Global equities fell during the first quarter of the year, declining 5.5% as measured by the S&P Global BMI amid heightened volatility, surging inflation and the Russia-Ukraine conflict.

Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, underperformed their conventional counterparts during the quarter, as the Information Technology sector, which is overweight in Shariah indices, receded more than 10%. The Pan Arab region stood out, surging upward by 15.0% despite declines across every other global region.

Drivers of Q1 2022 Shariah Index Performance

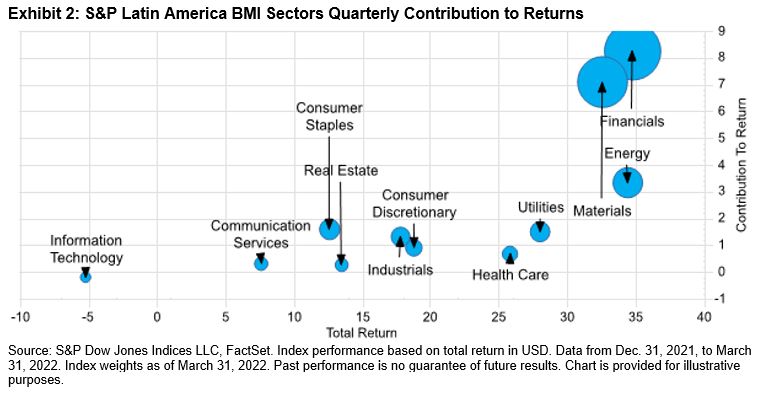

While global equities enjoyed broad gains in 2021, the trend reversed in Q1 2022. Information Technology—which tends to hold an overweight position in global Islamic indices—fell 10.4%, contributing heavily toward negative returns during the quarter, and representing a course change following robust performance in 2021.

Energy was by far the best-performing sector—following a substantial rebound in 2021, the sector continued to surge in Q1 2022 amid supply constraints due to the Russia-Ukraine conflict. Due to its low weight in Islamic indices, however, the performance impact was relatively muted.

On a regional basis, high average weight toward the U.S. and Canada benefited the global Shariah index during the quarter, as those countries enjoyed the best regional performance during the period. The relative underperformance of Asia Pacific and Europe developed markets acted as a drag on returns.

MENA Equities Surge Higher

Supported by rising energy prices, MENA regional equities gained considerably, as the S&P Pan Arab Composite advanced 15.0%. All GCC country indices enjoyed double digit gains, led by the S&P United Arab Emirates BMI (up 19.0%), followed closely by the S&P Kuwait BMI (up 17.9%). Meanwhile, the S&P Egypt BMI (down 20.0%) and S&P Morocco BMI (down 8.9%) suffered steep losses, as they were conversely affected by global supply shocks,.

For more information on how Shariah-compliant benchmarks performed in Q1 2022, read our latest Shariah Scorecard.

This article was first published in IFN Volume 19 Issue 15 dated the 13th April 2022.

The posts on this blog are opinions, not advice. Please read our Disclaimers.