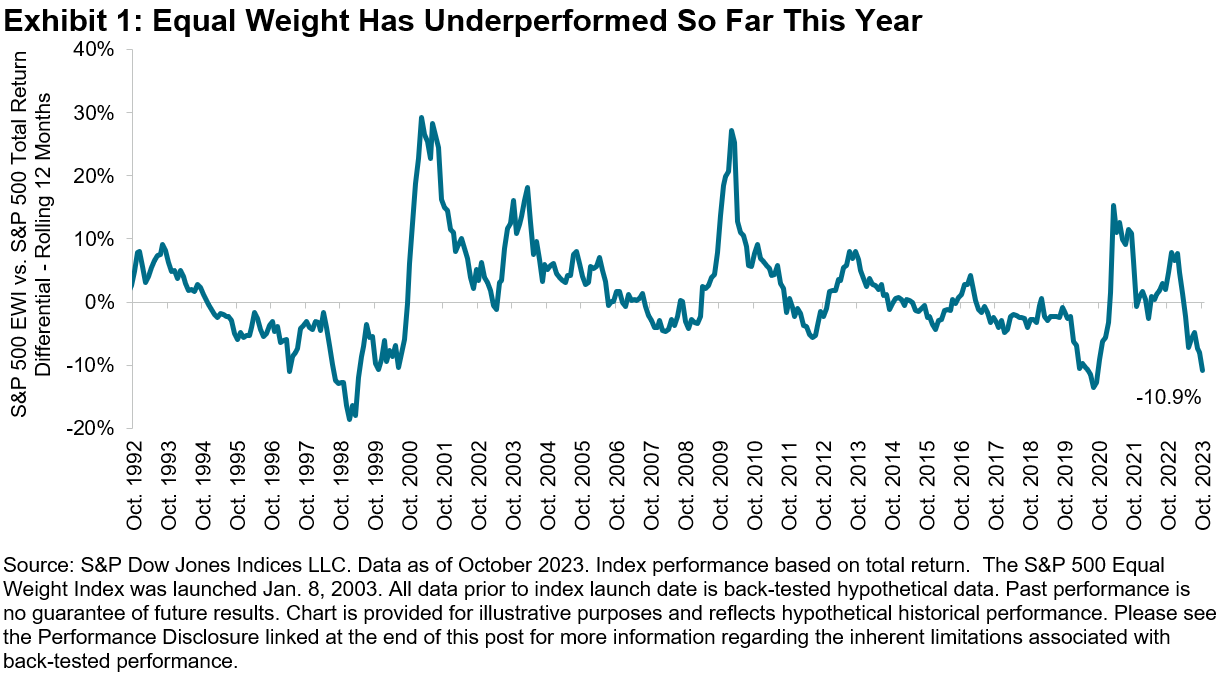

The trouncing of smaller caps by mega-cap stocks has been one of the hallmark market themes of this year, with the S&P 500® Top 50 outpacing the S&P SmallCap 600® by 30% YTD.1 As a result of its inherent small-cap bias, the S&P 500 Equal Weight Index (EWI) has suffered accordingly, underperforming the S&P 500 by 11% in the twelve months through October. But as we observe from the troughs and peaks in Exhibit 1, Equal Weight has always managed to recover from deep losses. February 2001, February 2010 and March 2021 are three prime examples, post major events like the tech bubble, financial crisis and COVID-19 recession.

