This blog was co-authored by Smadar Shulman and Paulina Lichwa-Garcia.

As the transition to net zero is becoming a critical consideration in portfolio management, the popularity of indices that incorporate the EU’s minimum standards for Climate Transition Benchmarks (CTBs) and Paris-aligned Benchmarks (PABs) has been gathering pace. Such benchmarks aim to select securities that are collectively compatible with a lower carbon economy.

What Are EU PABs and CTBs?

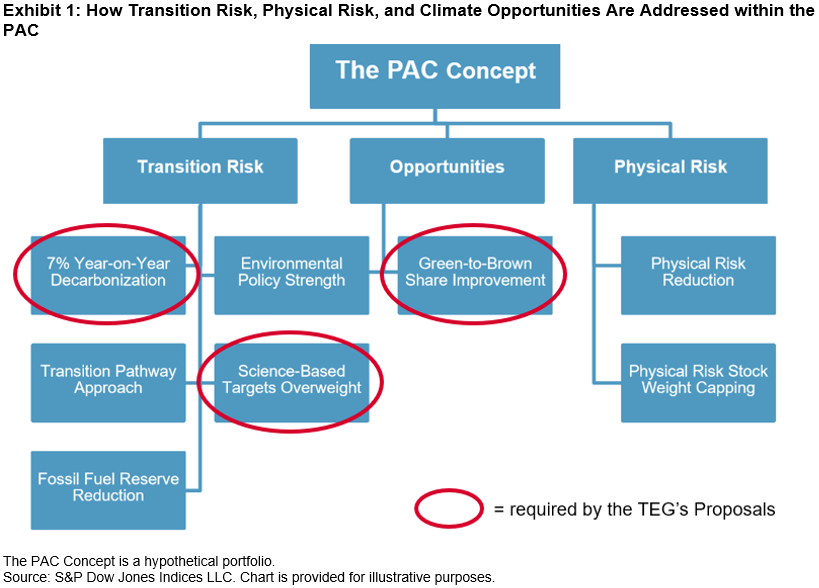

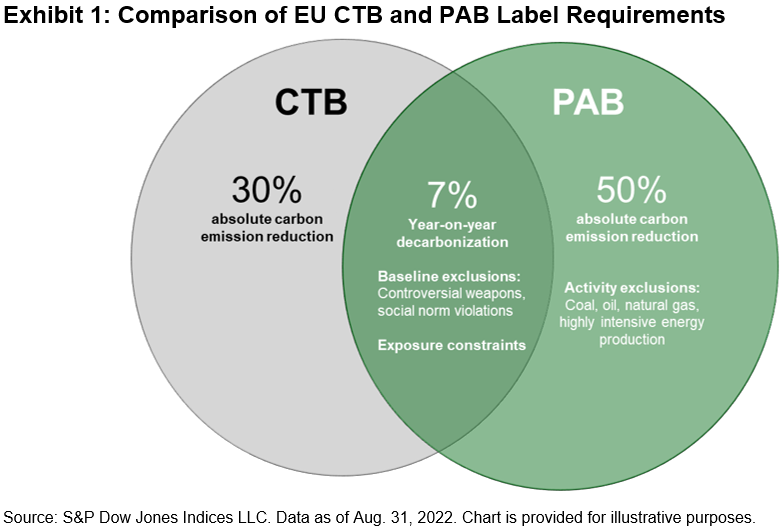

The EU has defined a regulatory framework with minimum standards for benchmarks labeled PAB and CTB1 in line with the goals of the Paris Agreement and net zero by 2050. These are similar in their year-on-year decarbonization trajectories but differ in the greenhouse gas (GHG) emissions reductions and business activity exclusions. Exhibit 1 illustrates their similarities and differences.

