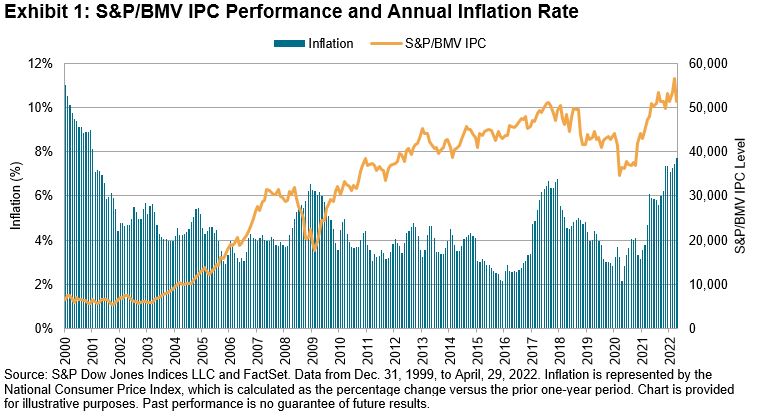

Inflation in Mexico has reached levels not seen in over 20 years, as the S&P/BMV IPC has receded from its all-time high reached earlier this year (see Exhibit 1). In this environment, market participants may question how inflation may affect index performance and the effectiveness of equity allocations as a hedge against it.

First, let’s analyze how the index has performed during periods of rising inflation. Exhibit 2 shows the rolling 12-month return of the S&P/BMV IPC compared with changes in inflation represented by the National Consumer Price Index (CPI) since 2000. For periods corresponding to rising inflation, the index returns were positive 75% of the time; however, during periods of sharp increases in inflation (over 3%), this figure increased to 100%, as shown by the returns in the circle. This shows that, historically, high inflation was associated with strong performance in the Mexican equity market.

How has the S&P/BMV IPC performed relative to inflation? Have allocations to the index served as a hedge against inflation, especially during periods of high inflation?

We can see in Exhibit 3 that, excluding periods of externally driven economic turmoil (the dot-com bubble, the Great Financial Crisis of 2008, the NAFTA renegotiation in the late 2010s and the COVID-19 pandemic), the market generally outperformed inflation by a significant amount. Since 2000, the index outperformed inflation in 60% of rolling 12-month periods. Including dividends being reinvested as measured by the S&P/BMV IRT, this grew to 68%. If we look at the past 10 years, the average outperformance was 9.4% on a price return basis and 10.4% including dividends. Analyzing the entire period in Exhibit 4, the S&P/BMV IPC provided a cumulative return of 127% over inflation and 168% with reinvested dividends, as represented by the S&P/BMV IRT.

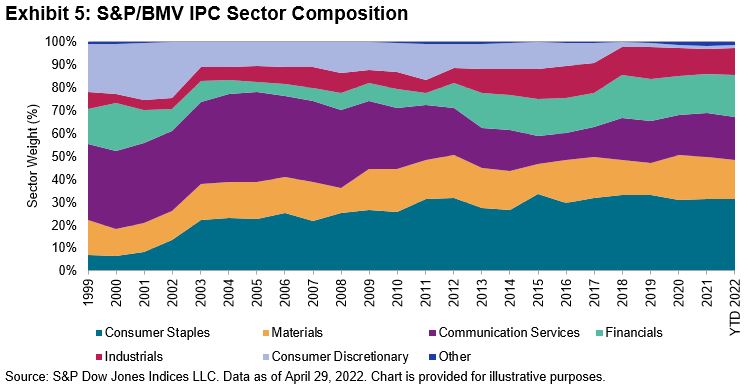

Lastly, this strong performance during rising inflation can be explained in part by the index’s composition. Consumer Staples and Materials, two sectors commonly considered to perform relatively well in inflationarity environments,1 make up nearly 50% on average of the S&P/BMV IPC over the past 10 years (see Exhibit 5). Therefore, their contribution to the index’s total return can be significant during these periods.

In conclusion, the S&P/BMV IPC has generally performed well during periods of rising inflation, more so during sharp increases, and has provided signficant real returns above inflation over the long run.

1 Demand for Consumer Staples tend to be relatively inelastic, so these companies are typically able to pass along rising prices better than other sectors. Commodity-oriented sectors such as Materials also tend to perform well in inflationary environments, as these companies benefit from rising commodity prices.

The posts on this blog are opinions, not advice. Please read our Disclaimers.