The S&P/ASX Australian Index Series has played a significant role in characterizing the Australian equity market performance since its inception in April 2000. Since then, the S&P/ASX 200 has served as the foundation for benchmarks and index-based investing strategies from sectors to quality, value, and momentum factor approaches.

Following the launch of the S&P 500® ESG Index, which uses the new S&P DJI ESG Scores,[1] S&P Dow Jones Indices is proud to announce the launch of the S&P/ASX 200 ESG Index.

In this blog, we will focus on the role the S&P/ASX 200 ESG Index provides as the ESG alternative to mainstream listed equities investing in the Australian market. Using the new S&P DJI ESG Scores and other ESG data to define the index’s eligible universe, the S&P/ASX 200 ESG Index targets 75% of the market capitalization of each GICS® industry group in the S&P/ASX 200. The outcome is to provide an improved index ESG score relative to the benchmark, while providing similar risk and returns, allowing investors to easily put their investment beliefs into action.

The S&P ESG Indices target an improved ESG index profile by allocating to the best 75% of the GICS industry group market capitalization in each benchmark’s eligible universe by ESG score rank. The index’s eligible universe is defined as all benchmark constituents after the removal of companies:

- with specific involvement in the production or sales of tobacco or controversial weapons or low levels of compliance with the principles of the UN Global Compact or

- in the lowest 25% of S&P DJI ESG scores among their global GICS industry group peers.[2]

The remaining constituents find themselves market-capitalization-weighted in an index that has historically closely tracked its benchmark, while yielding an improved ESG profile. These indices are designed for investors wishing to integrate ESG factors into their investments without straying far from the benchmark’s risk and return profiles (see Exhibit 2), making them an appealing alternative to core domestic and global allocations.

Additional Resources on the S&P ESG Index Series

- FAQs: S&P ESG Index Series

- Steadman, Reid, and Perrone, Daniel. “The S&P 500® ESG Index: Integrating Environmental, Social, and Governance Values into the Core.” S&P Dow Jones Indices. April 2019

- The S&P ESG Index Series Methodology

[1] The S&P DJI ESG Scores are based on data gathered by SAM, a division of RobecoSAM, through SAM’s Corporate Sustainability Assessment (CSA).

[2] The index also accounts for ESG controversies that arise in its companies via SAM’s Media and Stakeholder Analysis (MSA), which continually monitors media for potential ESG-related events that could challenge the ESG scores SAM had assigned to companies.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

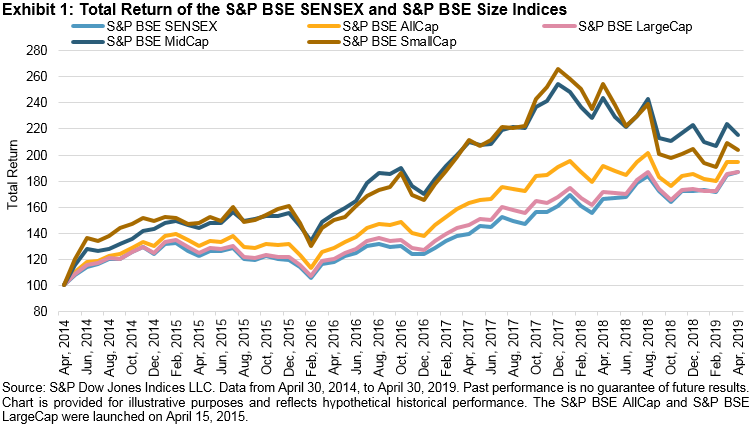

Exhibit 2 provides the five-year absolute returns of the S&P BSE AllCap Series. Among the sub-sector indices in the S&P BSE AllCap, the

Exhibit 2 provides the five-year absolute returns of the S&P BSE AllCap Series. Among the sub-sector indices in the S&P BSE AllCap, the

Source: “

Source: “