This is more an eyewitness account than an analytical review of the growth of indexing since I joined S&P in 1982.

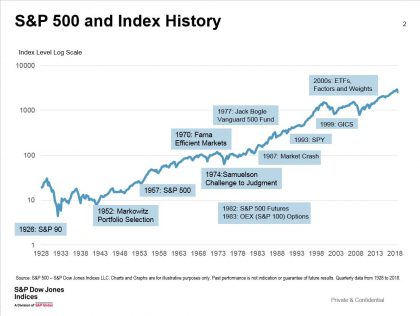

At the beginning of 1982, few people saw indices as a business. There were only two well-known US indices – the S&P 500® and the Dow™ – and one index fund. Interest rates and inflation were in double digits and the economy was in the second of two back-to-back recessions. No one wanted to buy stocks.

That January the Chicago Mercantile Exchange (CME) began trading futures on the S&P 500. In August the Fed backed away from tight money, T-bills fell under 10% and bull markets in stocks and bonds began. Stocks didn’t peak until 2000, after a nasty moment in October 1987. Bonds may not have peaked yet. By the end of 1982 Wall Street was using the S&P 500 futures to hedge positions and indices weren’t just for promoting newspapers. In 1983, the Chicago Board Options Exchange (CBOE) began trading options on the CBOE 100 stock index under the ticker OEX, later the index became the S&P 100.

Indices were a small part of S&P. In 1983, there were about 10 people in the index group when its name was changed to Index Services from Research. Today “the S&P” means the S&P 500. In 1983, the initials meant S&P Stock Reports – one page stock recommendations. S&P had many more people supporting active managers and stock pickers than working on indices.

Black Monday was October 19, 1987, the day the market crashed. From January to late August 1987, the market rose 37%; from the high to October 16, it dropped 16%. On Monday, October 19, the S&P 500 lost 20%. The Dow lost 22%. Then it recovered: The S&P 500 closed 1987 unchanged for the year. The one-day drop on October 19 was greater than the crash of 1929, which took two days.

In 1980s, trading stocks became an American pastime and part of daytime television with Financial News Network, acquired by CNBC in 1991. The S&P 500 became the benchmark and scorekeeper for the markets. Investment banks hired analysts to track indices and companies started asking how to become part of the S&P 500.

The 1990s started with a recession as the market that fell 23% from July to October 1990. At the American Stock Exchange (later acquire by the NYSE) the new products team, looking for ways to increase trading volume, dug into the SEC’s report on the 1987 crash. Buried in the report was a comment that a mechanism to execute a single trade for a basket of stocks or an index would have helped. From that thought came the “Big SPDR” – the first US exchange traded fund (ETF) launched in 1993. The ETF tracked the S&P 500; SPDR stood for Standard & Poor’s Depository Receipts.

The ETF brought several innovations to investors: It could be bought and sold through any broker and traded any time the market was open. ETF fees are typically lower than actively managed mutual funds. ETFs are designed to track an index and the index gives investors transparency into strategy and securities.

The Tech bull market that began in 1995 put indices on the map. Most tales of the tech boom-bust chronicle the insanity of the boom exemplified by Pets.com (a real company). There were other, more substantial companies, pushing the market higher. Two internet pioneers, which met the S&P 500 requirement for positive earnings, were added to the S&P 500: America Online (AOL) in December 1998 and Yahoo in December 1999. Both are now part of Verizon.

The bull market paused in 1998 when Russia defaulted of its debt in August and Long Term Capital Management, an aggressive hedge fund, collapsed in September. Stocks dropped 19% before rebounding. The end of the Technology bull market came on March 24, 2000. From then until October 9, 2002 the market fell 50%.

The Tech bust had a lesson for investors. Weighting an index by companies’ market caps is a natural approach – the market itself is cap weighted so the index return and the market return should match. The Tech Boom-Bust proved that on the way up cap weighting can be a strong momentum performer. On the way down after the market turns, the index is often over-weighted in the stocks with the most to lose. S&P began exploring other ways to weight indices.

In January 2003, S&P launched an equal weighted version of the S&P 500. Rather than weighting stocks by market value, the index weights each stock equally. Compared to the standard S&P 500, the equal weight version over weights the smaller stocks and under weights the larger ones. From January 2003 to May 2019, the equal weight S&P 500 returned 9.2% per year compared to 7.3% per year for the cap-weighted version.

The weighting in the standard S&P 500 shifted to float adjusted market capitalization in 2005. With the increasingly popularity of indices, investors recognized that excluding closely held shares which rarely trade would make tracking an index with an ETF easier. The average float among S&P 500 stocks was over 90% and the index had always excluded stocks with a float less than 50%, so there was not a major impact from float adjustment.

See Part 2 on the time since the Tech Bust.

The posts on this blog are opinions, not advice. Please read our Disclaimers.