In India, the festival of lights known as Diwali brings with it a seasonal uptick in gold imports. A feature of this renowned festival involves the exchange of gifts among friends, families, and colleagues. The most popular gift to give during the festival is gold. The propitious sentiment toward the precious metal makes it a perfect gift during this time. Jewelry is also prominently worn by families throughout the five-day festival, making gold an integral piece of this ancient tradition.

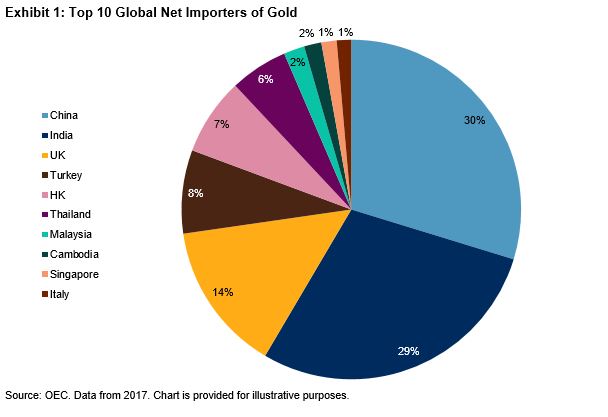

Gold tends to shine bright during the second half of the year as demand picks up. It is estimated that Diwali accounts for approximately one-fifth of annual gold purchases in India—more than any other time of the year. Jewelers and gold coin dealers in India frequently see a spike of 20%-30% in sales leading up to the festival. India is the second-largest consumer of gold after China, although they are close in size, with each accounting for approximately 30% of net global imports of the yellow metal in 2017. Gold is the second-largest import in India after crude oil, illustrating how important the country is to the global gold market and likewise how important it is for Indian consumers to appreciate the global supply/demand dynamics of gold.

The consumption of gold during the Diwali festival and peak wedding season running from August to December is unlike anywhere else in the world. This year, Diwali demand will compete directly with a favorable cyclical environment for gold investment. Gold has been one of the best-performing commodities this year. As of Sept. 30, 2019, the S&P GSCI Gold was up 14.21% YTD and on par with the S&P 500®, which was up 18.74% YTD. Historically, the metal tends to perform well in times of global economic uncertainty, low interest rate regimes, and periods of U.S. dollar weakness. In an environment in which negative-yielding government debt is only increasing, investors have shown their willingness to allocate a larger portion of their portfolio to gold, for which there is no yield that could turn negative. Data from the World Gold Council suggests that investor and central government demand for gold has grown at a faster pace than jewelry demand through the first six months of this year.

The consumption of gold during the Diwali festival and peak wedding season running from August to December is unlike anywhere else in the world. This year, Diwali demand will compete directly with a favorable cyclical environment for gold investment. Gold has been one of the best-performing commodities this year. As of Sept. 30, 2019, the S&P GSCI Gold was up 14.21% YTD and on par with the S&P 500®, which was up 18.74% YTD. Historically, the metal tends to perform well in times of global economic uncertainty, low interest rate regimes, and periods of U.S. dollar weakness. In an environment in which negative-yielding government debt is only increasing, investors have shown their willingness to allocate a larger portion of their portfolio to gold, for which there is no yield that could turn negative. Data from the World Gold Council suggests that investor and central government demand for gold has grown at a faster pace than jewelry demand through the first six months of this year.

The Indian gold market has shown its resilience even when import taxes are raised, as they were in July of this year, from 10% to 12%. Gold prices simply marched higher, as can be seen by Exhibit 4. There was a similar outperformance in 2013, the last time India raised import tax duties. What is interesting about 2013 is the S&P GSCI Gold saw a drastic move lower on the year, down almost 30%, while local gold prices in India moved less than half that amount. A tax increase can usually be seen as a headwind for demand, but it was overcome by the sheer force of gold buying in India. This year, local gold prices in India have outperformed the S&P GSCI Gold, albeit not as pronounced as in 2013. Regardless, the cultural significance of gold in India provides a firm base for demand and prices.

The outperformance trend played out across major regions, as Shariah-compliant benchmarks for U.S., Europe, Asia-Pacific, developed, and emerging markets each outperformed conventional equity benchmarks by meaningful margins. The Pan Arab region was the lone exception, with the

The outperformance trend played out across major regions, as Shariah-compliant benchmarks for U.S., Europe, Asia-Pacific, developed, and emerging markets each outperformed conventional equity benchmarks by meaningful margins. The Pan Arab region was the lone exception, with the