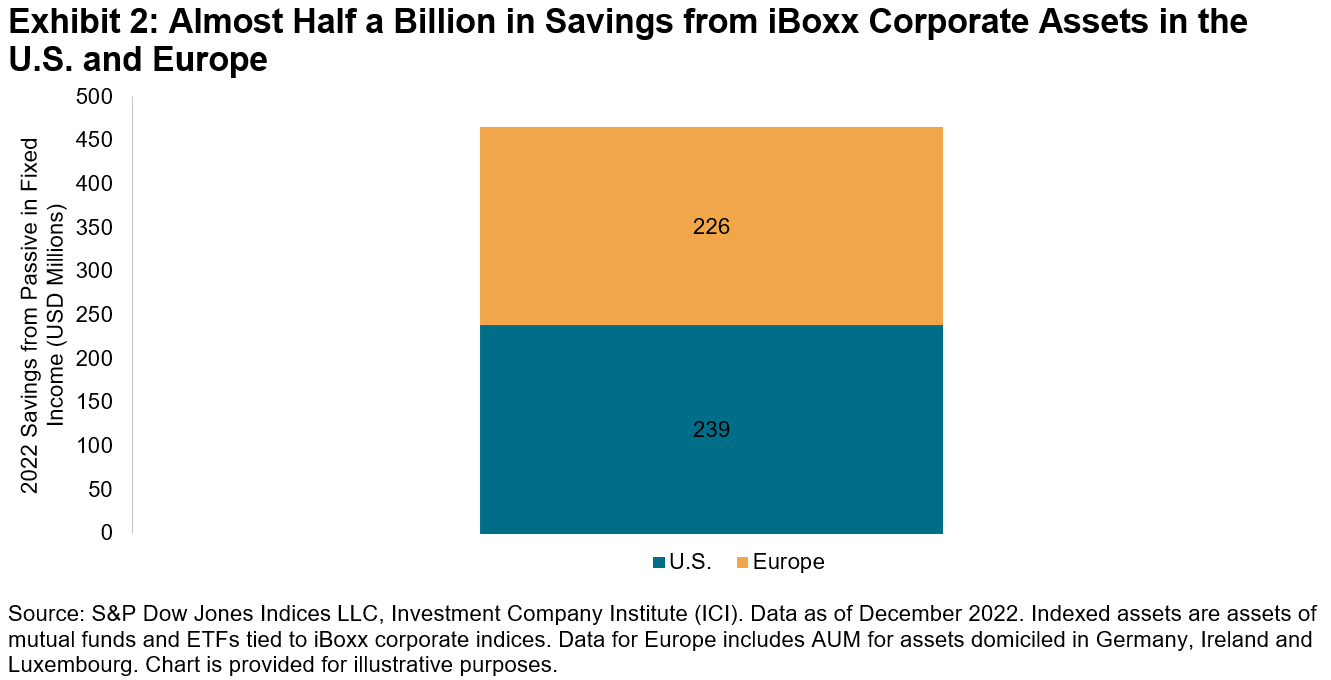

Using the same average fee differentials between active and passive fixed income funds in the U.S. and Europe, as applied regionally to approximately USD 102 billion of assets invested in mutual funds and ETFs tracking iBoxx corporate bond indices in both regions, we can estimate a current run rate of equal to at least USD 465 million per year in fee savings made by passive investors thanks in part to the iBoxx series (see Exhibit 2).

Of course, this USD 465 million estimate understates the full cost savings of the fixed income index industry, since it encompasses funds tracking only select indices from S&P Dow Jones Indices in the U.S. and Europe.

Our Annual Survey of Indexed Assets shows global assets tracking our iBoxx Corporate indices were USD 121 billion as of December 2022 (this also includes institutional segregated mandates, as well as assets outside the U.S. and Europe). To provide context on the size of the passive market in fixed income, this number makes up only 1% of the global total of USD 11.5 trillion in assets of all open-end bond funds1 and only around 0.5% of global rated corporate debt outstanding.2 In other words, there is plenty of headroom for future passive growth in fixed income, and the prospects for greater fee savings are promising.

Obviously, the savings generated by the shift from active to passive management would be of no consolation if investors lost more in performance shortfalls than they gained in reduced fees. As readers of our SPIVA® reports may know, in the 15 years ending in June 2023, 94% of all actively managed General Investment Grade bond funds lagged the iBoxx $ Liquid Investment Grade Index. High Yield results were almost equally disappointing. As indexing in fixed income has gained momentum, bond market participants have benefited from fee savings and avoidance of active underperformance, a powerful combination.

1 2023 Investment Company Fact Book, Investment Company Institute. Regulated open-end funds include mutual funds, exchange-traded funds (ETFs) and institutional funds.

2 Credit Trends: Global State of Play: Debt Growth Diverging by Credit Quality. Level of global rated corporate debt reached USD 23.2 trillion as of July 1, 2023.

The posts on this blog are opinions, not advice. Please read our Disclaimers.