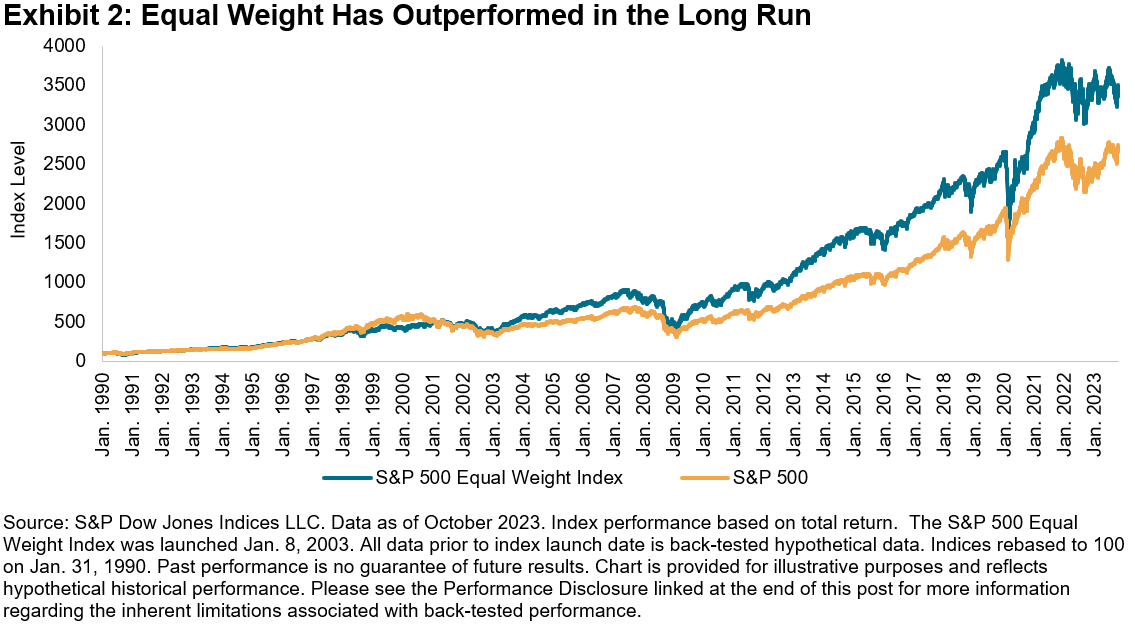

While the strategy has weakened so far this year, we know from Exhibit 2 that Equal Weight tends to outperform over the long term. The strategy’s small size, anti-momentum and value tilts are key performance contributors. Further, Equal Weight’s innate rebalancing mechanism of selling the winners and buying the losers is an important benefit of the mean reversion we observe in Exhibit 1.

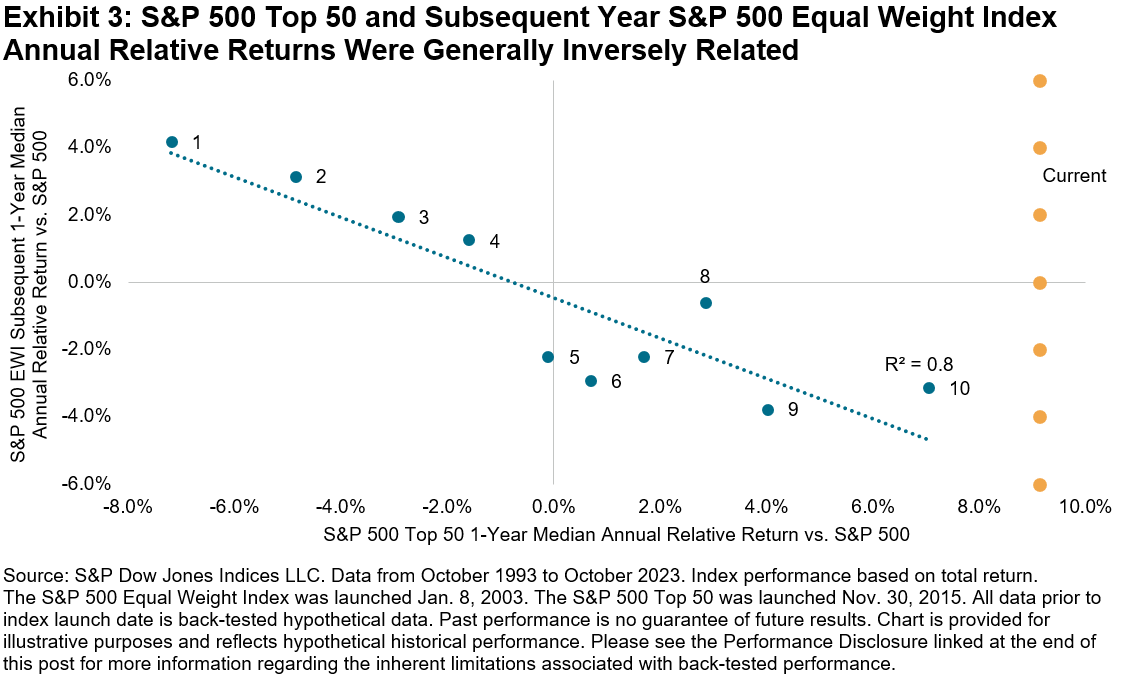

The quandary at hand is that it’s difficult to know in advance when the inflection point of outperformance for Equal Weight will occur. Historically, we have seen that turning points have coincided with extremes in mega-cap outperformance. We can visualize this relationship by ranking the months in our database by the 12-month relative performance of the S&P 500 Top 50 and dividing them into deciles. Next, we analyze the median subsequent 12-month performance of Equal Weight in each of these deciles. We observe that lower decile S&P 500 Top 50 months tended to be followed by Equal Weight outperformance in the next year, while higher deciles tended to be followed by Equal Weight underperformance.

Currently, thanks to the dominance of the Magnificent Seven stocks, we are at high levels of mega-cap outperformance relative to history, with the S&P 500 Top 50 outperforming the S&P 500 by 9% in the 12 months through October, beyond the 10th decile by a margin of 2%. Historically, we have seen that a retreat toward a lower decile tended to follow, accompanied by Equal Weight outperformance. Whether we experience a pullback in mega-cap strength or a continuation in mega-cap momentum remains to be seen.

1 Performance as of Nov. 17, 2023.

The posts on this blog are opinions, not advice. Please read our Disclaimers.