During the pandemic, we’ve seen an evolution of behavioral changes fuel transcendent trends across our economy that may create new future growth opportunities.

This has spurred investor interest in thematic ETFs that seek to provide exposure to firms at the forefront of innovation. In 2020, more than $40 billion flowed into ETFs focused on Future Communication, Clean Energy, Smart Transportation, and Cloud Computing.1

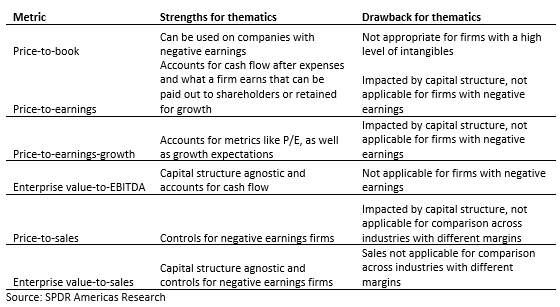

To formulate a fundamental view on these areas of innovation, it is important to consider which valuation metric may be the most appropriate.

Fundamentally thematic

Selecting the most appropriate metric requires understanding the type of firms typically found in the 145 funds we identify as thematic strategies. Our security look-through analysis finds many of these funds are concentrated in the Consumer Discretionary, Health Care, and Information Technology sectors. Importantly, the firms in those sectors typically have significant intangible assets2 on their balance sheets. Price-to-book may not be the best metric here because high intangible assets usually understate a firm’s book value—potentially inflating the firm’s price-to-book measure.

Earnings-related issues for thematics

There is an issue, however, if we use earnings-related metrics (e.g. price-to-earnings (P/E), price-to-next-12-month-earnings, and enterprise value-to-EBITDA). First, negative earnings firms must be removed, resulting in an incomplete exposure being analyzed. And those firms must be removed so as not skew the result (i.e., negative P/E values would tamp down the high P/E values when performing an average calculation for a portfolio).

The presence of negative earnings firms in some thematic exposures means any multiple that has earnings-related information in the denominator should not be utilized. This also holds true for the price-to-earnings-growth ratio (PEG), since it still relies on earnings in the denominator, while normalizing the ratio by expected growth.

No earnings, but revenue, hopefully

While some innovative firms do not have earnings, they likely have sales/revenue. Therefore, using one of these two sales-based metrics may be more optimal: price-to-sales and enterprise value-to-sales. The latter, in my opinion, offers the most appropriate and comprehensive view of a firm’s operations, as enterprise value (EV) accounts for both the firm’s equity value and amount of debt.3 Accounting for the level of leverage/debt utilized by the firm to generate revenue, it tends to be more comparable across industries, given it is capital structure agnostic (i.e., high-debt industries typically look cheaper on a price-to-xyz basis since their debt isn’t captured in the metric, but under EV, the debt is taken into account).

A list of metrics — and the strengths and drawbacks of thematic valuations — are shown below:

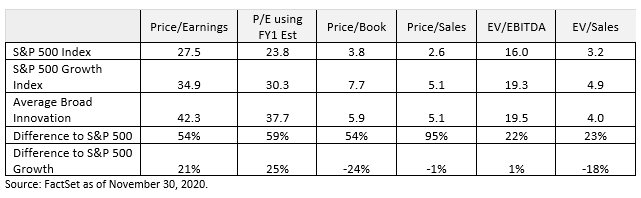

The table below compares the different metrics for an aggregated portfolio of all 18 Broad Innovation funds4 with the broad S&P 500. The average figure for the Broad Innovation category is higher than the broad market — as would be expected. However, when it comes to enterprise value-to-sales, the skew is much tighter, due to dynamics discussed above.

While these exposures were trading rich at the end of last year, the multiples are elevated to the broader market due to higher expected growth estimates and the potential for behavioral changes to create future growth opportunities.

Analysis in 2021 and beyond

The pandemic will continue to spark greater need for innovative technologies that allow for more contactless interactions, advanced medicine, digital connectivity, and intelligent infrastructure.

With more ways to participate in these thematic trends, investors need a classification framework as the first step in due diligence. It’s also important to understand the construction approaches for each exposure. Of all the valuation multiples available, enterprise value-to-sales may be the most appropriate.

1 Bloomberg Finance L.P. as of December 31, 2020 based on SPDR Americas Research calculations.

2 An intangible asset is an asset that is not physical in nature. Goodwill, brand recognition and intellectual property, such as patents, trademarks, and copyrights, are all intangible assets. Intangible assets exist in opposition to tangible assets, which include land, vehicles, equipment, and inventory.

3 EV is the market capitalization of a company as well as short-term and long-term debt less any cash on the company’s balance sheet.

4 Eighteen funds, as classified by SPDR Americas Research as of December 15, 2020.

Glossary

S&P 500® Index: A popular benchmark for U.S. large-cap equities that includes 500 companies from leading industries and captures approximately 80% coverage of available market capitalization.

S&P 500® Growth Index: A market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit strong growth characteristics.

Disclosures

The views expressed in this material are the views of Matthew Barotlini through the period ended February 12, 2021 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk including the risk of loss of principal. Past performance is no guarantee of future results.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. All material has been obtained from sources believed to be reliable. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without State Street Global Advisors’ express written consent.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

Investing involves risk including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

State Street Global Advisors, One Iron Street, Boston, MA 02210.

© 2021 State Street Corporation. All rights reserved.

3373882.2.1.AM.RTL | EXP. 2/28/2022

The posts on this blog are opinions, not advice. Please read our Disclaimers.