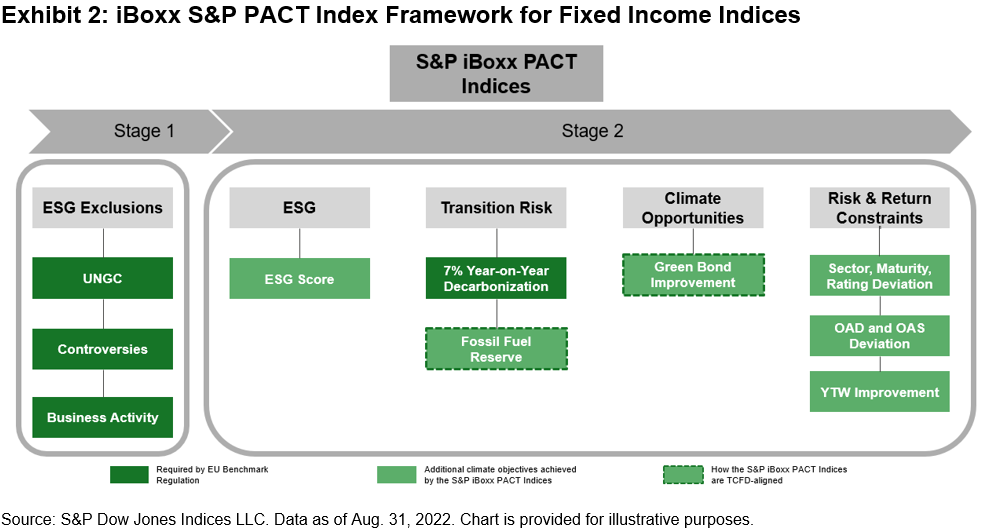

Application of the S&P PACT™ to Fixed Income indices

While the blueprint regulation provides minimum standards, there are additional elements relevant for fixed income investors to consider. This includes methodology design, application to a fixed income universe and further consideration of climate-related risk factors.

The recently launched iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG expands the suite of S&P PACT Indices (S&P Paris-Aligned & Climate Transition Indices) into fixed income. The index is based on the broad iBoxx € Corporates, covering investment grade euro-denominated corporate bonds, and takes into consideration not only the EU minimum standards for PABs, but also other factors such as transition risk, climate opportunities, ESG score overlay and fixed income risk and return profiling constraints.

The iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG offers a differentiated solution for fixed income investors seeking a bond benchmark that incorporates the goals of the Paris Agreement that:

- Aims to meet or exceed the EU’s minimum standards for PABs;

- Leverages multiple ESG data sources, utilizing screening and optimization to determine climate index constituents and weights;

- Incorporates factors that seek to manage transition risk and climate change opportunities, in alignment with the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD);

- Offers a broad exposure while aiming to efficiently track the underlying index (iBoxx € Corporates) and minimize turnover; and

- Improves the ESG score against the underlying universe.

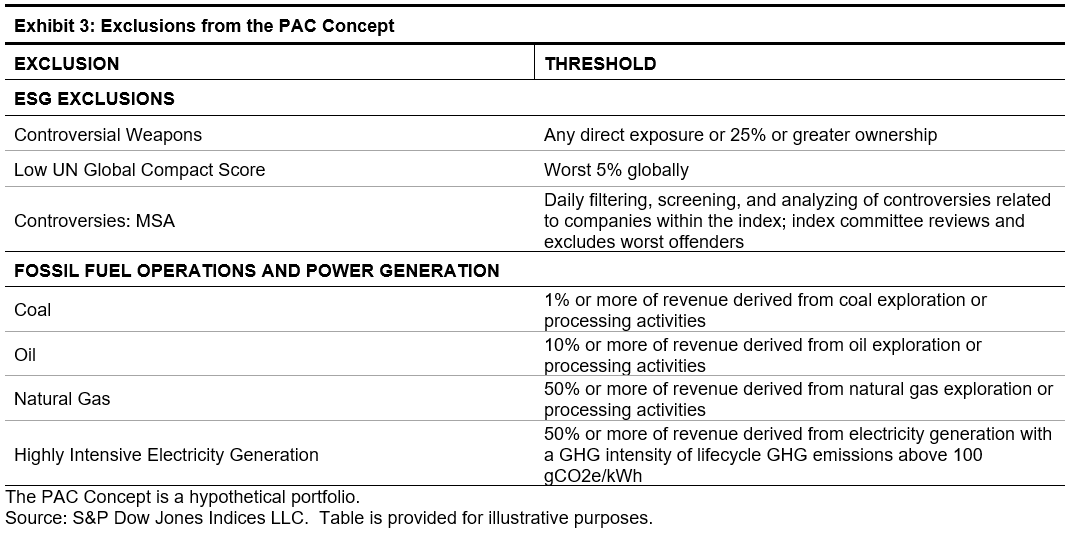

In addition to the required decarbonization trajectory (using Scopes 1, 2 and 3 GHG emissions data) and a minimum set of exclusions, the index also excludes companies involved in fossil fuel operations and power generation. Furthermore, the index seeks to reduce companies’ fossil fuel reserves emissions exposure versus the underlying index, which is considered a more forward-looking measure than historical GHG emissions. Both transition risks are based on S&P Global Trucost ESG and climate data. The ESG overlay exceeds the EU’s minimum standards by aiming for ESG score2 improvement against its underlying index universe.

