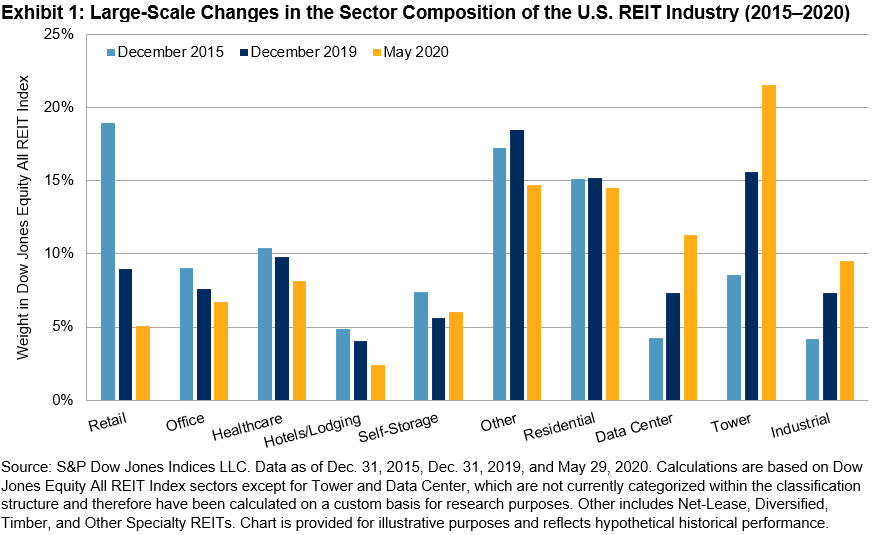

The economic and societal effects of the COVID-19 pandemic accelerated secular trends that have been reshaping the commercial real estate industry for years. Core U.S. REIT sectors such as Retail, Office, and Residential, which once dominated the REIT landscape, have ceded ground to specialized REITs—particularly those owning data centers and cell towers. Industrial REITs have also increased in importance, supported by e-commerce growth.

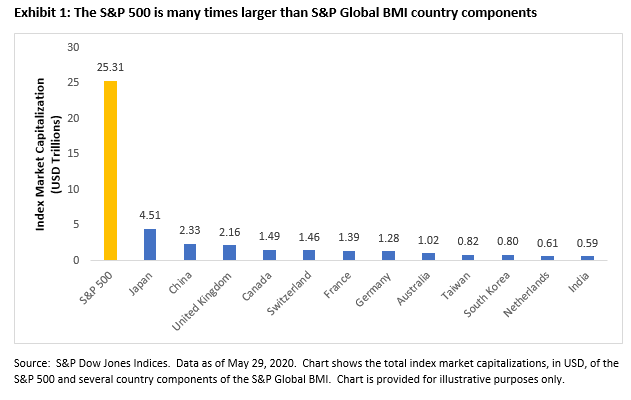

As of Dec. 31, 2015, Data Center, Tower, and Industrial REITs (in aggregate) accounted for 17% of the Dow Jones Equity All REIT Index—a broad index covering U.S. equity REITs. By the end of 2019, their share of the index weight rose to 30%, and by the end of May 2020, these sectors represented more than 42%. Meanwhile, Retail REITs dropped from 19% to 5%.

The Retail sector, in particular, has been hampered by the growth of e-commerce, as demand for space in malls and shopping centers has diminished due to increased online shopping. One of the primary beneficiaries of this trend was Industrial REITs—many of which support logistics for e-commerce. Tower REITs benefited from strong demand for infrastructure to support growing wireless data usage, while Data Center REITs boomed from the growing need for high quality space to store servers and other computing equipment.

All these trends were sharply accelerated by the pandemic, which has driven a far larger share of economic activity online, spurring even greater demand for data centers, wireless communication, and industrial warehouses. Meanwhile, travel has come to a near standstill, leaving hotel occupancies at record lows. Companies are now rethinking how much office space they will need in the future, as remote working becomes more common, and retirees are rethinking the safety of living in retirement communities owned by Healthcare REITs.

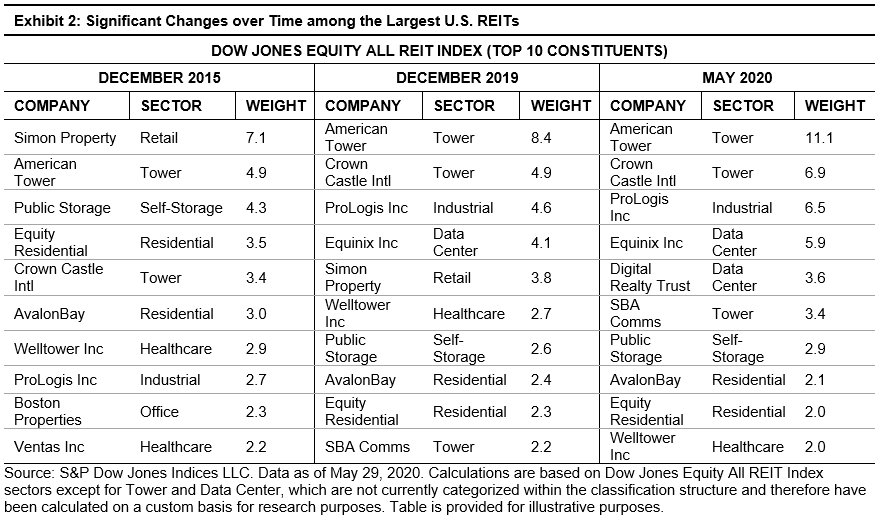

These changes in sector leadership are also illustrated through the top constituents of the Dow Jones Equity All REIT Index. As of the end of May 2020, five of the six largest U.S. REITs were either Tower or Data Center REITs. Furthermore, Simon Property—the largest U.S. REIT for many years—no longer resides within the top 10. The industry has also become somewhat more concentrated over the years, spurring demand for capped versions of headline indices, such as the Dow Jones Equity All REIT Capped Index.

These transformations in the composition of the U.S. REIT market have, of course, been driven primarily by relative performance. Perhaps more than any other equities market sector, the dispersion of sub-sector returns within the Real Estate sector has been highly variable both in the short- and longer-term. As shown in Exhibit 3, Data Center and Tower REITs gained 20% and 18%, respectively, YTD through May 29, 2020, while Industrial REITs also posted positive returns. On the other hand, Retail and Hotels/Lodging dropped 51% and 48%, respectively.

These performance trends were remarkably similar directionally over the longer term. Between the end of 2015 and May 2020, Tower, Data Center, and Industrial REITs experienced cumulative gains in excess of 130%, while Retail and Hotels/Lodging declined sharply.

In our paper, Understanding REIT Sectors, published in January 2020, we highlighted how the U.S. REIT industry has expanded over the years beyond traditional property types to include a diverse set of companies driven by a wide range of underlying factors. The COVID-19 pandemic has shined a bright light on the evolution underway in the REIT industry.