The merit of international diversification seems to have proven itself lately in the context of the Indian market. Over the past year, interest has increased in adding global exposures to local investment portfolios. Global markets offer the potential opportunity to diversify beyond a traditional concentrated focus on local markets.

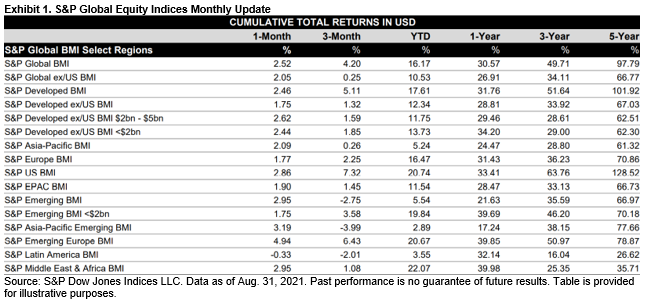

The latest August Global Equity Dashboard reflected the upward trend of global equities, with the S&P Global BMI posting a YTD return of 16% and a one-year return of 30%. The S&P Global BMI is an index that is designed to measure more than 11,000 stocks from 25 developed and 25 emerging markets. The S&P United States BMI and the S&P Emerging Europe BMI have had YTD returns of over 20%, which has resulted in increased interest for allocation in those regions. Furthermore, 44 of the 50 country subindices of the S&P Global BMI gained in the last month. The U.S. had the most significant weight, around 57.5%,1 in the S&P Global BMI in terms of country exposure.

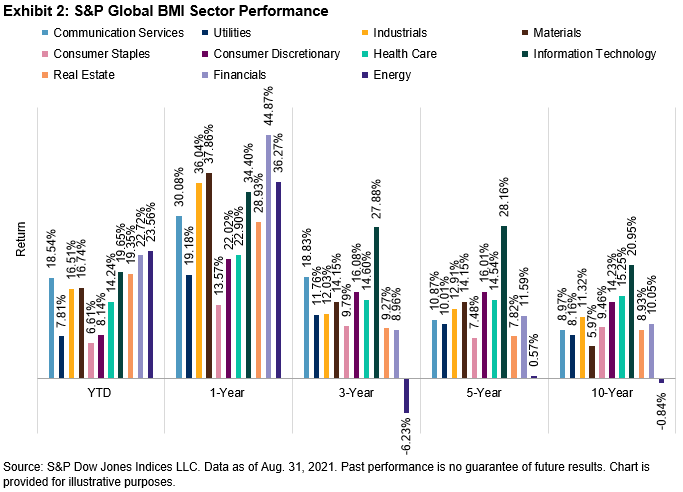

Looking at sector performance, Information Technology led in the 3-, 5-, and 10-year periods, while the 1-year period favored Financials (44.87%), Materials (37.86%), and Energy (36.27%). However, the trend shifted YTD, with Energy (23.56%) outperforming and Financials (22.72%) and Information Technology (19.65%) close behind.

The U.S. markets have been gaining popularity in India among other global options. The S&P 500®, the best single gauge of large-cap U.S. equities, has gained popularity among Indian investors. The index posted its seventh straight month of gains in August, climbing 3.0% for the month supported by positive earnings and continued support from the Fed. The options available for global diversification are growing beyond plain vanilla domestic strategies. Thematic, strategy, and sustainable factors are also becoming available to add additional flavor.

India is known for its home bias, but that trend was bucked last year and has continued YTD. Fund of funds investing overseas have grown more than eight-fold since year-end 2019 from INR 2635 crores to INR 21441 crores in August 2021,2 with a 137% growth YTD. While the number of schemes has not increased significantly, the Indian passive market is looking to offer more options for global diversification. The last year has witnessed a host of new passive product filings, with the Securities and Exchange Board of India clearly demonstrating the growing appetite for international investing among local investors.

1 As of Aug. 31, 2021

2 Source : AMFI

The posts on this blog are opinions, not advice. Please read our Disclaimers.