We introduced the S&P Kensho Moonshots Index (the Moonshots index) and its constituent next-generation innovators in our previous blog. An express intent of the index is to identify innovative companies early in their gestation, when the opportunities for rapid growth may be higher. In this blog, we examine how effective the index is at capturing that potential for higher early-stage growth, and how it stacks up against more established innovators, as reflected in market returns.

To identify established innovators, we constructed a comparative portfolio made up of companies drawn from the selection universe used by the Moonshots index, whose market capitalization exceeded the maximum threshold at each rebalance, but whose Early-Stage Innovation score would have qualified for inclusion (Established Innovators—see the methodology document for more info).

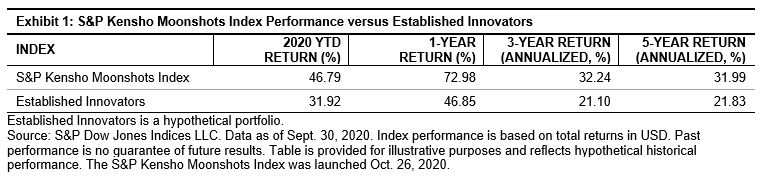

The market consistently rewarded the Moonshots index over the Established Innovators on an annualized return basis over one-, three-, and five-year periods (see Exhibit 1). These findings suggest that the market attaches a premium to the early-stage innovators identified by the Moonshots strategy.

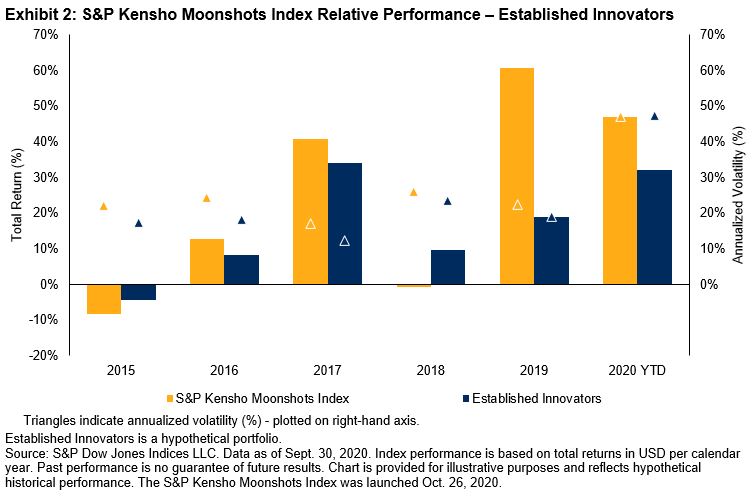

Annualized returns can often mask periods of underperformance; however, Exhibit 2 shows how the Moonshots index consistently outperformed on a calendar year basis, with the only exceptions being 2015 and 2018, when the Established Innovators edged ahead.

It is also worth noting that, despite its focus on relatively smaller companies, the Moonshots index and the Established Innovators exhibited similar levels of volatility. The outperformance of the Moonshots index relative to the Established Innovators is therefore not a function of higher risk.

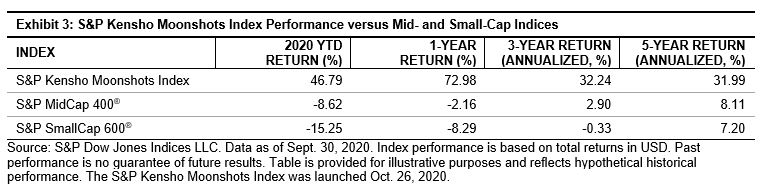

The magnitude of the Moonshots index’s historical outperformance relative to small- and mid-cap benchmarks on an annualized basis (see Exhibit 3) emphasizes how differentiated the index is from its similarly sized peers. In fact, during a time when small- and mid-cap companies generally underperformed their larger brethren, it is of particular interest that the Moonshots strategy is able to outpace both constituencies.

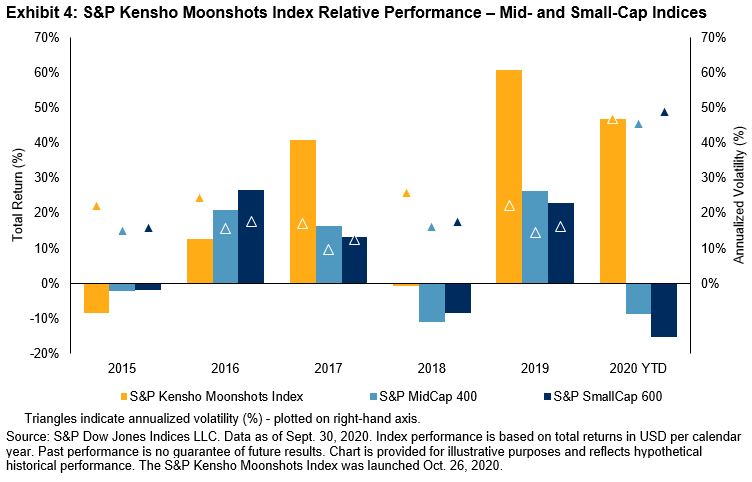

However, a review of calendar year relative performance (see Exhibit 4) suggests a more nuanced picture.

It highlights an important characteristic: accelerating outperformance as emerging exponential innovation gains traction.

Rapid developments in artificial intelligence, robotics and automation, ubiquitous connectivity (Internet of Things) and exponential processing power—together, the catalysts of the Fourth Industrial Revolution—as well as their application in innovations across the global economy, have greatly accelerated over the past few years. The pivot in the Moonshots index’s track record in 2017 from one of moderate underperformance to consistent and significant outperformance is aligned with the increase in investor awareness of these macro dynamics and an acceleration in the adoption of these underlying transformative technologies.

Today’s rapid pace of technological advancement means companies must commit to innovation in order to survive and thrive. The outperformance of the S&P Kensho Moonshots Index versus both established innovators and similarly sized peers suggests that it is successfully capturing the higher growth potential of these emerging leaders, or next-generation innovators.

The author would like to thank John van Moyland, Managing Director, Global Head of S&P Kensho Indices for his contributions to this blog.

The posts on this blog are opinions, not advice. Please read our Disclaimers.