Over the last few years, mega-cap companies have played an increasingly important role in driving U.S. equity market returns. Indeed, the five largest names in the S&P 500® accounted for 16.8% of the index at the end of last year, the highest year-end weight since 1982 and higher than the 16.6% reached at the end of 1999 during the Tech Bubble.

The sizeable representation of mega-cap companies in the U.S. equity market means that indices seeking to measure the performance of the market – such as the S&P Composite 1500 and the Russell 3000 – often have similar weights in these companies. Perhaps unsurprisingly, the two indices exhibited similar risk/return characteristics, historically.

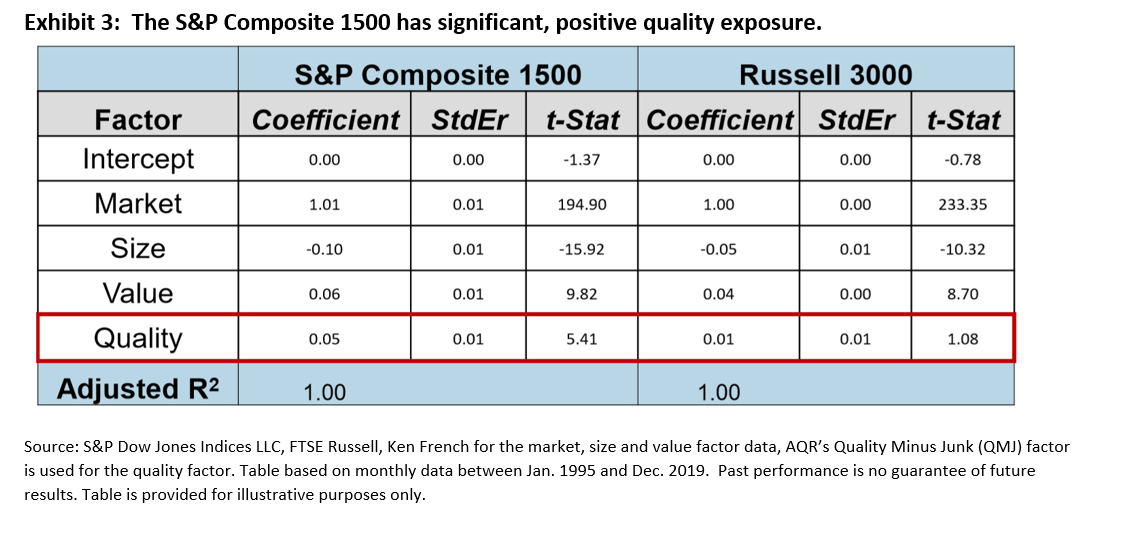

However, it is important to remember that not all indices are created in the same way. For example, unlike the Russell 3000, the S&P Composite 1500 focuses on profitable U.S. companies by incorporating earnings criteria. Exhibit 3 shows that this focus meant the S&P 1500 has significant, positive quality exposure, which was also observed for each of the S&P 500, S&P MidCap 400® and the S&P SmallCap 600®.

Differences in index construction, especially the S&P 1500’s earnings screen, may also be relevant given the proportion of IPOs with negative earnings: 2019 saw 74% of IPOs with negative 12-month trailing earnings per share, following 2018’s record-equaling figure (81%). To the extent that these companies are expected to out- or underperform, differences in index methodologies may help to explain any divergence in index performance.

As a result, the sizeable representation of large-cap stocks means indices designed to track the U.S. equity market often have similar weights in these companies, resulting in similar risk/return profiles. However, understanding the different factor exposures of the S&P Composite 1500 and its competitors may be useful for assessing the impact of various market drivers on index returns.

The posts on this blog are opinions, not advice. Please read our Disclaimers.