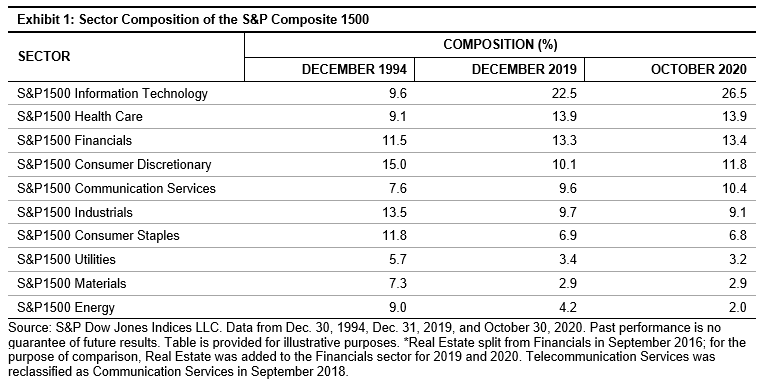

The S&P Composite 1500® serves as a benchmark for around 90% of the U.S. equity market and offers a comprehensive perspective on it.1 Companies in the S&P Composite 1500 are classified into sectors based on the Global Industry Classification Standard (GICS®). As with the benchmark, the S&P Composite 1500 Sector Indices are weighted by float-adjusted market cap, and each contains stocks from its respective GICS sector. Hence, the sector changes in the S&P Composite 1500 over the years can tell us of the trends of the U.S. market.

Exhibit 1 shows the sector weights as of Dec. 31,1994, Dec. 31, 2019, and Oct. 30, 2020. Information Technology has become the dominant sector, followed by Health Care as the second-largest sector, while Materials and Energy sectors weighed the least in the index.

The weights of the Information Technology and Health Care sectors had the most significant growth from Dec. 30, 1994, to Dec. 31, 2019, with increases of 134% and 53%, respectively.

The same trend has continued through 2020. The weight of the Information Technology sector grew from 22.5% to 26.5% in less than a year (from the end of 2019 to Oct. 30, 2020). In fact, the weight of the sector in the S&P Composite 1500 has increased 176% since the end of 1994, from 9.6% to 26.5%.

In contrast, the sectors with the largest declines were Materials and Energy. Their weights dropped 60% and 53%, respectively, from Dec. 31,1994, to Dec. 31, 2019. The decrease in market share of both sectors has continued in 2020.

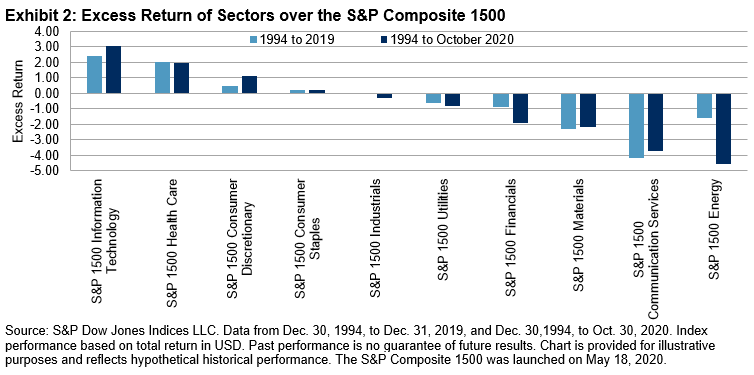

The performance of the sector indices reflects the sector changes over the history. Exhibit 2 shows the excess return of the sector indices versus the S&P Composite 1500 from Dec. 30, 1994, to Dec. 31, 2019, and to Oct. 30, 2020. Information Technology and Health Care were the top-performing sectors for both periods. Over the past 25 years, we observe continued outperformance in both sectors. This suggests that performance is one of the driving forces behind the sector expansion.

The leading constituents changed along with the sector changes. In 1994, the leading constituents were from diverse sectors, but a more concentrated composition is observed in 2019 and in 2020. As indicated in Exhibit 3, six out of ten stocks were from Information Technology and Communication Services sectors at the end of 2019 and October 2020. The three Information Technology companies together contributed 9.4% and 12.2% weight to the S&P Composite 1500 as of Dec. 31, 2019, and Oct. 30, 2020, respectively.

In society today, Information Technology is playing a larger role than ever. The advancement of technology has impacted people’s daily life, reshaped the economy, and is reflected in the stock market. Exploring the sector changes in the S&P Composite 1500, which is a gauge of U.S. market, can help us understand the transformed economic reality and could identify potential investment opportunities.

1 The S&P Composite 1500: An Efficient Measure of the U.S. Equity Market, Philip Brzenk, Hamish Preston, Aye Soe. May 2020.

The posts on this blog are opinions, not advice. Please read our Disclaimers.