The S&P PACTTM Indices (S&P Paris-Aligned & Climate Transition Indices) comprise the S&P Climate Transition (CT) Indices and the more ambitious S&P Paris-Aligned (PA) Indices. These indices are intended to meet the EU’s minimum standards for EU Climate Transition benchmarks and EU Paris-aligned benchmarks under the Regulation (EU) 2016/1011 (EU Benchmark Regulation). The indices follow a 1.5°C scenario toward net zero by 2050 and incorporate recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). This blog focuses on the S&P PA Index for developed markets (the S&P Developed Ex-Korea LargeMidCap Net Zero 2050 Paris-Aligned ESG Index).

What are the high-level ESG exposures? The indices show improvements across a large range of climate and ESG factors, including physical risks, transition risks, and opportunities, alongside environmental, social, and governance exposure improvements.

Which ESG factors are important in driving the weights of the index? First, approximately 23% of the weight from the investable universe is excluded and a further 16% active share (which measures the percentage of index weights that differ from the underlying index) is taken on from reweighting.

The active share from exclusions is easy to quantify—it is simply the excluded weight of the underlying index. The active share from reweighting is attributed to climate factors (see Exhibit 3), largely caused by the transition pathway (aligning with 1.5°C on a forward-looking basis), high impact revenues (to maintain neutrality, per the EU Benchmark Regulation), physical risk, and ESG scores.

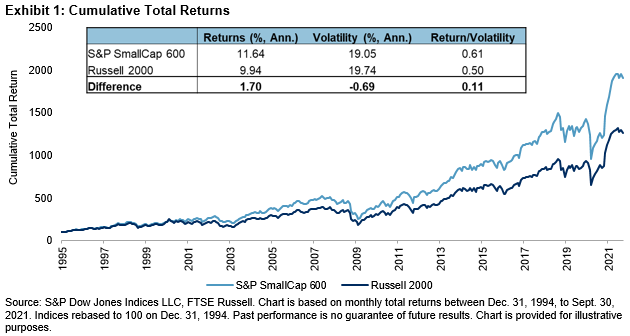

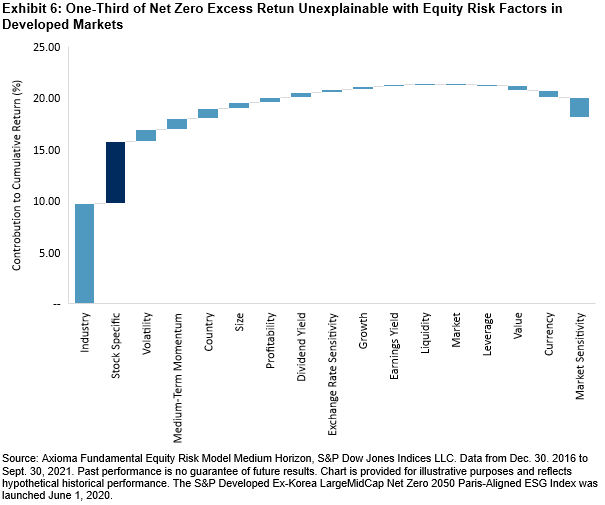

How has the index performed? We see an excess return from the S&P Paris-Aligned Index, with lower volatility and max drawdown, resulting in a higher risk-adjusted return. Of this excess return, around two-thirds can be explained by equity risk factors, leaving around one-third of the excess return as unexplained alpha (stock specific).

To learn more about the S&P PACT Indices, we have a short overview and longer paper to explain some technical details, both of which and much more can be found on our Net Zero investment theme page.

The posts on this blog are opinions, not advice. Please read our Disclaimers.