Global equities continued to rise during the second quarter, gaining 7.2% as measured by the S&P Global BMI, raising the YTD tally to 12.8%. Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, somewhat underperformed their conventional counterparts YTD, in part due to continued strength in the Financials sector, which gained 18.7% during the period. All major regional Shariah and conventional benchmarks had positive returns YTD.

Sector Drivers Led to Underperformance of Shariah Benchmarks YTD

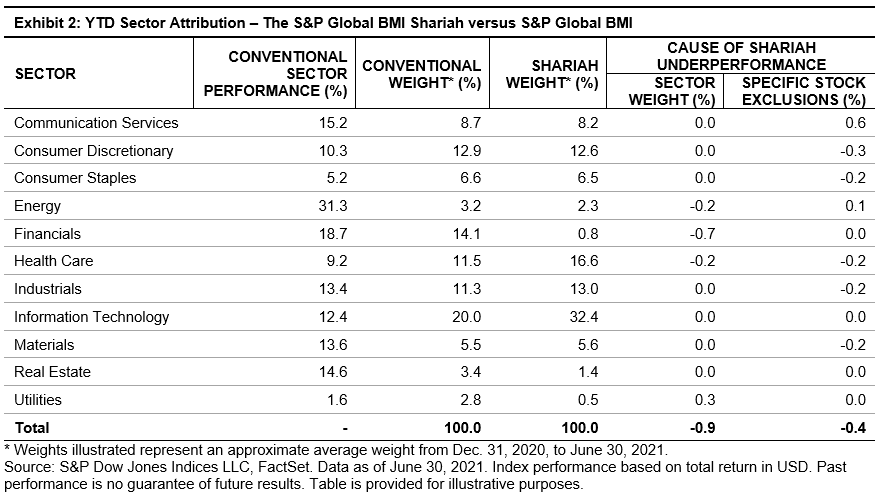

While global equities rallied broadly through H1 2021, sector performance played a part in the relative underperformance of Shariah-compliant equity benchmarks. Financials—which is nearly absent from Islamic indices—outperformed the broader market with a gain of 18.7%, contributing most heavily to the broad outperformance of conventional benchmarks over the period. While Energy represents a smaller portion of broad benchmarks, the sector outpaced the broader market by strides, gaining 31.3%, further adding to the conventional outperformance.

Exhibit 2 displays sector returns along with the effect of over- and under-weight sector allocations of the S&P Global BMI Shariah compared with its conventional counterpart. A large majority of S&P Global BMI Shariah underperformance during the period—0.9%—is explained by differing sector allocations, while 0.4% is explained by the inclusion or exclusion of individual Shariah-compliant stocks within sectors.

MENA Equities in Recovery

MENA regional equities gained considerably YTD, as the S&P Pan Arab Composite advanced 22.5%. The S&P Saudi Arabia BMI led the way in the region, gaining 30.7%, followed by the S&P United Arab Emirates BMI, up 25.8%.

Notably, the S&P Pan Arab Composite Shariah surpassed its conventional counterpart by 2.6% during the quarter, in large part due to significant representation of Saudi Arabia, which outshone its regional peers.

For more information on how Shariah-compliant benchmarks performed in Q2 2021, read our latest Shariah Scorecard.

This article was first published in IFN Volume 18 Issue 27 dated the 7th July 2021.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

1 Source: S&P Dow Jones Indices LLC, USD 1.46 trillion, based on 950+ assets priced by Lukka Prime, as of June 30, 2021.

1 Source: S&P Dow Jones Indices LLC, USD 1.46 trillion, based on 950+ assets priced by Lukka Prime, as of June 30, 2021.