S&P DJI recently launched the S&P Risk-Managed Target Date Indices. In this post, we will explore the characteristics of these indices in detail.

Each index consists of two component indices: a baseline S&P Target Date Index based on an underlying glide path and an S&P 500® Managed Risk 2.0 Index. The S&P 500 Managed Risk 2.0 Index seeks to stabilize the volatility around a target level and provides downside protection during sustained market declines

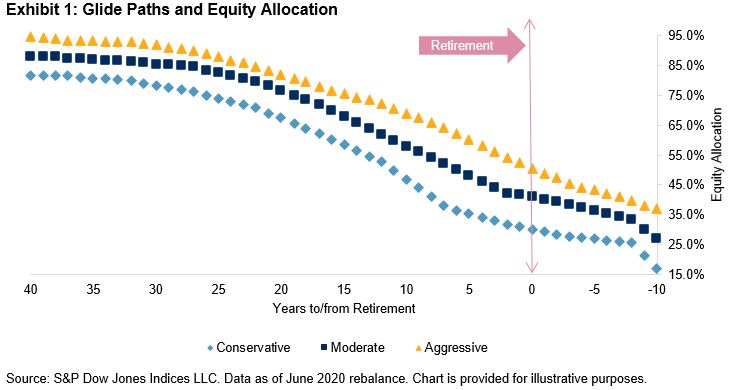

The baseline S&P Target Date Indices comprise three baseline glide paths1—conservative, moderate, and aggressive—and Exhibit 1 shows how asset allocation changes based on the type of glide path.

The aggressive glide path offers the highest equity allocation, the conservative glide path offers the smallest equity allocation at all the stages of retirement, and the moderate glide path offers an equity allocation level in between those two. As expected, as a person approaches retirement, the equity allocation decreases across all glide paths. The basic premise is that a person who is far away from retirement is able to take more risk by allocating a significant portion of their portfolio to equities. For example, for a person who is 40 years away from retirement (25 years of age), the equity allocation for the aggressive glide path is 94.6%, while the equity allocation for the conservative glide path is 81.5%. The three baseline indices are constructed using these underlying glide paths for each vintage starting from 2015 until 2060 in five-year increments.

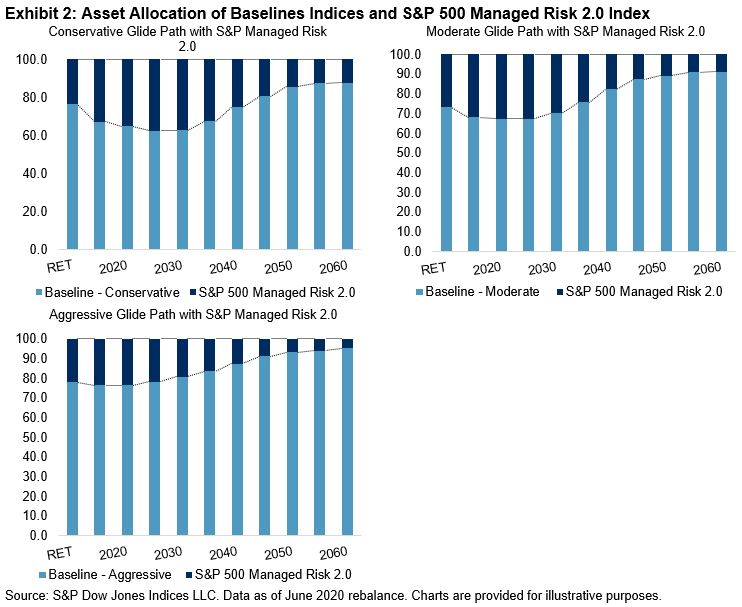

In order to provide stability during volatile market conditions, the baseline indices are combined with an S&P 500 Managed Risk 2.0 Index. The allocation to the S&P 500 Managed Risk 2.0 Index varies across different glide paths. This allocation is dynamically linked to the baseline equity allocation rather than being static, in order to better reflect the market conditions. Exhibit 2 shows the asset allocation mix of the baseline indices and their corresponding S&P 500 Managed Risk 2.0 Index. The allocation to the managed risk component decreases over time across all glide paths as the person moves away from the retirement date, indicating that near-retirees2 need more downside protection than pre-retirees,3 as they have less time to recover any potential losses before they hit the retirement age of 65.

In the next blog, we will explore the performance of the S&P Risk-Managed Target Date Indices and see how the addition of a risk component helped the strategies withstand the recent market downturn caused by the COVID-19 pandemic.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

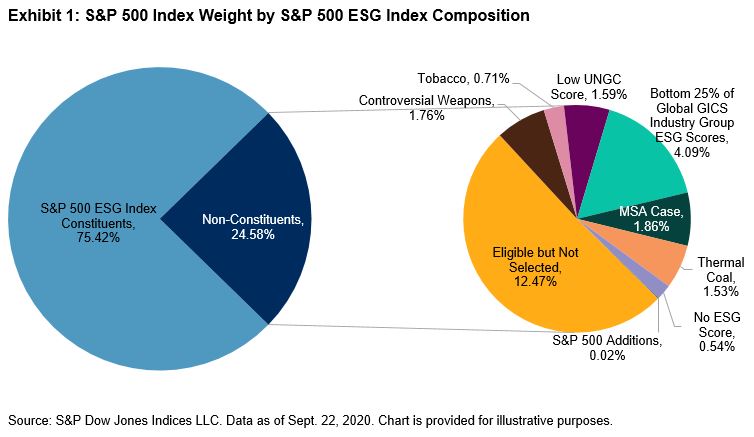

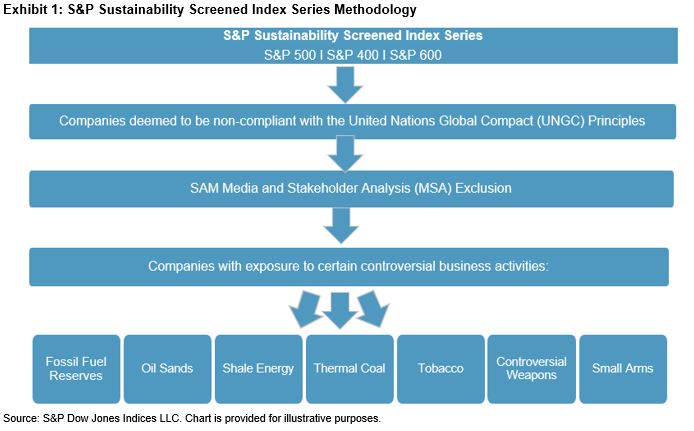

In addition to these key business involvement screens, companies are also assessed based on their compliance with the principles of the U.N. Global Compact.3 Companies that do not act in accordance with the associated standards, conventions, and treaties are ineligible for the index. The addition of this screen allows for the index to account for companies with violations linked to human rights, labor, environment, and corruption abuses.

In addition to these key business involvement screens, companies are also assessed based on their compliance with the principles of the U.N. Global Compact.3 Companies that do not act in accordance with the associated standards, conventions, and treaties are ineligible for the index. The addition of this screen allows for the index to account for companies with violations linked to human rights, labor, environment, and corruption abuses.