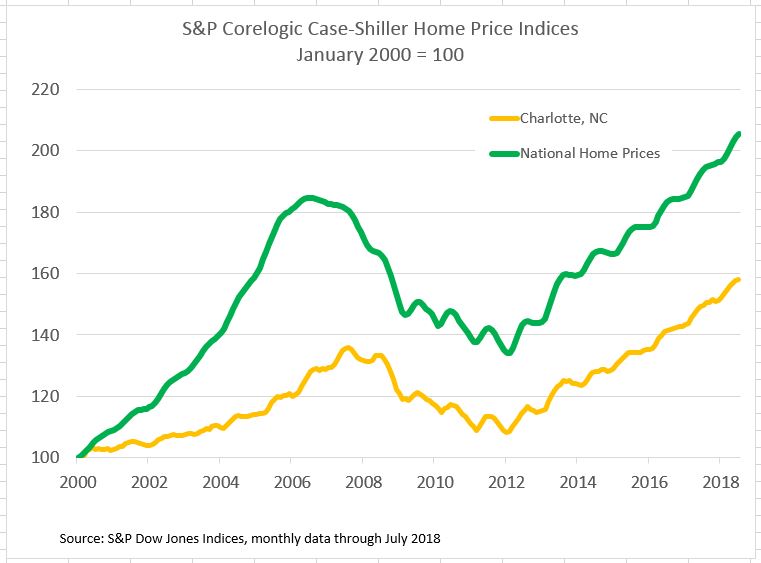

With this morning’s S&P Corelogic Case-Shiller Home Price Indices report that house prices continue to rise even as existing home sales flatten out, analysts are debating if the hoped-for recovery from Hurricane Florence could reignite home sales or simply mean upward price pressure on housing and construction.

Current damage estimates for Florence are close to $20 billion and could rise as flood waters recede and more accurate accounting is possible. This compares to figures of $125 billion for Katrina in 2005 or Harvey last year. Immediate losses in retail sales and production by businesses in the affected area will not be recovered. Some portion of the losses due to damaged and flooded homes will be offset by insurance money. Looking farther ahead, there should be increased economic activity including new jobs from repair and rebuilding efforts focused on housing and infrastructure. Housing demand is anticipated to rise and will probably be met more by new construction than repair of existing homes. The speed and intensity of this activity depends on funding from government programs and insurance. The economic impact of the Florence on the Carolinas is large; however, the national economy will continue growing and hurricane damage will be absorbed over time.

Any increase in inflation should be short lived and modest. As transportation in the affected region returns to normal, supplies of food, building materials and other essentials are not likely to be limited. Expectations of future inflation – a key factor keeping inflation low – will not change. Short-term price jumps will be limited.

Neither the hurricane, rising home prices, nor flattening home sales will change the Fed’s course to another quarter-point increase in the Fed funds rate to be announced on Wednesday afternoon. The central bank’s efforts to normalize monetary policy and shrink its balance sheet will continue into 2019; an unforeseen event that could disrupt the Fed’s plan would have to be far larger than Hurricane Florence.