The S&P Kensho Moonshots Index (the Moonshots index) is an innovative strategy that aims to gain exposure to the most innovative companies in their early stages of growth.1 Our earlier publication2 showcased the ability of the Moonshots index to harvest the premium of early-stage innovation companies versus their more established counterparts. Innovation as a theme continues to grow, as both companies and consumers navigate the economic and behavioral impacts from COVID-19.

Recent Moonshots index performance has been volatile, with December 2021 and January 2022 witnessing significant negative monthly returns compared with the index’s history (see Exhibit 1). The index’s performance versus the S&P SmallCap 600® benchmark was analogous, with the Moonshots index posting significantly negative returns (see Exhibit 2). Despite this latest bout of volatility, the Moonshots index value as of Feb. 16, 2022 remains above (about 15%) its pre-pandemic level.

Given the novel focus of the Moonshots index, an ideal comparative performance benchmark is difficult to come by. Nonetheless, a popular and similar-themed ETF product from ARK Invest (ARKK) has also been buffeted by market volatility, retracing most of its 2021 gains. The performance of the Moonshots index and ARKK have closely tracked each other since the pandemic started (see Exhibit 3), in addition to having similar volatility profiles (see Exhibit 4). However, we should note that ETF performance and index performance may be materially different in that index performance does not reflect management fees, trading costs, or other expenses.

Despite recent performance headwinds, Moonshots as an investment theme could be an appealing proposition for the following reasons.

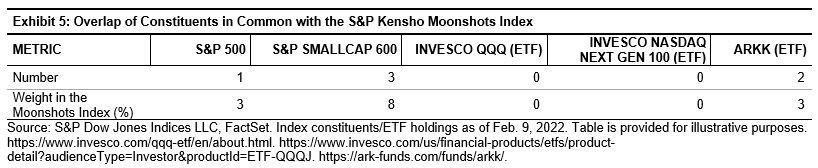

- A Unique Set of Holdings: The constituents of the Moonshots index are a unique set of stocks that offer potential diversification benefits. There is minimal overlap between this set of index constituents and some of the popular benchmarks and thematically comparable ETFs (see Exhibit 5).

- Diversification: The Moonshots index’s rules-based construction reduces concentration, mitigating the likelihood of overall index performance driven by a select few stocks. The top 5/10 stocks in the 50-stock Moonshots index account for 14%/27% of the index weight. In contrast, the ARKK actively managed 44-stock portfolio allocates 33%/55% of its total weight to the top 5/10 stocks.

- Capturing Growth: The Moonshots index’s emphasis on innovation guides its natural overweight to the growth factor. The index is heavily tilted toward Information Technology and Industrials, the more growth-exposed sectors of the economy. This is also apparent from the index’s close correlation with a proxy for growth performance (see Exhibit 6).

- Harvesting Size Premium: The Moonshots index’s methodology focuses on smaller capitalization securities that are in their early stages of expansion. The weighted average market cap of the Moonshots index is USD 2.6 billion compared with USD 644 billion for the S&P 500. Size bias is a concept that has been well documented3 as a systematic strategy that can reap benefits over the long term.

2 https://www.indexologyblog.com/2020/11/30/moonshots-catching-lightning-in-a-bottle/

3 A five-factor asset pricing model, Eugene F. Fama, Kenneth R. French, 2015

The posts on this blog are opinions, not advice. Please read our Disclaimers.