Going beyond the EU’s minimum standards, the index also aims to track the underlying index efficiently by design, minimizing turnover and including fixed income constraints (e.g., on yield, duration, maturity and rating).

In terms of climate opportunities, the index apportions a higher weight to green bonds,3 reflecting the opportunity embedded in such issuance.

Index Profile: iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG

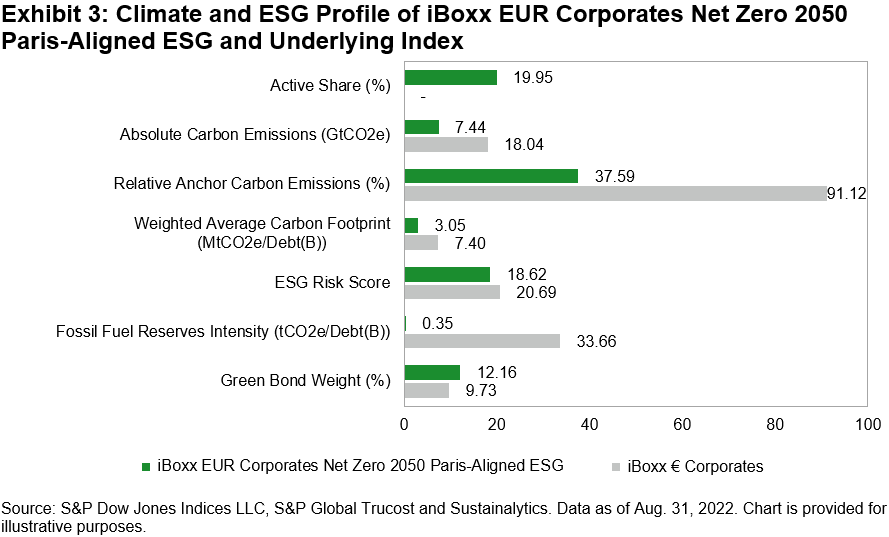

Comparing the iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG with its underlying index, Exhibit 3 illustrates the sustainability-related improvements.

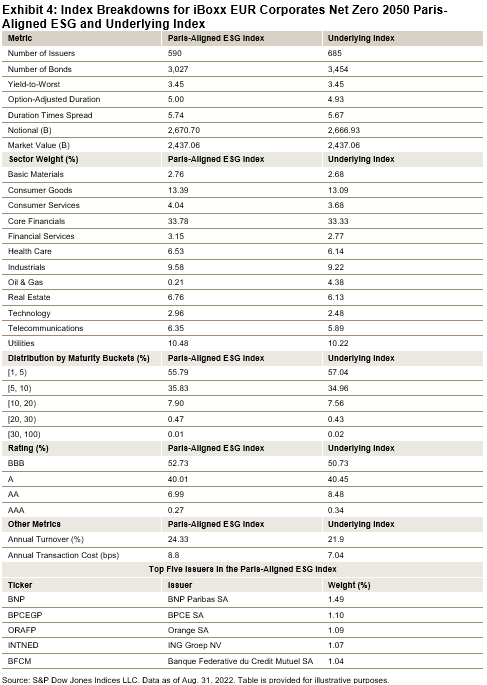

Going deeper, Exhibit 4 shows a comparison of key metrics and breakdowns by sector, maturity and rating.

Conclusion

At the core, the iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG has a simple goal of providing an indexing solution for products seeking to divert capital into investments aligned with the net zero 2050 pathway. But as a solution to a complex problem, it incorporates multi-layer considerations in a rules-based way. The iBoxx EUR Corporates Net Zero 2050 Paris-Aligned ESG seeks to achieve and exceed the EU’s minimum standards while also building in considerations for ESG, climate risk-related factors and fixed income-related risk/return profiling while closely tracking the underlying benchmark.

1 Regulation (EU) 2019/2089 of the European Parliament and of the Council of 27 November 2019 amending Regulation (EU) 2016/1011 as regards EU Climate Transition Benchmarks. EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019R2089&from=EN

2 ESG score is sourced from Sustainalytics research.

3 These are broadly based on the International Capital Market Association’s (ICMA) voluntary Green Bond Principles, which require a Use of Proceeds (UoP) commitment for green projects: https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/